Electric SUV sales have jumped in Australia, albeit from a very small base, thanks to the introduction of more models including the cheapest electric offering currently available in Australia, the recently released $43,990 MG ZS EV.

However, the near six-fold increase in electric SUVs in January, to just 213, was overshadowed by a big increase in petrol and diesel SUVs as the number of new fossil vehicles sold in Australia jumped 10 per cent, or nearly 8,000, to more than 79,000 vehicles.

And Australia’s share of EVs in overall new car sales – less than 0.5 per cent (not including Tesla EVs) trails the western world by some distance, with many European countries already reporting EV shares of more than 10 per cent and Norway more than 70 per cent (pure battery-electric).

The modest gains for EVs in Australia in January were accompanied by a call from the Federal Chamber of Automotive Industries (FCAI) for federal and state governments to work together to banish unhelpful policies and regulations if the auto industry is to achieve net-zero goals.

However, it stopped short at calling for a clear transition to electric vehicles, instead of pushing for consumer education to “let the market decide”.

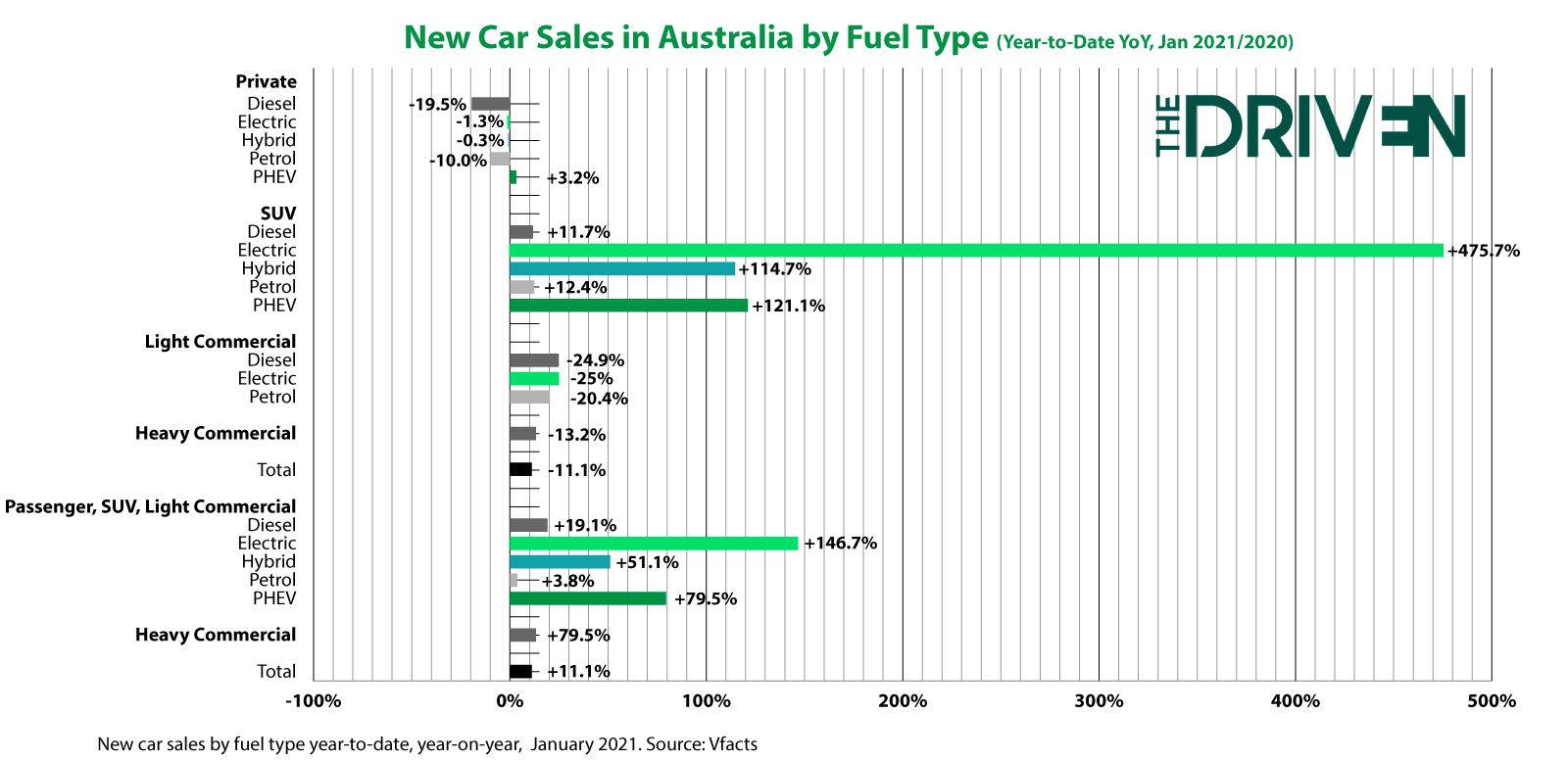

Auto sales are bouncing back after as new figures in from Vfacts for January show the industry has instead seen an 11.1% jump, after a tumultuous 2020 which saw a 13.7% drop in sales from January to December.

It’s still early in the year of course but one thing is certain: Australians continue their love affair with SUVs, and while conventional hybrid engines have gained, plug-in electrics still account for a very minor total, despite the presence of the Kona Electric, which in 2021 was the most popular electric SUV in Australia, and the MG ZS EV.

At first glance, it would appear that it is only SUVs driving EV sales increases in Australia – but there is another tale to be told when including Tesla which continues to be the market leader in Australia but does not report its local sales to the FCAI.

Overall, electric vehicles were the largest fuel type to jump, up almost 150% from 2020, and PHEV sales increased by 80%.

Many countries have laid down tough new rules to halt petrol and diesel sales (Norway by 2025 and the UK by 2030) and even automakers such as Nissan and GM are laying down net-zero by 2050 targets (2040 in the case of GM).

Australia has no such target, only a voluntary emissions standard.

“The FCAI CO2 Emissions Standard aligns with manufacturers’ traditional position of bringing the best possible products, with the latest safety and drive-train technologies, to the Australian market,” FCAI chief Tony Weber said.

“The initiative aims to provide certainty to manufacturers to enable them to confidently plan future product for the Australian market. The intent behind this new Standard is to ensure automotive manufacturers can continue to do what they do best – and that is to bring the latest, safest, and most fuel-efficient vehicles to the Australian market.”

Under the voluntary CO2 emissions standard, the FCAI estimates that cars and light SUVs will, on average, have CO2 emissions under 100 grams per kilometre and heavy SUVs and light commercials under 145 grams per kilometre by 2030.

In the UK and Norway, of course, they will be zero and industry experts have warned multiple times that without legislative measures to reduce vehicle emissions, Australia is at risk of becoming a dumping ground for less efficient vehicles as carmakers shunt new technology to regions with clear targets to reduce emissions.

They say that purchasing incentives are needed if the local auto market is to meet the FCAI standards.

In Europe, vehicle emissions standards now stipulate the average fleet carbon emissions from any carmaker must be under 95 grams per kilometre – meaning even if the Australian industry keeps to the FCAI voluntary standard, it will be a decade later.

When it comes to transport, against the rest of the world the 16.2% increase in battery electric vehicle (BEV) sales in Australia in 2020 were still lacklustre given global BEV sales jumped 80% according to EV Sales.

With EV sales still hogtied by outdated taxes such as the luxury car tax, and the states of Victoria, South Australia and NSW threatening to impose a road tax on electric vehicles, there is clearly more work to be done, says Weber.

Weber says the FCAI “supports governments and industry working together to develop a comprehensive approach to addressing motor vehicle emissions that includes fuel quality standards, the introduction of Euro 6,” but stopped short of calling for a transition to zero emissions transport.

“Rather than prescribing one technology over another, we should continue to encourage buyers to make informed decisions and let the market – manufacturers and customers – drive the uptake of new and emerging technologies such as full electric and hydrogen as we move to 2030 and beyond to 2050,” said Weber.

The local auto industry needs “a challenging but realistic, achievable and market-relevant CO2 standard,” said Weber.

Bridie Schmidt is associate editor for The Driven, sister site of Renew Economy. She has been writing about electric vehicles since 2018, and has a keen interest in the role that zero-emissions transport has to play in sustainability. She has participated in podcasts such as Download This Show with Marc Fennell and Shirtloads of Science with Karl Kruszelnicki and is co-organiser of the Northern Rivers Electric Vehicle Forum. Bridie also owns a Tesla Model Y and has it available for hire on evee.com.au.