Dormant Chinese ICE vehicle factories may be the giant canary in the coal mine for the global car industry as it faces a death spiral thanks to the rapid shift to electric vehicles.

The Financial Times story this week titled “Zombie car factories on the rise in China as buyers opt for EVs” reports that the asset value of internal combustion engine (ICE) vehicle factories has plummeted as legacy carmakers scale back production because of the growing popularity of electric vehicles.

The gigantic stranded asset problem facing fossil carmakers has been anticipated for many years by keen observers of the industry however now “its happening”.

The Financial Times says in 2017, Hyundai invested $US1.15 billion in a new factory in Chongquing in south-western China the capacity of 300,000 ICE vehicles per year but just 6 years on and the company has been forced to sell the new factory in December “for less than a quarter of the investment value.”

According to the Financial Times the plant is one of hundreds of “zombie factories” that analysts are predicting over the coming decade.

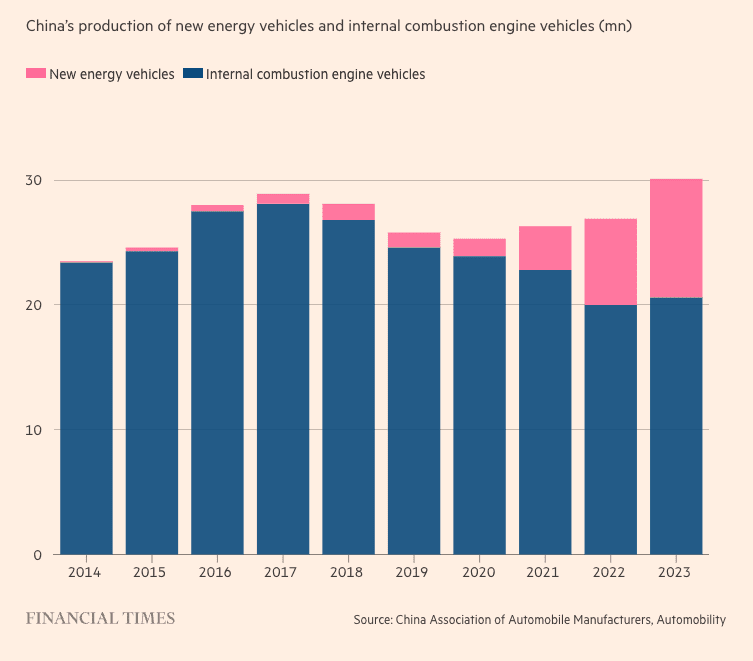

China’s 2023 ICE vehicle production is down a staggering 37% from its peak of 17.7 million in 2017. According to Shanghai consultancy Automobility, only half of the country’s installed capacity of ICE manufacturing plants was currently being used.

High demand for Chinese made electric vehicles like those made by BYD is putting immense pressure on large foreign carmakers like Toyota, Volkswagen and GM who have been very slow to develop fully electric offerings.

“Industry executives say that the biggest pressure on all legacy carmakers in China stems from the rise of new EV factories, which take a radically different approach to car manufacturing.” says the Financial Times.

Rapidly declining battery costs may accelerate the death spiral

New research suggesting electric vehicle batteries will continue to drop in costs thanks to increased economies of scale and a prolonged decline in lithium prices are set to accelerate the demise of ICE vehicle production in China.

The world’s largest battery manufacturer CATL recently announced that it was on track to cut battery costs in half to just $50/kWh by the middle of 2024, surprising even bullish futurist Tony Seba, who 10 years ago predicted it would take until 2027 to reach that price.

Li-ion #batteries from CATL and BYD dropping as low as $56/kWh. 🔋

"Currently, VDA-sized #LFPcells are selling for less than RMB 0.5/Wh [USD $69.53/kWh]. Leapmotor's vice president Cao Li recently said in an interview that the company's procurement cost for LFP cells has dropped… https://t.co/QasXsLvqtJ

— Tony Seba (@tonyseba) January 20, 2024

Daniel Bleakley is a clean technology researcher and advocate with a background in engineering and business. He has a strong interest in electric vehicles, renewable energy, manufacturing and public policy.