Recently I wrote a letter to Minister Chris Bowen about decarbonising Australia’s vehicle fleet. I suggested that, although commendable, the new carbon emissions reduction target of 62-70 per cent by 2035 will not be achievable without significant regulatory changes and incentives.

The changes I recommended, together with graphics and links are outlined in this article:

- Need to make small affordable electric vehicle (EV) models available in Australia and incentivise their sale.

- Rectify the perverse incentives to purchase large vehicles, which are more dangerous:

- Current Fuel Emission Standards wrongly deem all EVs to be zero emissions.

- ANCAP ratings are misleading

- Tax write-offs encourage purchase of larger vehicles than are necessary for businesses

- Maintain the vehicle fuel excise as a pollution tax on all fuels, while applying road user charges to all vehicles

- Need for roll-out of trickle chargers in public car parks.

1. Small affordable EVs cannot be bought in Australia

Many people want to buy small (700 kg – 1.3 ton), low cost (less than $25,000) electric vehicles (EVs) because of financial and parking constraints and substantially lower carbon pollution. But those like myself who want to buy an economical small or micro EV cannot obtain one in Australia.

There is only one small EV sold here – the Fiat 500 E – and it is not affordable, costing about $50,000. A compact model, the Hyundai Inster starts at $40,000. Many right hand drive small and micro EV models such as the BYD Seagull, Leapmotor EO3, Wuling Air and Mitsubishi eKX are manufactured and sold in millions in Asia, but are not available in Australia.

In the case of the Mitsubishi eKX, the Australian Vehicle Safety Standards have been in my view overly stringent and excluded this small ‘kei car’, despite it passing Japanese standards.

I believe that the biggest impediment to small EVs is that auto retailers are choosing to only market large and medium EVs because they are more profitable. There are no incentives for them to import small and micro models. One reason is that all EVs are deemed by the Fuel Efficiency Standards to be zero emission, which is in fact not true (see below).

Government regulators are apparently not fully aware of the carbon and toxic pollution mortality costs and increasing crash trauma costs to vulnerable road users of widespread ownership of over-sized SUVs, most of which are only used for transporting one or two people.

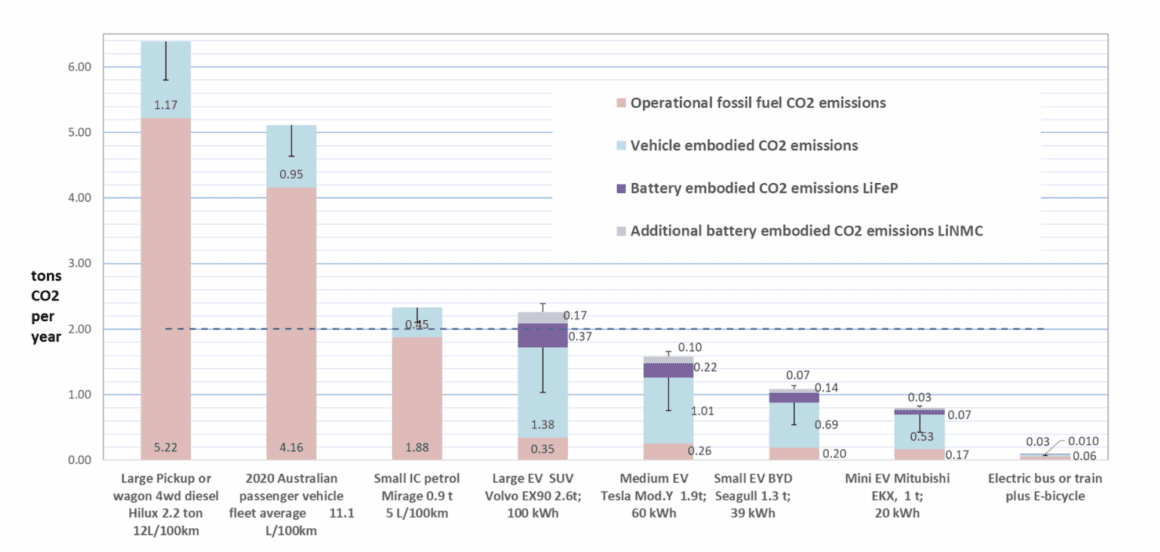

Carbon and toxic pollution from vehicles causes significantly more deaths than crashes. Furthermore, large EVs with big batteries emit up to 3 times more embodied CO2 emissions than small EVs.

2a. The Fuel Efficiency Standard (FES) is misleading and does not incentivise sale of small and micro EVs

While the Fuel Efficiency Standard will increase electrification of the transport fleet it actually works against, rather than incentivizing ownership of small electric vehicles. The reason is that it deems all EV’s to be ‘zero carbon emission’, which is not true.

Large EVs with large batteries incur significant embodied carbon emissions – up to 3 to 4 times more than small and micro EVs – in their manufacture (see figure1). One ton of carbon has the same impact on climate regardless of whether it is emitted at a factory overseas or on Australian roads.

Government needs to incentivise sale of small and micro EVs because they are most efficient for personal transport and they are the only EVs many people can afford. I believe the Federal Government should introduce measures 1 – 3 below and measure 4 would be up to state governments :

- Change the FES to include embodied emissions, thus reflecting the true total carbon impact of both EV and IC vehicles.

- Regulate to require that retailers must include micro EVs (0.7-1.2 ton) in their offerings to consumers.

- Continue the rebate scheme for purchase of EVs below 1.3 ton and 45 kWh battery capacity; the smaller the vehicle the higher the rebate. Fund this by charging a levy on the sale of large IC vehicles – the bigger the vehicle, the higher the levy.

- States should reduce third party insurance costs of small vehicles and increase them for larger vehicles according to weight, thus reflecting their real carbon pollution and toxic pollution impacts on the community at large and crash impacts on vulnerable road users. Bullbars should be banned.

2b. ANCAP ratings wrongly incentivise purchase of large vehicles for personal use

ANCAP crash ratings act as a perverse incentive for people to purchase large vehicles when they don’t need them. ANCAP has wrongly become the de-facto measure for overall vehicle safety.

In fact, ANCAP ratings disproportionally score safety of occupants over vulnerable road users and the occupants of smaller vehicles they may collide with.

Furthermore, they ignore the biggest killers of all – carbon dioxide and toxic exhaust emissions. A full explanation of this can be found here.

- ANCAP needs to be radically revised to prioritize trauma impacts on other road users over the occupants of the vehicle.

- Real pollution ratings (including embodied CO2 emissions) need to developed, mandated and required to be displayed on all new vehicles.

2c. Full tax write-offs encourage purchase of larger vehicles than are necessary for businesses

The 100% business tax write-off in the year of purchase for vehicles used in businesses should be discontinued because it encourages purchase of large dangerous polluting utes and SUV wagons for personal uses rather than for the necessary conduct of business.

This write-off should be replaced with the tax deduction system where mileage and purpose of commercial trips recorded in log books can be deducted from taxable income.

3.Maintain the vehicle fuel excise as a pollution tax on all fuels, while applying road user charges to all vehicles

Road user charges should be levied on all vehicles according to weight and distance travelled, thus reflecting their impacts of road and parking infrastructure. However, it is important that the existing fuel levy should remain as a carbon pollution tax on all fuels, including aviation fuels.

It would need to be adjusted according to the emission factor of the fuel, for example diesel is 2.8 kg CO2 per litre and petrol is 2.5. The diesel rebate for mining and other offroad vehicles should be abolished as pollution is the same whether on road or off-road.

At 52c per litre, fuel excise is actually much less than the real mortality cost of CO2 and toxic exhaust pollutants emitted by vehicles. Public awareness campaigns are needed to make drivers aware of the real cost of their vehicle’s pollution and why an indexed pollution tax on all fuels is justified.

4. Public destination fast chargers are still few and far between in most urban areas and there is little or no trickle charging available in urban carparks.

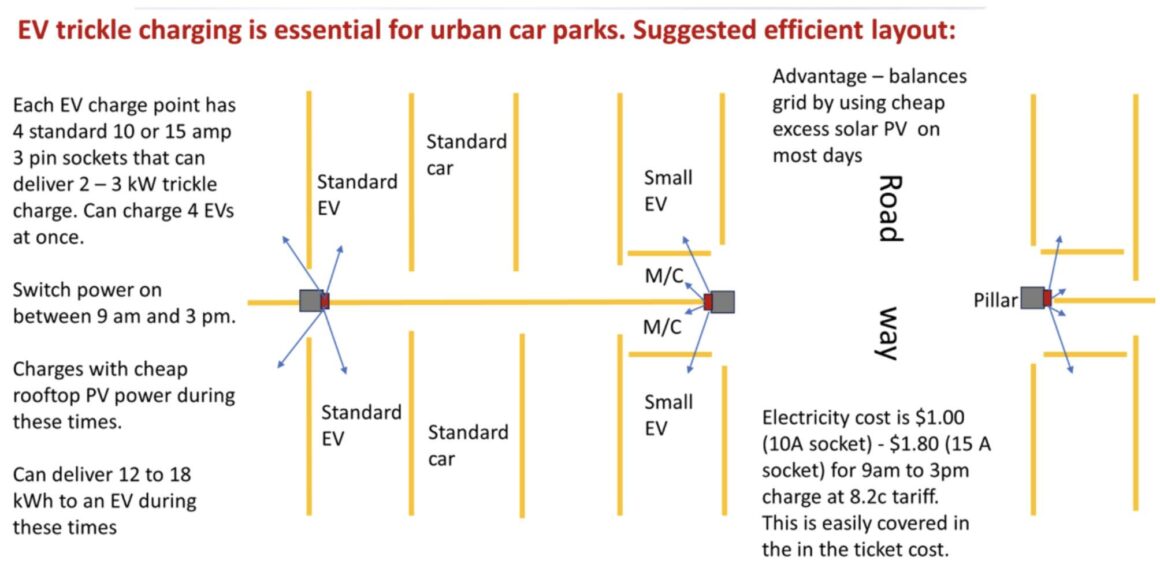

Trickle chargers, (10 or 15 amp domestic type sockets) are needed for shorter range EVs and E-motorcycles, to eliminate ‘range anxiety’ and stimulate uptake of these most efficient and low emission transport modes. Indeed, E-bicycles, e-motorcycles, mobility scooters and some micro EVs can only charge from this type of socket. The sockets can also be used by full sized EVs.

Another major benefit of 2- 3 kW trickle charge sockets in car-parks is that they can be timed to utilize the solar PV generation peaks that are becoming increasingly problematic for the electricity grid. In some areas, too much rooftop PV energy is being generated in summer and is being increasingly wasted by curtailment. Trickle chargers in car parks would ‘soak up’ this excess energy.

Utilizing their home generated energy is not possible for rooftop PV owners such as myself who typically generate about 30 kWh/ day of electricity from a 5 kW system. This is exported to the grid at near zero tariff because my EV is not at home during the hours of 8 am – 4 pm when my PV energy could charge it.

The Federal Government could and should make grants available through the States for municipal, shopping centre and railway station carparks to install 10-15 amp charging sockets. Initially less than a dozen of these sockets per car park are all that would be needed but more would need to be installed as demand increases. The cost would be low, <$500 per socket including wiring, as no circuit upgrades would be needed initially. Later as demand increases, transformer and circuit upgrades costing in the order of $1 million may be needed for the larger carparks.

The chargers could be timed to operate only for 6 hours between 9 am and 3 pm when cheap solar energy is available, thus reducing the need for PV curtailment in the grid. The cost of the electricity used would be so low that it could be initially be provided for free or included as a flat rate in the price of tickets.

Trickle chargers are the ideal solutions for these situations where cars are parked more than 6 hours in the middle of the day because:

- They are low cost and many more could be installed per transformer due to lower peak power draw of 2 – 3 kW (see slide attached).

- They are adequate to eliminate range anxiety in urban situations by supplying about 12 kWh of electricity in a 6 hour charge – enough for an EV to do return journeys of at least 80 kms.