It is already well established that the share market value of Tesla is more than most of its competitors combined, and five times that of the established US auto heavyweights Ford and General Motors.

Tesla’s valuation – currently at around $US620 billion ($A840 billion) is mostly based on the EV maker’s future prospects, including the expectation that Tesla is going to dominate the global auto market, and make huge profits from its software, autonomous driving, and other services.

The current valuation is certainly not based on earnings, given that Tesla has only just posted its first billion dollar quarterly profit for the three months to the end of June.

But analysts now expect Tesla earnings to jump sharply. Revenue is forecast to leap 10 fold over the coming decade from around $US32 billion to more than $US335 billion, and profits will jump with it, helping it to overtake its bigger rivals as it ramps up production at new gigafactories

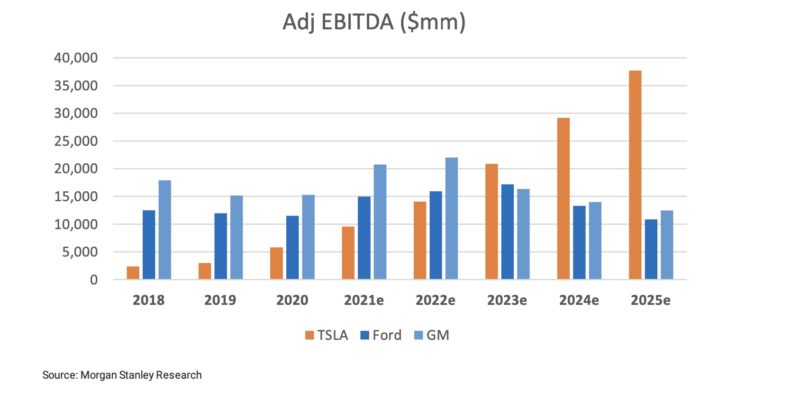

According to Morgan Stanley, see graph above, Tesla’s Ebitda (earnings before interest, tax, depreciation and amortisation) will leap to around $US38 billion in fiscal 2025, around four times more than the current fiscal year.

By 2023, Morgan Stanley says, Tesla annual profits will be more than $US20 billion, and bigger than GM and bigger than Ford.

By 2024, Morgan Stanley says, Tesla will earning nearly $US30 billion, more than both GM and Ford combined. In fiscal 2025, Tesla will likely be earning around $US38 billion, nearly double Ford and GM combined.

Extraordinary.

Giles Parkinson is founder and editor of The Driven, and also edits and founded the Renew Economy and One Step Off The Grid web sites. He has been a journalist for nearly 40 years, is a former business and deputy editor of the Australian Financial Review, and owns a Tesla Model 3.