Tesla continues to haemorrhage large losses across Western Europe, with fleet operators now baulking at the brand because of the risk of resale values, according to one the region’s most respected auto analysts.

Schmidt Automotive Research, founded by its namesake Matthias Schmidt, says the blame can be sheeted down to the refresh of the Model Y and the “openly political positioning” of CEO Elon Musk, with the result that fleet operators are now shying away from the brand because of the risk of falling resale values.

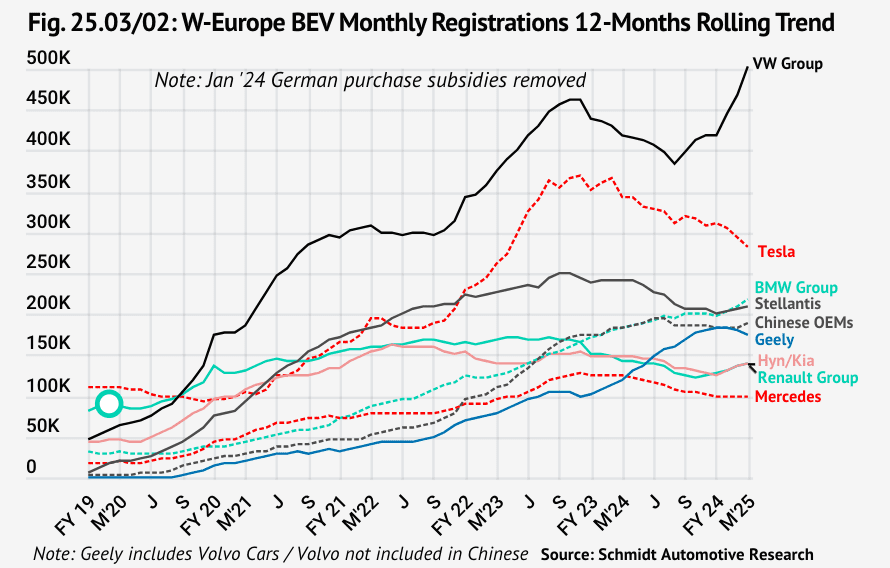

A new report published this week by Schmidt Automative shows that Tesla’s market share in western Europe fell by half over a trailing 12 months period, while Volkswagen Group became the first automotive OEM (original equipment manufacturer) to achieve over 0.5 million new BEV passenger car registrations over a 12-month period.

According to Schmidt, “Tesla continued to haemorrhage large losses seeing its share of the region’s market half from 18.9% during the opening quarter of 2024 to just 9.2% during the same period this year.”

Schmidt “partly” attributed those losses to a model refresh of the company’s Model Y, the region’s most registered BEV model. However, as has been widely reported previously, Schmidt also pointed the blame at Tesla CEO Elon Musk’s “openly political positioning”.

Schmidt echoed these views earlier in the month to the New York Times, explaining that “European April data is strongly indicating that this is more than a model changeover blip, and Tesla’s European issues are more deeply rooted and stemming from Mr. Musk.

“The tide appears to have turned at Tesla, and Europe at least appears to be moving on, or back to legacy manufacturers that have caught up,” he added.

Tesla’s shrinking market share allowed another German carmaker, BMW Group, to surpass the American EV maker on a quarterly basis, helping it to achieve a double-digit share of the market for the first quarter.

BMW saw a 1.6 percentage-points increase, year-over-year, whereas Tesla remained in single-digit territory after an almost 10 percentage-point year-over-year loss.

This news comes only a month after Schmidt Automotive Research data showed Tesla’s share of the Western Europe new passenger car market fell to its lowest level in almost three years.

According to Schmidt Automotive Research data, during the first quarter of 2025, “Tesla’s share of the total new car market across all fuels sank to an almost three-year low of just 1.7% share of all new cars that entered the 18-market region between January and March.”

Joshua S. Hill is a Melbourne-based journalist who has been writing about climate change, clean technology, and electric vehicles for over 15 years. He has been reporting on electric vehicles and clean technologies for Renew Economy and The Driven since 2012. His preferred mode of transport is his feet.