The International Energy Agency, the organisation created to protect the developed world’s access to oil supplies after the shock of the early 1970s, has some bad news for the oil industry: The world is going electric.

According to its annual and voluminous (650 pages) World Energy Outlook, published on Tuesday, the Paris-based IEA says the number of electric vehicles on the roads by 2040 may top one billion. That will represent half of all vehicles on the road at the time, up from a paltry 0.3 per cent now.

The massive global uptake is driven by a switch to electrification, not just in transport but a range of different sectors (heat and manufacturing included), that is in turn driven by the plunging cost of wind and solar which can deliver cheap electricity.

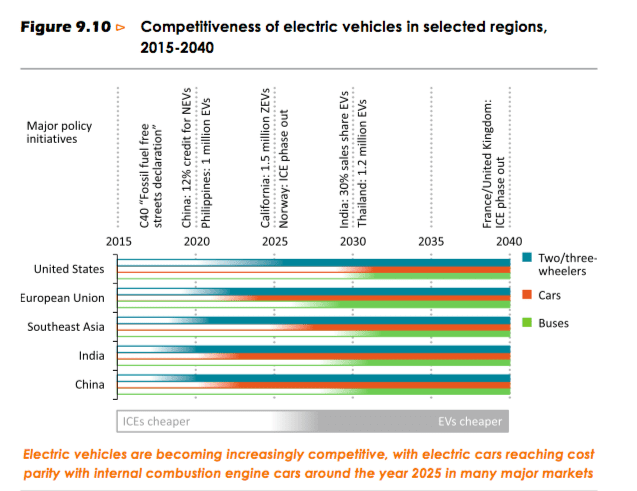

EVs will also hit price parity at varying times across the next decade. The IEA is traditionally conservative on its forecasts for new technologies – both in cost and deployment – but it still expects cost parity to be reached by the mid 2020s in Japan, Korea and many European countries.

Cost parity arrives in those countries first because of a preference for small vehicles that require lower battery capacity and have relatively high taxes on petroleum fuels.

Cost parity arrives in those countries first because of a preference for small vehicles that require lower battery capacity and have relatively high taxes on petroleum fuels.

In India, cost parity is expected to be reached soon after, followed by China and Southeast Asian countries in the late 2020s, where the size of the average car is bigger.

It says cost parity in North America is more challenging due to relatively low fuel taxes and customer preference for larger vehicles with a long driving range. But that may be challenged by Tesla’s experience where customer are ready to pay more an EV they covet.

On trucks, the IEA is even more conservative, suggesting that electric trucks “equipped with overhead catenary lines” start to be cost-competitive with diesel medium- and heavy-duty trucks in the European Union in the early-2030s and in China from the mid-2030s.

It does not seem to contemplate battery-only trucks of the type being proposed by Tesla, or even fitted out by Australia’s SEA Electric, which is seeing four-year pay-backs on all-electric battery packs.

It does not seem to contemplate battery-only trucks of the type being proposed by Tesla, or even fitted out by Australia’s SEA Electric, which is seeing four-year pay-backs on all-electric battery packs.

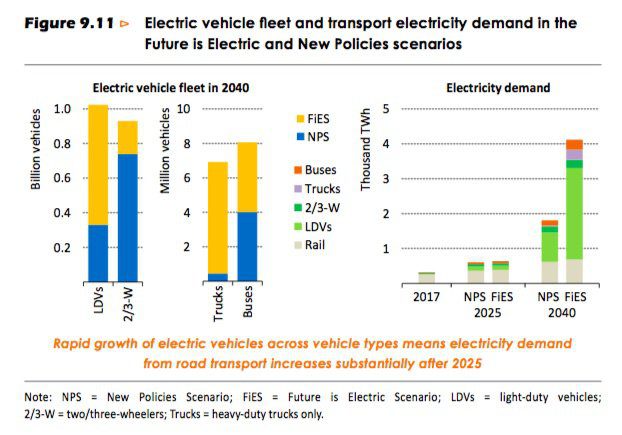

Still, even with these conservative estimates on cost, the IEA is seeing change in its Future is Electric scenario.

“By 2040, there are 950 million electric cars, nearly half of the total fleet of over 2 billion,” the IEA says in its report.

“There are also 74 million electric light commercial vehicles, and 15 million electric heavy-duty vehicles (including buses and trucks).

“About 70% of two/three-wheelers are electrified too. The result is an increase in electricity consumption by road transport vehicles of around 3 400 TWh (terawatt hours) by 2040.”

That should be good news. Right now, nearly 90% of the cars, trucks, motorbikes and buses on the road rely on engines fuelled by oil, and road transport is responsible for 44 per cent of global oil demand.

The IEA notes that some 500 million cars joined the global car fleet between 2000 and 2017, nearly half in China, taking the total fleet to 1.1 billion cars, nearly all fuelled by oil.

Electric cars, despite increasing sales in some European countries, Canada, and the US, account for just 1% of current annual car sales and represent less than 0.3% of the global car fleet.

The IEA suggests that investment for charging infrastructure will total more than $US4 trillion between now and 2040, excluding grid enforcement costs, under its scenario.

An additional ramification is that vehicles are likely to be increasingly automated. This could increase their energy consumption, not only for on-board batteries but also for extra upstream demand for data centres and data transmission infrastructure.

Giles Parkinson is founder and editor of The Driven, and also edits and founded the Renew Economy and One Step Off The Grid web sites. He has been a journalist for nearly 40 years, is a former business and deputy editor of the Australian Financial Review, and owns a Tesla Model 3.