Sales of Australia’s leading EV brand Tesla have slumped in October – following a typically buoyant end-of-quarter result in September – with the Model 3 electric sedan hitting its lowest levels since 2022, and despite a stronger performance from the Model Y electric SUV.

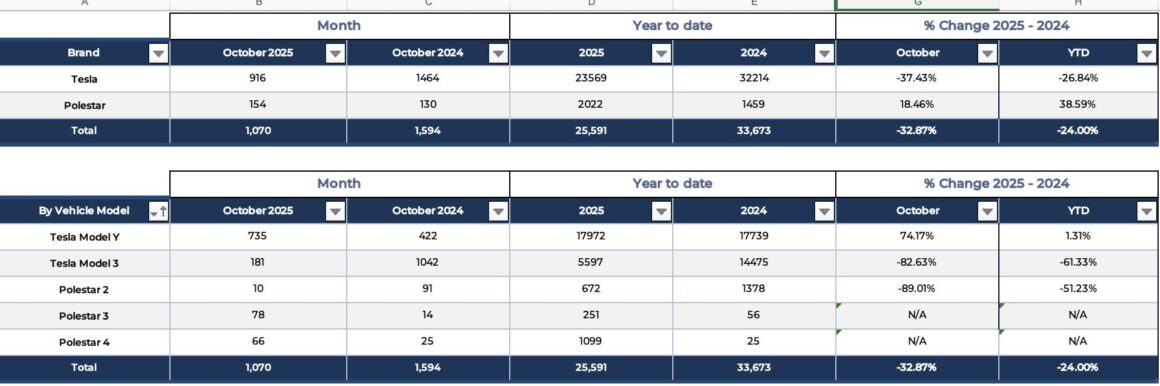

New data from the Electric Vehicle Council shows that Tesla sold 916 EVs in Australia in October, a fall of 37.5 per cent below the same month a year ago, taking its running total for the year to 23,569, a fall of 27 per cent.

Tesla sales have been disrupted by the wait for the new Model Y, which is now tracking ahead of last year’s total after an early year slump, with total sales of 17,972 in the first 10 months of 2025, up 1.3 per cent from a year ago. Tesla sold 735 Model Ys in October, up from 422 this time last year, but down from 3,927 in September.

Tesla typically ramps up its sales at the end of each of quarter, but while the Model Y is performing OK, the story is not so good for the Model 3, which slumped to just 181 sales in October, down from 1,042 in the same month last year. The Model 3 has sold just 5,597 in 2025 to date, down 61 per cent from the same period a year ago.

The EVC releases data only from its all-electric members Tesla and Polestar, who have quit the main car body the FCAI, over its stance on emissions standards.

The new data reveals that Polestar recorded 154 sales for the month, up from 130 a year ago, with the premium Polestar 3 – thanks to some big price discounts – doing best with 78 sales, ahead of the Polestar 4 (66) and the Polestar 2 (10).

The fall in the once-popular Polestar 2 sedan could be in preparation for the updated 2026 model year which is expected to land in the coming months.

Tesla’s sales in October could also be seeing a slowdown as the company awaits the landing of its Model Y Performance variant as well as the upcoming Model 3 Long Range RWD model which will be the longest range EV available in our market.

October also saw a drop in incentives from Tesla, such as the trade-in bonuses seen earlier in the year, which could partially be behind this slowdown.

Full market impact is likely to be seen in the coming days when we receive FCAI’s data on how other brands performed during the month. With early data revealing a slowdown, we expect final figures to show a total market share of around 8% for full battery EVs, down from recent months of more than 10 per cent.

See more data in The Driven’s month by month database: Australian electric vehicle sales by month in 2025 – by model and by brand