Toyota shareholders have voted down an investor proposal calling for the company to commit to a comprehensive annual review of its climate-related lobbying. Toyota’s board had recommended shareholders vote against the resolution.

Three asset managers, who collectively hold $400 million of Toyota stock, submitted a proposal urging Toyota Motor Corp improve disclosure of its lobbying on climate change. According to Reuters it was the first investor proposal to come before the automaker’s annual general meeting in almost two decades.

The shareholder group calling for the change included Danish pension fund AkademikerPension, Norway’s Storebrand Asset Management and Dutch pension investment company APG Asset Management.

“We’re concerned that Toyota is missing out on profits from soaring EV sales, jeopardising its valuable brand and cementing its global laggard status,” AkademikerPension’s chief investment officer Anders Schelde said last month.

“We need concrete policy changes and a better annual review drawing on independent data to calm international investors.”

In its Responsible Investment and Stewardship Policy, Dutch pension investment company APG Asset Management outlines its responsible investment guidelines for climate change:

“Global climate change is one the greatest challenges of our time.

“As a long-term investor we are acutely aware of the exposure of companies to the risks and opportunities associated with climate change, either through the physical consequences of global warming and/or through changes in government policy, technology and markets aimed at reducing global warming.

“It is therefore critical that companies adequately assess and manage climate risks and opportunities as part of their business strategies and risk management.”

APG’s exclusion policy states “We expect companies to act in line with the principles of the UN Global Compact. On a regular basis we screen our equity and bond portfolio and engage with companies we think are in breach of these. Where engagement does not lead to the desired change we can decide to divest.”

The company’s investment inclusion diagram shows how APG deals with laggards using an engagement process before deciding whether or not to invest.

In its Policy for Integration of Sustainability Risks, AkademikerPension also has strong investment guidelines around climate risks:

“Climate risks can be divided into transition risks and physical risks for the investments. Both types of risks can negatively affect a company’s assets or earning potential, and can thus reduce the value of the investment.

“Transition risks are risks of changes in a company’s market conditions, which can for example arise as a reaction to climate change or environmental events. This could, for example, be political initiatives or changes in legislation (for example, a CO2 tax).”

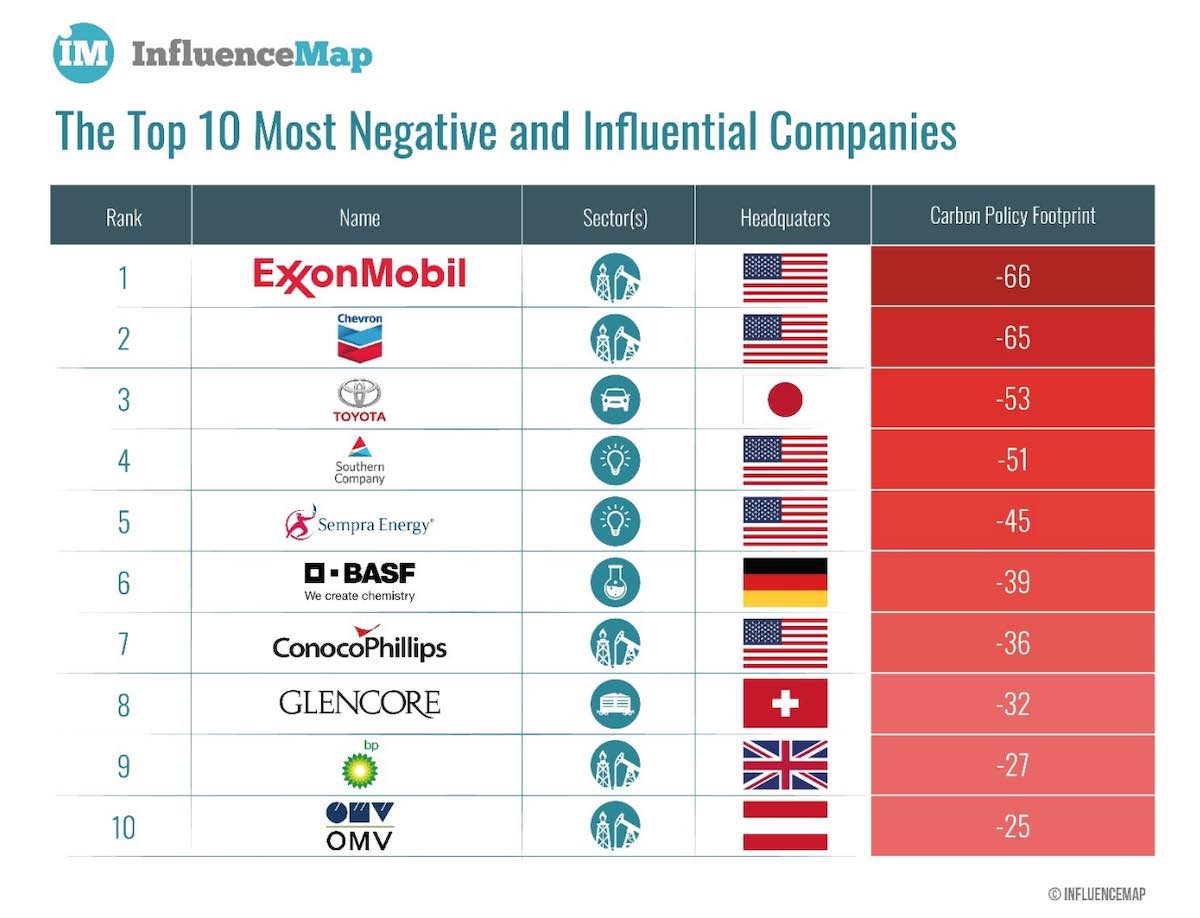

In 2021 think tank InfluenceMap ranked Toyota the 3rd most obstructive company in the world on climate policy behind Exxon Mobil and Chevron.

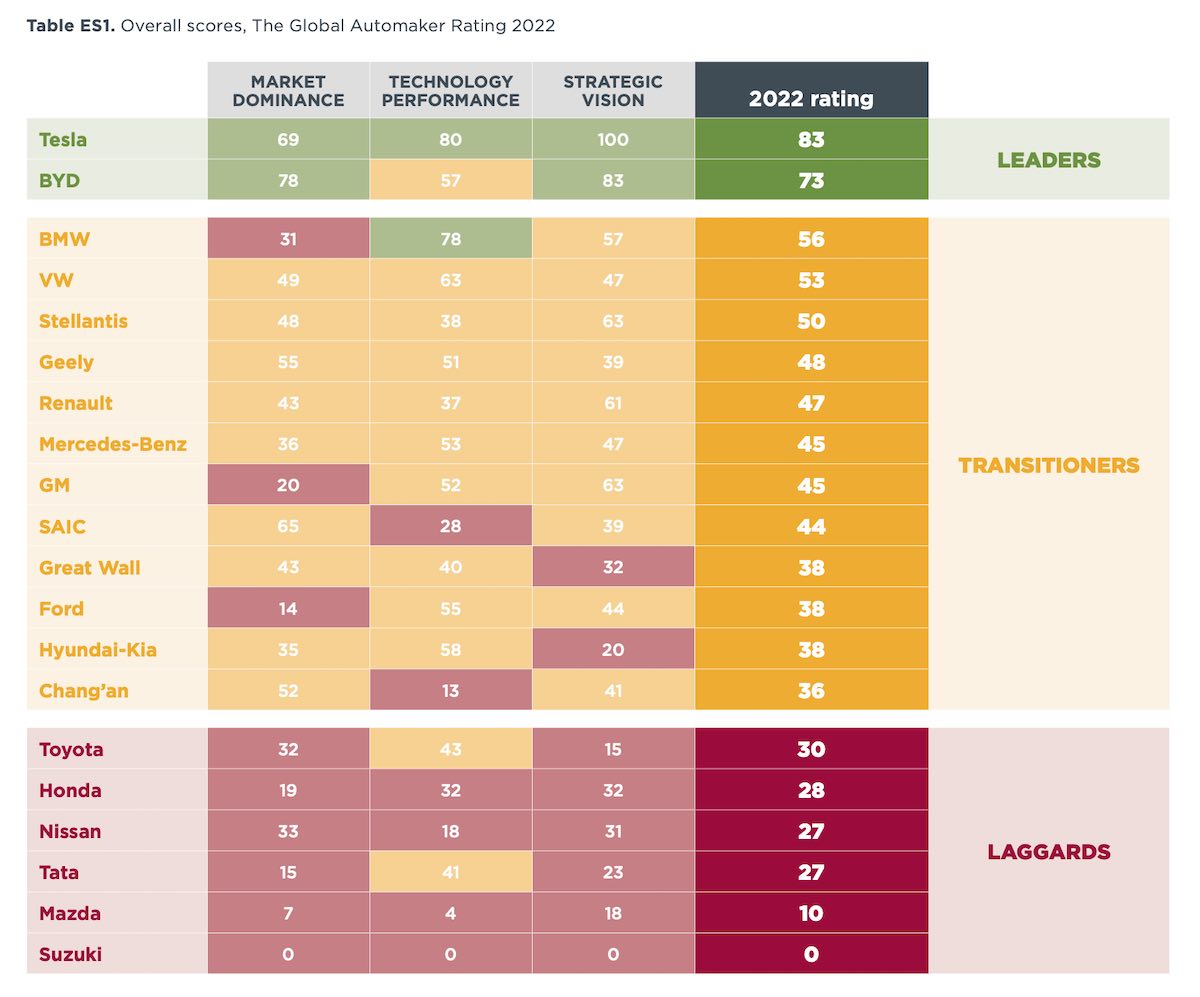

Last month the International Council on Clean Transportation (ICCT) also put Toyota in the “Laggards” category in its report ranking the world’s top 20 auto makers EV transition, including market share, technology and strategic vision.

Toyota’s position as a climate action obstructionist has been well documented by numerous leading think tanks and research groups. The agm vote makes it clear Toyota has no intension of providing transparency around its lobbying efforts to weaken climate policies of governments around the world.

It’s now up to the three major shareholders to determine whether their $400 investments in Toyota are now in breach of their own climate risk guidelines.

Daniel Bleakley is a clean technology researcher and advocate with a background in engineering and business. He has a strong interest in electric vehicles, renewable energy, manufacturing and public policy.