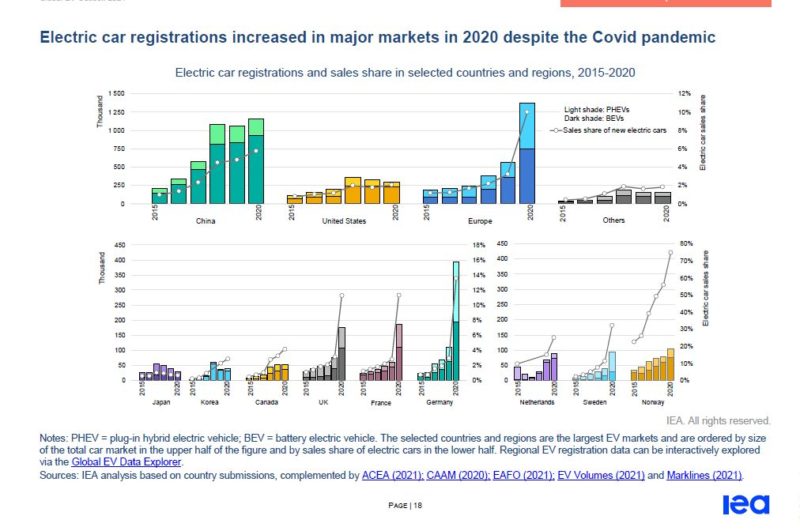

A new report from the International Energy Agency (IEA), the 2021 ‘Global Electric Vehicle Outlook’ (GEVO) has found that just like renewable energy, the electric vehicle industry weathered the worst impacts of Covid-19. In 2020, the global car market contracted 16%, while the EV market increased by 41%, albeit from a low base.

2020 ended up with a total of more than 10 million electric vehicles on the world’s roads, and another 1 million electric vans, trucks and buses. The market has shifted to Europe from China, with 1.9 million registrations compared to China’s 1.2 million. The US remains the other significant region for electric vehicle sales.

“While they can’t do the job alone, electric vehicles have an indispensable role to play in reaching net-zero emissions worldwide,” said Fatih Birol, Executive Director of the IEA. “Current sales trends are very encouraging, but our shared climate and energy goals call for even faster market uptake.

“Governments should now be doing the essential groundwork to accelerate the adoption of electric vehicles by using economic recovery packages to invest in battery manufacturing and the development of widespread and reliable charging infrastructure.”

The report highlights the importance of policy in enhancing the growth of electric vehicles and deepening decarbonisation in transport. While Norway remains the country with the fastest relative growth in electric vehicles, 2020 proved a significant year for large markets with significant transport emissions due to high populations, such as Germany, France and the United Kingdom:

The report contains significant detail on the importance of subsidy schemes to boost the growth of electrified transport in countries. Several key countries outside of Norway have begun adding significant quantities of money to incentivise EVs, and this has been reflected in the shifting sales in these countries.

“The Covid-19 pandemic spurred governments to enact stimulus measures, many of which singled out EV development both as a way to create jobs and to push for a cleaner tomorrow”, the report authors write.

In Australia, the federal government has essentially refused to commence action to incentivise EVs, with a ‘Future Fuels Strategy’ (FFS) presented in recent months that was widely criticised for delaying action on Australia’s significant transport emissions.

However, the Victorian state government has recently opted to add a disincentive to electric vehicles sales in the state; taxing the use of electric vehicles to replace revenue from road user charging and adding too few incentives to cancel this out. This has been predicted to lead to a decrease in EV sales.

The IEA’s report addresses this challenge. “The net tax loss is mainly due to lower overall energy consumption (EVs are two-to-four times more efficient than comparable ICE vehicles) rather than different taxation levels of electricity and oil products”, write the IEA in the GEVO. They also raise the possibility that simply raising fuel taxes for those who choose not to or cannot switch to an electric vehicle could raise equity issues.

Several options are proposed, which “could include coupling higher taxes on carbon-intensive fuels with distance-based charges”, but they add that “it is also important to note that widespread EV adoption will reduce air pollution, offsetting lost tax revenue by reducing health damages and their associated costs”.

In the report’s various modelling scenarios, they predict a major role for EVs in decarbonisation. The ‘Sustainable development scenario’, which targets 1.65C of warming, predicts 860 terawatt hours of new electricity demand from EVs. Estimates of total consumption relative to electricity demand in this scenario range from 2% in India to 5% in Europe and the United States, suggesting this new demand is not proportionally significant.

“Expanding EV stock also enhances energy security by reducing oil use which today accounts for around 90% of total final consumption in the transport sector. Globally, the projected EV fleet in 2030 displaces over 2 million barrels per day (mb/d) of diesel and gasoline in the Stated Policies Scenario and about 3.5 mb/d in the Sustainable Development Scenario, up from about 0.5 mb/d in 2020. For context, Germany consumed around 2 mb/d of oil products across all sectors in 2018”, write the authors of the GEVO report.

Australia’s government recently received criticism for attempting to boost its reserves of oil for its vehicle fleet instead of increasing the switch to electricity. Earlier this year, the Energy and Emissions Reductions Minister Angus Taylor announced a new subsidy for oil refineries.

The IEA predicts, for its more ambitious scenario, that the net impact of electric vehicles on emissions will be a reduction of more than 400 megatonnes of CO2-e by 2030, slightly less than what Australia’s total domestic emissions are today.

Ketan Joshi has been at the forefront of clean energy for eight years, starting out as a data analyst working in wind energy, and expanding that knowledge base to community engagement, climate science and new energy technology. He writes for The Driven’s parent site, RenewEconomy, and has also written for the Guardian, The Monthly, ABC News and has penned several hundred blog posts digging into climate and energy issues, building a position as a respected and analytical energy commentator in Australia. He’s spoken at the Ethics Centre IQ2 debates on the need for urgent decarbonisation, he’s served as an subject matter expert on national television, and has a wide following on social media around energy and climate.