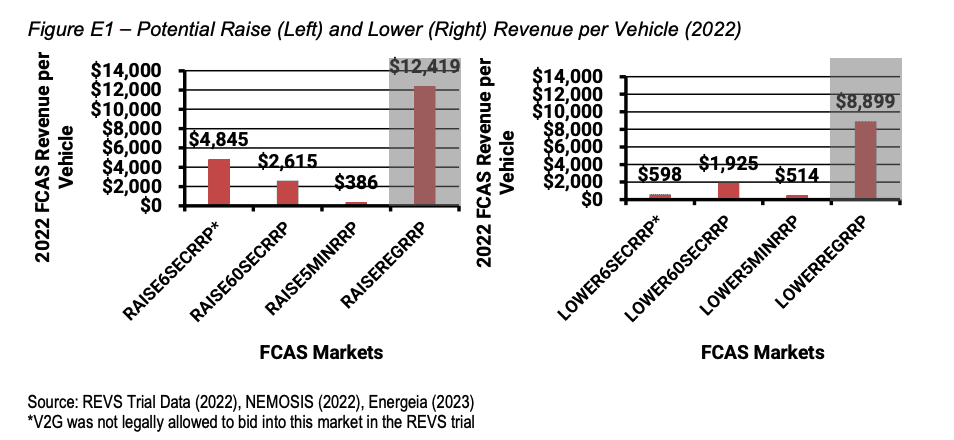

A new report from the Australian Renewable Energy Agency (ARENA) has found that a fleet of EVs used to supply Frequency Control Ancillary Services (FCAS) to the National Energy Market (NEM) could generate revenue of up to $12,000 per vehicle in a single year.

The staggering findings are outlined in a new report Insights from the Realising Electric Vehicle-to-Grid Services Project, that looked at the charging habits of EV drivers, the probable bidding capacity, and the potential business case for fleet operators to bid into FCAS markets using V2G.

The trial looked at some of the impediments to V2G technology and how new systems, such as operating envelopes, could help accommodate high local demands when overall network capacity allows;

It also looked at how a business case could be developed in the context of fleet operators accelerating the electrification of their fleet; and quantified the potential economic value and the user experience of V2G technology.

The most astonishing finding that the average EV could have earned around $12,000 participating in the NSW FCAS “Regulation Raise” market, based on 2022 data, and use just one per cent of the EVs total charging energy.

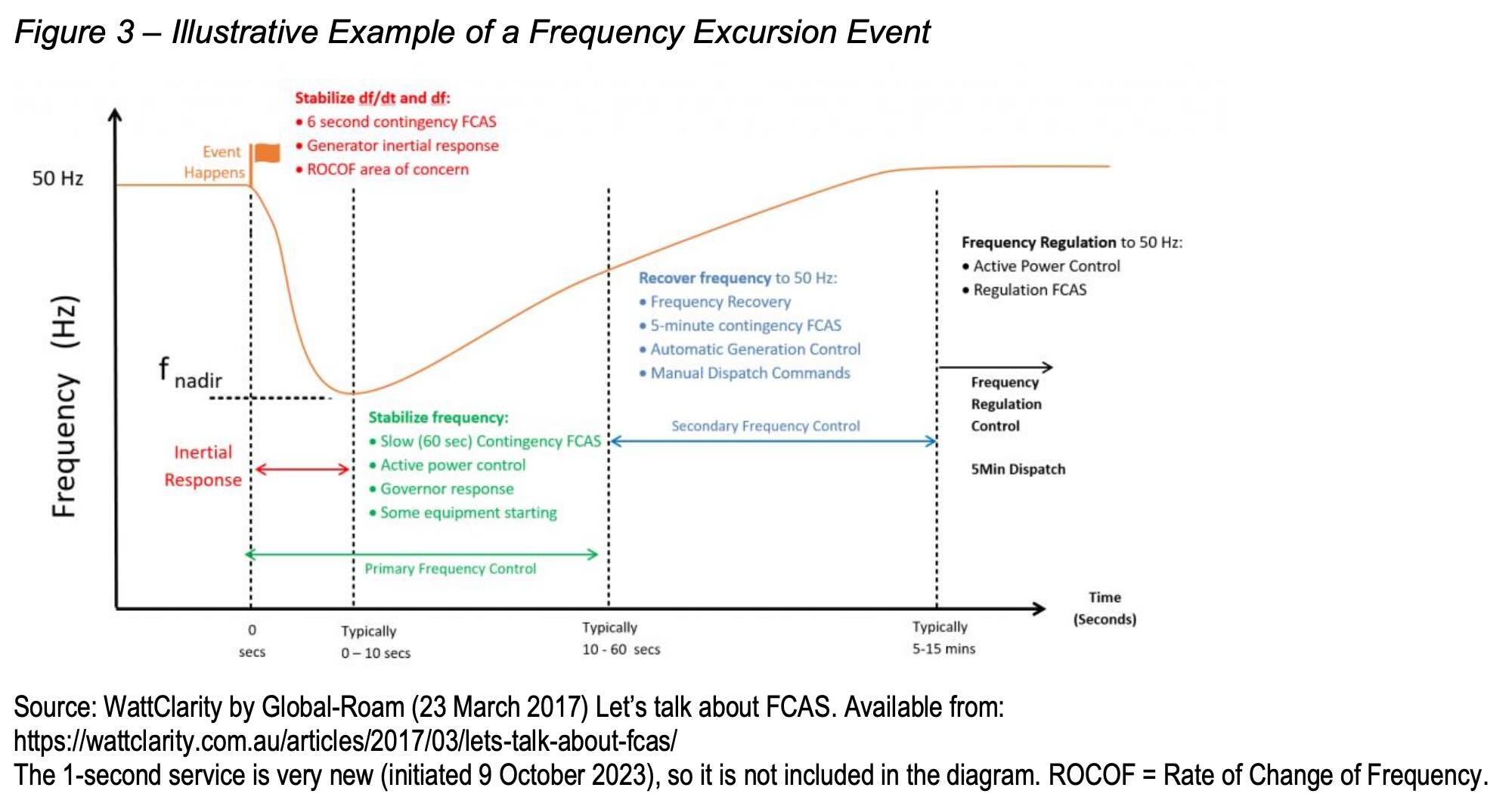

There are 10 FCAS markets in the NEM which help stabilise both minor and major variations in grid frequency with varying response times from 1 second 5 minutes.

Using 2022 FCAS market data and the real-world charging/plugin times of the commercial EV fleet, Energeia, the company AEMO commissioned to do the analysis, was able to calculate what the revenue from V2G FCAS would have been per vehicle.

Energeia found that the average vehicle could earn ~$12,000 participating in the NSW FCAS raise regulation market or ~$2,600 in the NSW FCAS raise 60-second contingency market in 2022.

Similarly, the average vehicle could earn ~$9,000 from participating in the NSW FCAS lower regulation market, or ~$2,000 from participating in the NSW FCAS lower 60-second contingency market.

“The data revealed that FCAS prices typically peaked in the late afternoon to early evening for the period observed, which aligned well with commercial vehicle availability,” the report says.

“Furthermore, the revenue that can be earned is further limited by the capacity of the charger. For example, if the charger capacity were raised to 15kW, the 60-second raise revenue per vehicle would increase to $5,604.”

Million mile batteries and V2G smart software converging

One of the main concerns with V2G has been that additional battery cycles would accelerate degradation of batteries however with recent advances in battery longevity this is no longer an issue.

A 2018 Model S recently clocked over 650,000 km with the same battery and CATL now provides 800,000 km warranties on its EV batteries. Last year Gotion High-Tech announced it would begin production of a battery with a lifespan of 2 million km which represents 130 years worth of average Australian driving.

Batteries that can be cycled over 5000 times before showing any signs of degradation open up incredible opportunities for vehicle-to-grid.

Earlier this month Octopus Energy, partly owned by Australia’s Origin Energy, launched the UK’s first vehicle-to-grid tariff, offering free charging for EVs if the customer allows the energy provider to utilise their vehicle’s battery to export electricity back to the grid during peak demand hours.

There are currently around 20 million light vehicles in use in Australia. If they were all electric and each had a 50 kWh battery pack, the national fleet would effectively represent 1000 GWh of storage.

This would dwarf all stationary battery storage combined with largest planned battery project at Melbourne Renewable Energy Hub at just 2.4 GWh. Even the Turnbull’s recent plans for two pumped hydro projects in the upper hunter at 15 GWh is minuscule in comparison.

And then there’s Australia’s 500,000 plus trucks. If fully electrified with an average 400 kWh battery in each truck, the trucking fleet could add another 200 GWh of battery storage to the network.

Companies like NewVolt, who last week launched its plans to build an electric truck charging network along the east coast of Australia, are paving the way for Australia’s trucking fleets to convert to fully electric which could unlock huge amounts of storage when trucks are idle.

With ARENA’s research showing the incredible financial benefits of vehicle-to-grid applications, the race is now on for governments and companies to fund and build the infrastructure that can tap into Australia’s future electrified car and truck fleets.

Energy and finance experts welcome the new findings

Tim Buckley from Climate Energy Finance says the new study’s findings can’t be overstated.

“Climate Energy Finance complements ARENA and Energeia on this new vehicle-to-grid study,” he said.

“Batteries on wheels (i.e. electric vehicles) should be viewed as one of the most important enablers of the full decarbonisation of our energy system. Australia’s energy security is undermined by a record $60bn pa of oil and diesel imports. Electrification of everything including transport will be a huge technology and decarbonisation enabler.”

Buckley says historically the Australian Energy Market Operator (AEMO) has framed the growing EV fleet as a problem because of extra energy demand however it should be viewed as an enormous capacity enabler.

“For too long AEMO have viewed EVs as a problem i.e. a source of extra demand on the electricity grid, rather than viewing EV-to-grid as a key solution, at potentially massive scale,” he says.

“AEMO today spends as much time reporting about the increasing issues of managing minimum on-grid electricity demand in the NEM as it does about maximum demand events.

“A smart grid with the upfront investment in widespread smart charging infrastructure (e.g. charging at all park-and-go community parking and railway station locations) and the right regulatory settings will work to enable artificial intelligence and software solutions to both improve grid reliability and lower the capital cost to all.”

Buckley says passenger vehicles have much more potential for V2G than trucks because of their high idle time.

“20 million passenger vehicles are on Australia’s roads. In two decades times this will translate to over 1,000GWh of collective battery storage and discharge capacity.

“Unlike trucks, passenger vehicles are used just 5-10% of a 24 hour period. Should even just 10% of EVs be plugged in and available at any point in time, that would be 100GWh of cumulative batteries able to be instantaneously available for soaking up excess solar power on the grid, or discharging to meet peak demand periods, be that for a few minutes when it is cloudy, or for 1-2 hours into the valuable evening peaks, predictably every night.”

Buckley says Australia’s wholesale electricity market has one of the highest and most sophisticated price only signals in the world, ranging from -A$1,000/MWh to +A$16,600/MWh with live pricing set on 5 minute intervals.

“Australia now also has 10 frequency controlled ancillary services (FCAS) markets, with both regulation and contingency FACS services priced in.

“This ARENA and Energeia study shows the potentially enormous power of pricing in each grid reliability service in enabling technology solutions across our grid, and as more batteries and batteries-on-wheels are deployed, the greater the grid reliability and the lower the total cost to consumers will be.”

Daniel Bleakley is a clean technology researcher and advocate with a background in engineering and business. He has a strong interest in electric vehicles, renewable energy, manufacturing and public policy.