The battery and electric vehicle boom is well underway, with sales continuing their explosive rise in the first quarter of 2023 (1QCY2023).

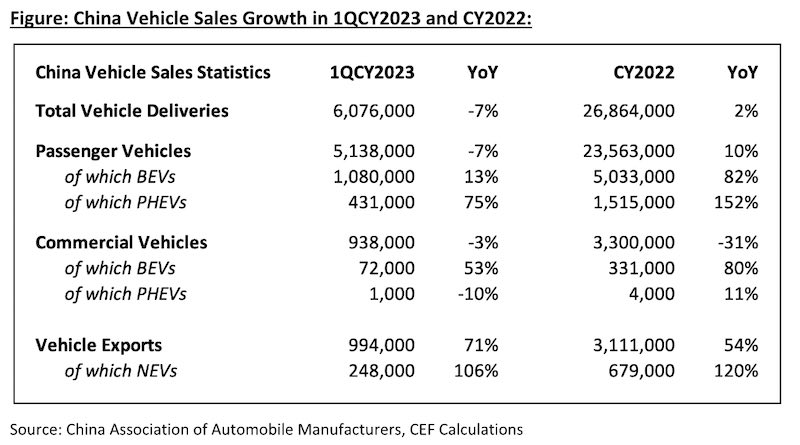

China EVs reached a 29% market share of passenger vehicle sales in 1QCY2023, according to the China Association of Automobile Manufacturers (CAAM). EV sales grew 26% year-on-year (yoy) to over 1.58 million, with fossil-fuel vehicle sales falling 15% over the same period.

At the current pace of electrified mobility growth, China EV sales are expected to break 8 million in 2023.

EV sales accounted for 15% of the global passenger vehicle market in 2022, up from just 5% in 2020. In February, EV sales in China hit a record 32% market share of passenger auto-sales, with fossil fuel-based vehicles falling 20% in absolute terms from February 2022.

The seismic ramifications from the invasion of Ukraine catalysed a fundamental global reshaping of the world’s energy and transport markets.

Energy and supply chain security has become paramount for economies and governments worldwide. Capital deployment into clean energy technologies and supply chain diversification has turbo-charged, galvanised by the US Inflation Reduction Act (IRA) and the EU Net Zero Industry Act (NZIA).

China continues its rapid climb in the global auto-export market, surpassing Germany as the second-largest exporter, behind Japan.

In 1QCY2023, China’s auto-export market grew 71% year-on-year to almost 1 million vehicles, with 25% electric. In 2022, China exported 3.11 million vehicles, up 54% from 2021. China is on track to become the largest auto-export supplier, with EV export growth continuing to outperform its fossil-fuel competitors.

China’s BYD, the largest EV manufacturer in the world, continued its dominant performance into 2023, growing 93% yoy to over 552,000 EVs in 1QCY2023, supplying almost a third of China’s EV sales. BYD produced over 1.8 million EVs in 2022, scaling 209% compared to 2021.

Tesla was dethroned as the leading EV producer in 2022 by volume, but continued to show impressive growth across its Chinese, European and US facilities. Tesla produced 422,000 battery EVs (BEVs) in 1QCY2023, up 36% from the opening quarter of 2022.

A key, and often overlooked, differentiation between the leading suppliers is Tesla’s commitment to fully electrified mobility. Tesla’s production capacity is now dedicated entirely to BEVs, with BYD producing BEVs and PHEVs (Plug-in Hybrid Electric Vehicles) under its electric banner. BYD produced 264,000 BEVS in 1QCY2023, only 63% of Tesla’s output.

Whilst China’s BEV market remains larger than its PHEV, the latter has continued to outpace its counterpart, with PHEV sales rising 75% in 1QCY2023 compared to 13% BEV. In 2022, the PHEV market grew 152% with BEV growing 82%.

Global policy shift on EV supply chain development

Global economies have demonstrated a clear and distinct rise in energy transition and climate policy ambition, providing significant policy support to scale domestic capacity in EV and supply chain production.

The Inflation Reduction Act, introduced in August 2022, has committed upwards of US$400-800bn alongside the Department of Energy to supercharge US cleantech processing and manufacturing.

The tax credit and subsidy program has mobilised billions of private capital into new battery and chemical processing facilities onshore from global leaders including Panasonic, LGES, and SK.

In March 2023, LGES announced a US$5.6bn battery manufacturing complex in Arizona, four times larger than the initially planned facility.

Panasonic, Tesla’s key supplier, broke ground in November 2022 on its US$4bn battery manufacturing facility in Kansas.

The US auto and battery sector has a combined US$52bn in planned new capacity, 20 times larger than the planned investment pipeline in 2021.

Announced in March 2023, the European Union released the Net Zero Industry Act (NZIA) and Critical Raw Materials Act (CRMA) to bolster the bloc’s supply of clean energy technologies.

Under the CRMA, the EU’s EV supply chain must source a minimum of 15% extraction and 40% chemical processing demand from domestic sources by 2030. To meet these ambitious targets, more than US$70bn will need to be injected into its economy by 2030, with more than US$50bn directly into the battery supply chain.

As CEF outlined in its lithium market review, Australia supplied 53% of global lithium in 2022, ahead of Chile and China (30% and 15% respectively). Australia’s lithium exports grew by 29% in 2022-23 compared to 2021-22.

Australia has a multi-billion-dollar investment pipeline in new extraction footprint and is massively scaling its global supply of the downstream precursor material, lithium hydroxide, the critical component to EV battery packs.

Beyond lithium, Australia is expanding downstream across the cathode value chain. On 14 April, Andrew Forrest’s Wyloo Metals and venture partner IGO announced plans to construct a value-add nickel sulphate refinery in WA, similar to BHP’s Kwinana nickel sulphate plant.

Wyloo and IGO want to progress further, setting their sights on developing a nickel-dense precursor chemicals facility to feed into the global EV battery manufacturers, an industry dominated by China.

More broadly, pressure is building for a domestic response to the IRA and related international developments, to ensure Australia is able to leverage its competitive advantages in cleantech and EV supply chain.

EV affordability improves with diversification and supply growth

As new raw material extraction and processing comes online, battery pack prices will continue to deflate, reducing the purchasing price of EVs for global consumers.

Capital flowing on a global scale also brings online new supply and diversification across the EV value chain, continuing to make EVs more affordable and accessible than ever before.

Full electric vehicles (BEVs) continue to deflate in price. In April, Tesla dropped its Model S price by US$20,000 and Model X price by US$34,000 since the beginning of 2023.

Tesla also lowered its prices in China in 2023, triggering a price war against Chinese competitors BYD and SAIC.

Whilst PHEVs can operate 100% on its battery system, the vehicle still has an Internal Combustion Engine (ICE). The running costs of operating ICEs will continue to rise as global producers cut output, restricting supply and inflating consumer-prices.

In April 2023, OPEC+ oil producers announced a further cut of 1.16 million barrels per day (bpd), bringing total supply restrictions to over 3.66 million bpd, or 3.7% of global demand, off the back of forecasted weaker demand.

2022 was a global milestone in accelerating ambition

The context for all the above is the acceleration of energy transition globally, with 2022 a milestone year for clean energy investment worldwide. Energy transition investments exceeded US$1.1 trillion in 2022, equalling upstream oil, gas and unabated fossil fuel-based power generation investments for the first time.

Clean energy manufacturing investments grew 44% in 2022, with 88% of the near US$80bn concentrated in battery and solar module manufacturing expansion.

Clean energy manufacturing experienced further supply chain concentration in 2022, with China accounting for 90% of total investments, up from 77% 5-years prior, and in a market four times larger. The IRA is catalysing a manufacturing boom in 2023 as the US plays catchup, and the NZIA brings the EU into the picture.

Amidst this significant surge in ambition in the global race to accelerate the energy transition, the value chain opportunities for Australia are enormous, as is the imperative for the Albanese government to formulate an appropriate policy response at speed, building on the substantial work it has already done to enhance Australia’s ambition.

Matt Pollard is Global EV Supply Chain Analyst at Climate Energy Finance.

Matt Pollard is the Net Zero Transformation Analyst at think tank Climate Energy Finance.