There are growing media reports warning of a significant collapse in sales of petrol and diesel cars in China, which could have massive impacts on some of the world’s biggest car brands.

The problems that are now emerging in the Chinese vehicle market have been developing for many months, however it seems like the penny is finally dropping for what this all could mean, not only for the future of the legacy automotive industry, but for the broader economy.

The Driven last week led the reporting with a story on Thursday titled “Legacy auto faces disaster in China with unsellable cars as pollution crunch looms“.

That has been followed up by a Bloomberg report – “China Slowly Squeezes Global Carmakers Out of Its Massive Market” – on Monday, and the US-based Electrek on Sunday – “ICE car values plummet in China and it is the canary in the coal mine”

There are multiple factors that appear to be accelerating this crisis and many auto industry observers and investors are now starting to consider what it all could mean.

China is the first major market to reach 25% EV sales

While countries like Norway already have a new car market that’s 90% EV, China is the first major market in the world where EVs have reached a market share of 25%.

In Norway, with a population of just 5.4 million people, second hand petrol and diesel car sales can be easily absorbed into the European market which has a population of almost 500 million.

That is not the case for excess petrol and diesel cars sold in China, which is the world’s largest car market with almost 27 million vehicles sold in 2022, making up 34% of the world’s car sales.

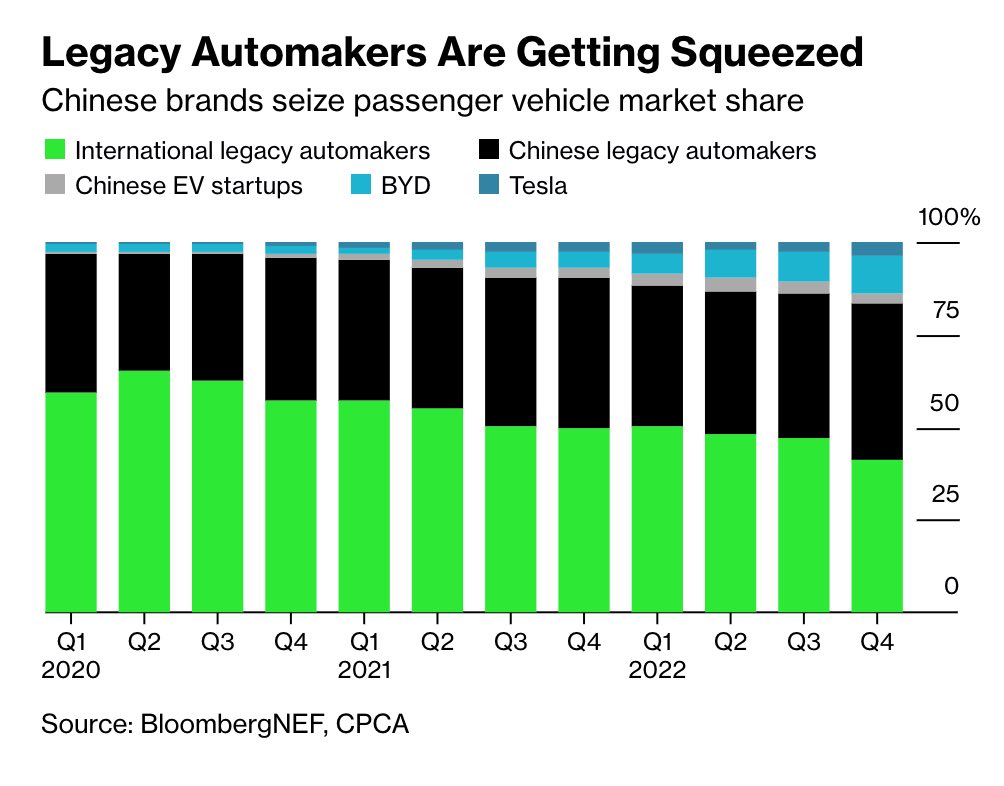

The emerging problem for the legacy automotive industry that many are now waking up to, is that electric vehicles are now taking massive chunks of market share away from petrol and diesel cars.

Even in Australia, the sales numbers of full battery electrics has overtaken that of the hybrids that many Japanese car firms have bet their future on: See EV sales overtake hybrids in Australia, grab 6.8% of overall new car market

Japanese, German and US traditional carmakers have been slow to develop EV production with none of the legacy auto companies producing EVs at scale.

EVs only make up 0.2% of Toyota’s total production meaning the market shift to EVs is also a market shift to Chinese brands like BYD and Tesla which dominate global EV sales.

Of the 27 million vehicles sold in China in 2022, 7 million were EVs. That’s 25% of the world’s biggest market effectively disappearing from the perspective of petrol and diesel car makers.

Legacy auto companies forced to cut new car prices by as much as 40%

Chinese business and finance news site Jiemian wrote a story on March 17 titled “China’s new car price war spills over into second-hand market”

“Old-style makers of traditionally-powered cars have decimated prices by as much as 40 percent prices, as the likes of Mercedes-Benz and Chevrolet seek to protect their hard-won market share.” reported Jiemien.

Jiemain says that the Chinese government halved sales taxes for new ICE cars to stimulate the market back in June last year. That only kicked the can down the road and now we’re seeing new and second hand ICE vehicle prices slashed as dealers frantically try to offload stock.

China’s second-hand car dealers are beginning to feel the shock of a raging price war threatening to lay waste to the country’s vast auto market.” says the Jiemain story.

Moving faster than expected, EVs to hit 35% by the end of 2023

The sheer speed at which the Chinese market is moving will compound the current problems. EV market share in 2022 grew at a staggering 93% over 2021.

Back in 2021 Reuters reported that EV sales in China were expected to hit 35% in 2025. Fast forward to March 2023, Bloomberg is forecasting that the Chinese market is likely to reach that milestone this year.

That effectively translates into the petrol and diesel car market contracting by millions much earlier than anyone (including legacy auto executives) anticipated.

Swollen car dealerships the canary in the coal mine for legacy auto

Like a bathtub with a stuck plug, the taps need to be turned off before it’s too late.

As Chinese dealerships have swollen over recent months, they have absorbed new cars coming off the production lines.

But they can only take so much and with the ever accelerating shift to EVs and China’s new 6b pollution standards likely to come into force in the next 12 months, it’s unclear how legacy auto companies are going to be able to sustain anything close to their current sales.

While the the drop in ICE vehicle market share doesn’t appear overly dramatic in the graph above, it’s important to realise that the shift is happening at an exponential rate. Exponentials can seem to move slow at first and then start to accelerate dramatically.

With EV market share in China growing from 5% to 35% in just three years, we are now getting into the meaty part of the curve. Each month the chunks being taken out of the ICE vehicle market get bigger and bigger.

On top of that, legacy auto companies are highly leveraged. A relatively small drop in sales might be all it takes to tip them over the edge.

What’s it going to take?

Like the subprime mortgage crisis of 2008, everything was fine until it wasn’t. The big question is what’s it going to take to tip legacy auto over the edge?

Both Toyota and VW are two of the most indebted companies in the world.

Can they endure a sustained drop in sales of 30% in markets like China? What if EV market share in China approaches 50% in 2024? Both Toyota and Volkswagen have no plans to start selling mass produced electric vehicles until 2027.

How do they possibly stay in business until then?

Daniel Bleakley is a clean technology researcher and advocate with a background in engineering and business. He has a strong interest in electric vehicles, renewable energy, manufacturing and public policy.