Shanghai based EV news site CnEVPost has reported that the Chinese government will capitulate to the demands of automotive dealer lobby groups to delay the starting date of new pollution standards which were due come into force on July 1.

The 6b pollution standard further tightens the 6a standard that was announced in 2016, and lowers the limits by about one third to half of the magnitude for toxic NOX, THC, NMHC, PM, and CH4 emissions.

Yesterday The Driven reported that the China Auto Dealers Chamber of Commerce (CADCC) posted an article on March 23 on WeChat saying that dealers could be left with hundreds of thousands of non-compliant unsellable petrol and diesel vehicles once China’s new emission standard is implemented in July. The CADCC article was later deleted.

The CADCC had received reports from many auto dealers that the upcoming full implementation of the China 6b emission standards will bring enormous pressure to the survival of auto dealers.

The now deleted document from the CADCC appealed for three measures on behalf of the majority of auto dealers.

- Postpone the implementation of the China VI B emission standards to January 1, 2024;

- Car makers should stop producing new cars that do not meet the China VI B emission standards;

- Auto OEMs should allocate existing new cars that do not meet the China VI B emission standards to dealers as soon as possible, and launch sales promotions.

It now appears that the Chinese government will indeed delay the implementation of the standard allowing dealers to continue selling petrol and diesel cars that don’t meet 6b.

China Automobile Dealers Association says 6b standard start date will be delayed

On March 30, a report from China’s National Business Daily stated the Shen Jinjun, president of the China Automobile Dealers Association (CADA) said relevant policies to extend the sales period of 6a models may be announced.

Translated: “The sales period of 6a is extended and relevant documents will be released soon” Shen Jinjun said.

The looming implementation of the new standard had sparked a price war in China as dealers scrambled to offload non-compliant stock before 6b came into force.

While it now appears that dealers have more time to sell the higher polluting vehicles, they still face a massive challenges as Chinese consumers shift rapidly to EVs. Over 25% of all new cars sold in China in 2022 were electric, a staggering 93% increase over 2021.

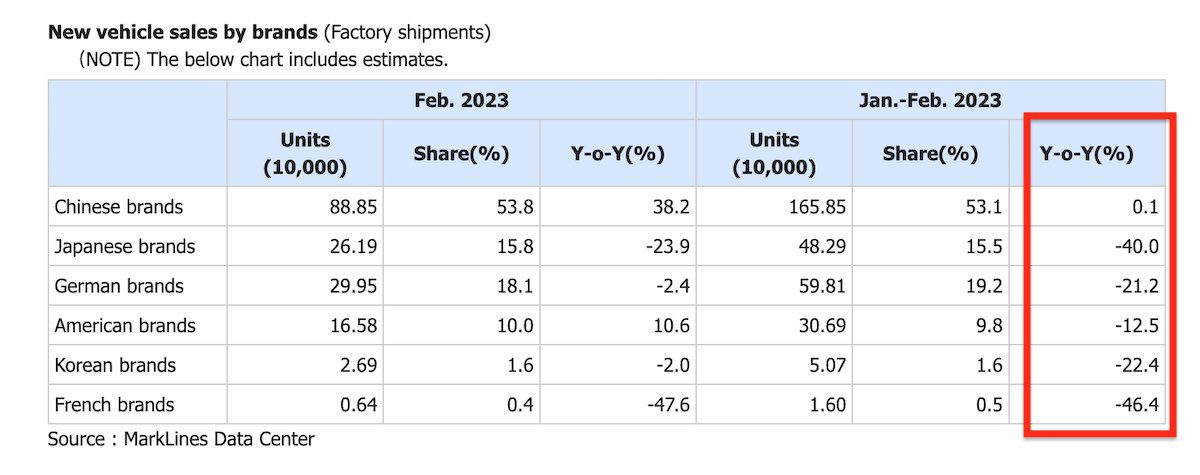

In the first two months of the year, sales of Japanese, German and US brands have plummeted in China.

These brands overwhelmingly produce petrol and diesel cars (and a trivial amount of EVs) and are therefore seeing their addressable market share vanish in China as consumers shift to Chinese made EVs.

Chinese and European governments buckle to powerful legacy auto lobby

The Chinese government’s decision to delay the new pollution standard follows a similar recent cave in by the European Union.

The EU was forced to allow an amendment to its 2035 petrol and diesel car ban to allow vehicles that run on e-fuels to be excluded from the ban.

Because cars that run on e-fuels can also run on petrol, it’s believed the amendment is simply a loophole to enable the continued sale of petrol vehicles in Europe after 2035.

The watering down of the EU 2035 fossil fuel car ban was led by Germany who’s government is dominated by a powerful petrol and diesel car lobby.

Governments around the world are facing growing pressure from the public to phase out petrol and diesel cars as soon as possible.

The automotive industry’s continued lobbying to delay the transition to clean transport will have profoundly negative impacts not only on the world’s ability to limit greenhouse gas emissions but also condemn billions of people to higher rates of harmful air pollution.

See also: Environmental and consumer groups demand Toyota go all electric, stop lobbying

Daniel Bleakley is a clean technology researcher and advocate with a background in engineering and business. He has a strong interest in electric vehicles, renewable energy, manufacturing and public policy.