Australia is not renowned for its rapid adoption of electric vehicles. And yet, it still smarts to see new data that reveals Australia to be one of the worst countries in the world for the number of public charging points installed compared to the number of EVs on the roads.

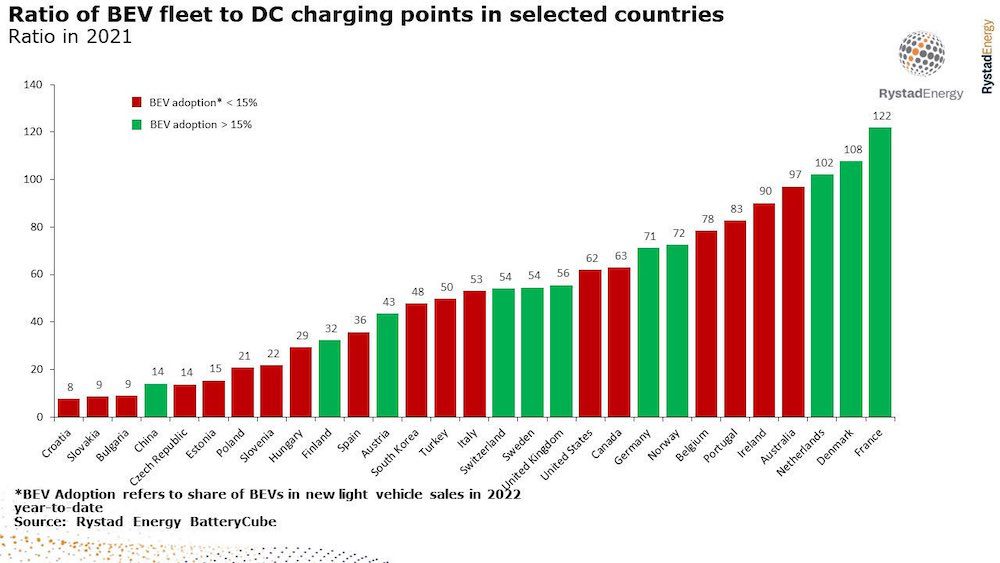

As you can see in the Rystad Energy chart below, the ratio of EVs to DC fast chargers in China, where the share of battery electric vehicles as a proportion of new sales is greater than 15 per cent, is a very healthy 14:1.

Compare that to Australia, where EV uptake languishes at 2.7% – with a total of just 50,000 BEVs on the roads as of the end of September – there is one fast charger to every 97 EVs.

To make matters worse, as The Driven has reported, a disappointing number of those public fast chargers are found by EV drivers to be out of order.

Is public charger access vital to EV uptake?

The good news, however, is that the Rystad Energy’s research has found that access to public charging infrastructure is not a limiting factor to the fast adoption of EVs, especially in nascent markets.

Rystad says that – as the chart shows – in EV-forward countries like Germany, France, and the Netherlands, there appears to be no direct correlation between the growth of charging infrastructure and sales of EVs.

Rather, consumers in these markets seem content with home charging, particularly in locations where the average journey time is low enough that public charging is not required.

But that brings us back to some more bad news: Australia’s problems with EV uptake run a lot deeper than accessibility to public EV charging infrastructure. Of far more significance, says Rystad, are issues like high fuel prices for ICE cars or high sticker prices for EVs.

“The emerging evidence shows that the availability of public charging stations, which also tend to be used less than private charging, does not influence EV adoption during the early phase of EV adoption,” says Rystad Energy analyst Abhishek Murali.

“Given the costs involved, governments are better advised to instead focus on funding and incentives to reduce sticker price and incentivise private charging before pushing ahead on public charging initiatives,” it says.

Better ways for governments to incentivise early EV uptake

To this end, the report notes that Germany has a separate funding of €350 million to incentivise it private charging – a decision based on the fact that more than 75% of charging there currently occurs at homes or workplaces.

California, meanwhile, has pioneered the concept of shared-private charging whereby residents with private chargers can lease out their charger for public use and draw income from its usage.

As a result, public charging points owned by the state and other companies make up only 45% of total public charging infrastructure, allowing the government to focus funding on DC fast charging infrastructure along highways.

The Chinese government, rather than opting to deploy charging infrastructure, requires companies to do so and then benefit from subsidies – a model that has led to many companies setting up their own networks and forming partnerships with automakers.

Home charging, first – and making EVs cheaper

Ultimately, says Rystad, “for early EV adoption, home charging is the first major requirement, followed by workplace charging and then regular public charging.

For now, however, the report recommends governments “focusing instead on reducing EV sticker prices via production incentives for automakers and subsidies for consumers” to help overcome early adoption barriers.

“Furthermore, deploying DC fast charging points across inter and intra-state highways to facilitate long distance travelling would lower the load on the distribution network.

“And deploying more public charging in areas where home charging is not possible would also help governments be better prepared for their self-imposed targets.”

Sophie is editor of One Step Off The Grid and deputy editor of its sister site, Renew Economy. Sophie has been writing about clean energy for more than a decade.