First Elon Musk took on Big Oil, and then the trillion-dollar auto industry. Then it was the turn of the legacy energy utilities. Musk launched the first models of his Tesla electric vehicles, and followed that up with a home-based Powerwall and a grid-scale big battery, and promised to de-carbonise the world.

How they laughed. And how they bet against him. Suddenly, though, it is dawning on many that Tesla and Musk are not quite the jokes they hoped they would be.

Over the last couple of months, and in particularly the last few days, the Tesla share price has gone into orbit. After jumping 20 per cent on Monday, it did the same and better on Tuesday, leaping to a peak of $US960 in early trade before settling at $US887, still a 13 per cent, or a $US16 billion gain in value on the day.

It’s jumped five fold in less than a year, but this is no penny dreadful. It’s now a $US160 billion ($A237 billion) company.

To be sure, this is not a market gain based on the traditional fundamentals of corporate structure and quarterly earnings.

There is not a hint of the current market value in conventional metrics. What we are seeing now is the growing realisation that Musk really might change the world for the better, and in ways they have not wanted to imagine.

The latest surge in the share price owes something to the short sellers – many rich investors who bet their house on Musk failing – suddenly having to cover their positions. Their combined losses are estimated at around $US5 billion over the last two days alone.

It also comes after some serious re-thinking about potential value of Tesla, and the future of those trillion-dollar legacy industries. One of the latest to come on board is billionaire investor Ron Baron, who says the Californian electric car company has the potential to hit $US1 trillion ($A1.48 trillion) in revenue in 10 years.

Baron was already a billionaire before he invested in Tesla stock in 2014. Now he’s a billionaire all over again because that $US357 million investment is now worth $US1.5 billion.

“There’s a lot of growth opportunities from that plant going forward,” Baron said on CNBC. “[Tesla] could be one of the largest companies in the whole world.”

A day earlier, Ark Invest suggested the stock could be worth $US7,000 a share within five years. That equates to a market value of around $US1.5 trillion – making it more valuable than the current top stocks, Apple and Saudi Aramco. (And there’s a lot of Apple in the way Tesla proposes to managed its EV and batteries).

Ark Invest’s reasons for this are worth repeating.

“Based on our updated expectations for electric vehicle (EV) cost declines and demand, as well as our estimates for the potential profitability of robotaxis, our 2024 expected value per share for TSLA is $7,000,” it wrote in a note to investors over the weekend.

This, essentially, is a massive bet on the success of Tesla’s Full Self Driving, and Musk’s dream of potentially turning every Tesla with the appropriate software into a robotaxi, and his own dreams of building a huge fleet of robo-taxis that will revolutionize the way we do road travel.

Stanford University’s Tony Seba has been talking about the arrival of self-driving for a few years now.

See Death spiral for cars: Why in 2030 you probably won’t own one. And The Driven Podcast: Tony Seba on why all new cars will be electric by 2025. There’s not many people looking into the future who doubt its arrival – the biggest question is who has the technology to deliver it.

Not everyone is convinced that Tesla has it right on full self driving. But if it does, FSD at Tesla is likely to happen at a fraction of the price of rivals such as Google, Apple and others. That’s the sort of advantage the most optimistic analysts are dialling in to their valuations.

Everyone else, meanwhile, is looking at the rollout of the new giga-factories in China and Germany, the new Model Y, and the impending Tesla Semi and the Cybertruck. They are obsessed with details, delivery numbers and margins.

Attractive and exciting as these developments are, some analysts are absolutely certain that the Tesla stock is over-hyped and headed for a bust. And by any conventional measure, it may well be, even if the hardest thing to measure and predict in stock movements is market sentiment.

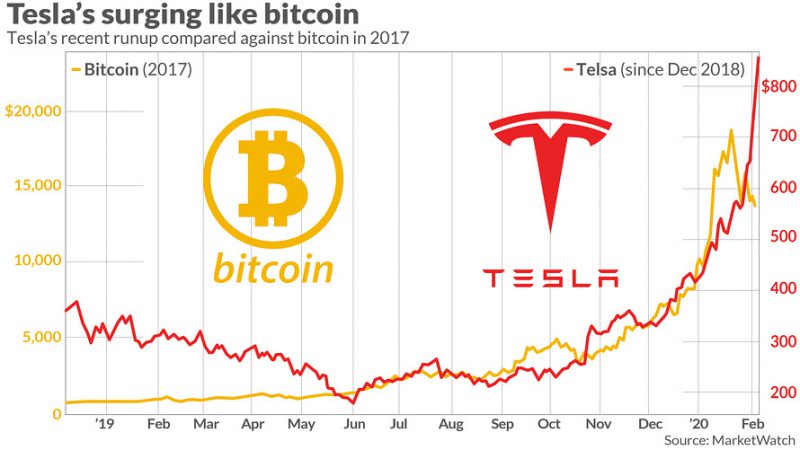

Some investors such as ex-Goldman Sachs Michael Novogratz are comparing the rise in Tesla stock to Bitcoin’s meteoric 2017 spike before it suffered an ignoble fall, Market Watch reports.

Others, such as chief market strategist at Miller Tabak, Matt Maley, are sure the rally just cannot last.

“Tesla has gone parabolic. The stock is going to get absolutely clobbered at some point before long,” he was quoted as saying by CNBC.

But Tesla – while a similarly disruptive force on markets – is a different beast to the cryptocurrency darling. And to focus on the hard data of its quarterly earnings, or even its share of the US EV market, or its upcoming “battery day” is to miss the big picture.

And that big picture is the shift, albeit belatedly, in the plans of the legacy car-makers whose party Tesla has crashed. They are now committing tens of billions to the roll out of electric models, hoping they can catch up and compete with the California upstart.

Even Ford for example, which on Tuesday (US time) posted a disappointing fourth quarter 2019 result that saw a 9% dip in stock values, has an all-electric Mustang Mach E waiting in the wings and has now also announced an electric Lincoln to be developed by Michigan EV startup Rivian.

GM, as The Driven reported earlier this week, is now trying to make a big splash and at this year’s Super Bowl launched an advertisement featuring LeBron James introducing an new all-electric Hummer.

These are vehicles that may – as geo-tagged Twitter data on mentions of the Mach E suggests – appeal to hitherto ignored fans of mass-market SUVs, muscle cars and big pickup trucks (utes).

Big Oil is also on the move, with most majors now embracing EV charging stations, wind and solar, and trying to claim a stake in the utility business. Their fossil fuel reserves are just a few policy shifts away from being worthless.

And, crucially, governments are on the move. The UK, with its Tory government, is fast tracking the banning of sales of new diesel and petrol cars from 2040 to 2035, as it seeks to set an example ahead of the “last chance” global climate talks in Glasgow later this year.

And for good measure, the Tories are going to ban conventional hybrids as well. Bang goes the business model of the only car company still worth more than Tesla, the Japanese giant Toyota.

The Tesla share price might rise and fall, but investors are just now starting to understand what the future might look. And until Tesla’s rivals start to share that vision, many investors have no reason to choose any other stock.

Says the billionaire Baron: “Whether Elon Musk is successful or not I am really glad to have invested in this company because I’m helping – this guy is saving the Earth. Brilliant guy, great businessman, and saving the planet.”

Note: This story has been updated to correct a forecast market valuation of the company.