Electrification of the global transport industry will shape the next phase of the eMobility revolution, with 20 per cent of all trucks and buses around the globe expected to be battery electric by 2030.

These are the high-level conclusions from a new analysis published by Strategy&, the global strategy consultancy of global accounting firm PwC, which analyses the global truck market’s shift toward electrification.

Strategy& predicts that one in five buses and trucks around the world will be battery electric by the end of this decade, with 90 per cent of all transport to be electrified by 2040.

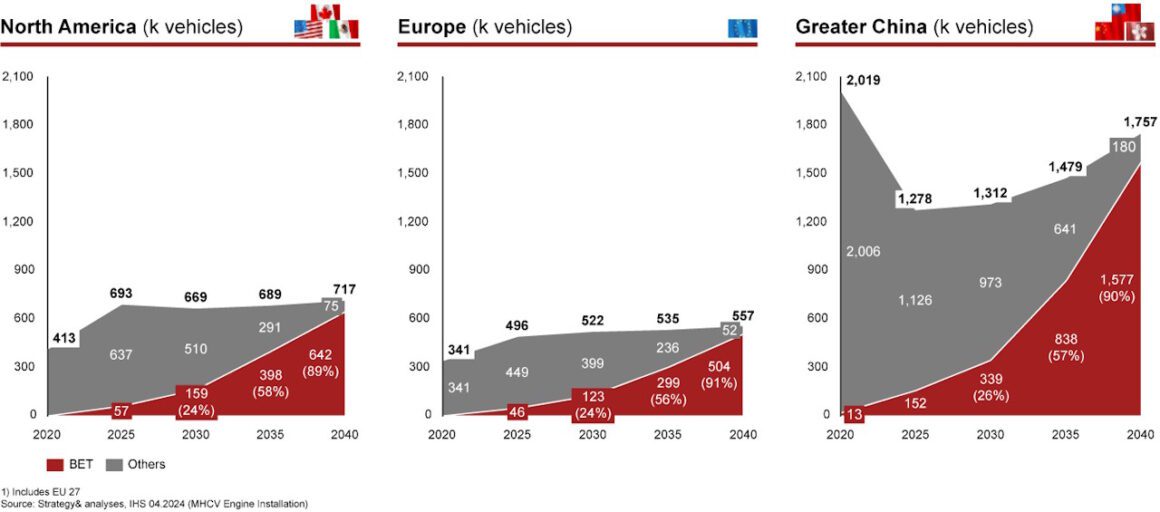

In real numbers, Strategy& expects production volume for North America, Europe, and “Greater China” (referring to Mainland China as well as its claimed regions) to be around 600,000 battery electric trucks (BETs) in 2030, escalating quickly to 2.7 million by 2040.

According to Strategy&, regulatory mandates – such as those in the European Union requiring truck OEMs to reduce new fleet emissions by 45 per cent by 2030 and 90 per cent by 2040 – are helping to drive the transport sector’s electrification transition.

Similar mandates are being considered in the United States and China and, like the EU, are planned to become steadily stricter from 2030 onwards.

Moreover, even though there are fewer trucks on the road than cars overall, Strategy& finds that an electrified truck saves on average more than 20-times as much CO2 as an electrically powered car.

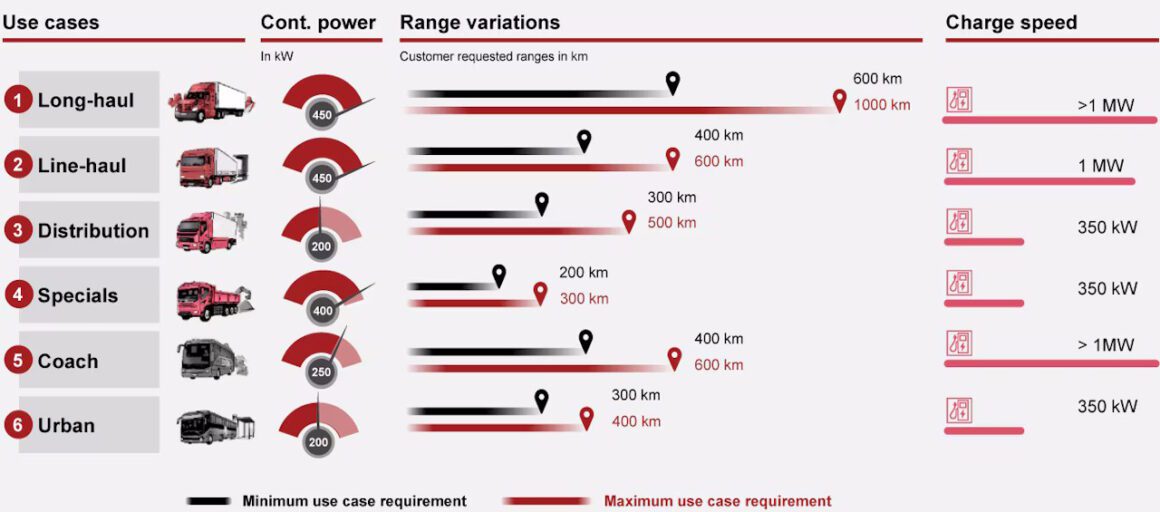

Alongside the impact of regulatory restrictions, advances in electric truck technology and better battery chemistries will continue to evolve, opening the door to more use cases, leading to more opportunities to electrify.

Initial BET generations have been limited by technology and cost, but OEMs are quickly developing newer generations of electric trucks with increased range and reduced costs.

Evolution of battery electric trucking technology will quickly see the range of electric trucks expand – by around 50 per cent from 600 to 900 kilometres, according to Strategy&, with charging speeds increasing by 200 per cent to up to 1,200kW. Conversely, the costs for BET drive trains will fall by around 10 per cent.

All of these changes will help to ensure that BETs can be used economically in long-distance transport and on scheduled services between logistics hubs.

These technological innovations will be vital, however, in reducing the initial high cost of investment required to buy BETs, though cheaper running and fuel costs (electricity compared to diesel) result in a lower total cost of ownership (TCO) for those able to meet the initial investment costs.

Expanding truck electrification will also require further “truckification”, using trucks in more use cases to replace other emissions intensive transport technologies, but this completes the circle, requiring ever evolving technological innovation.

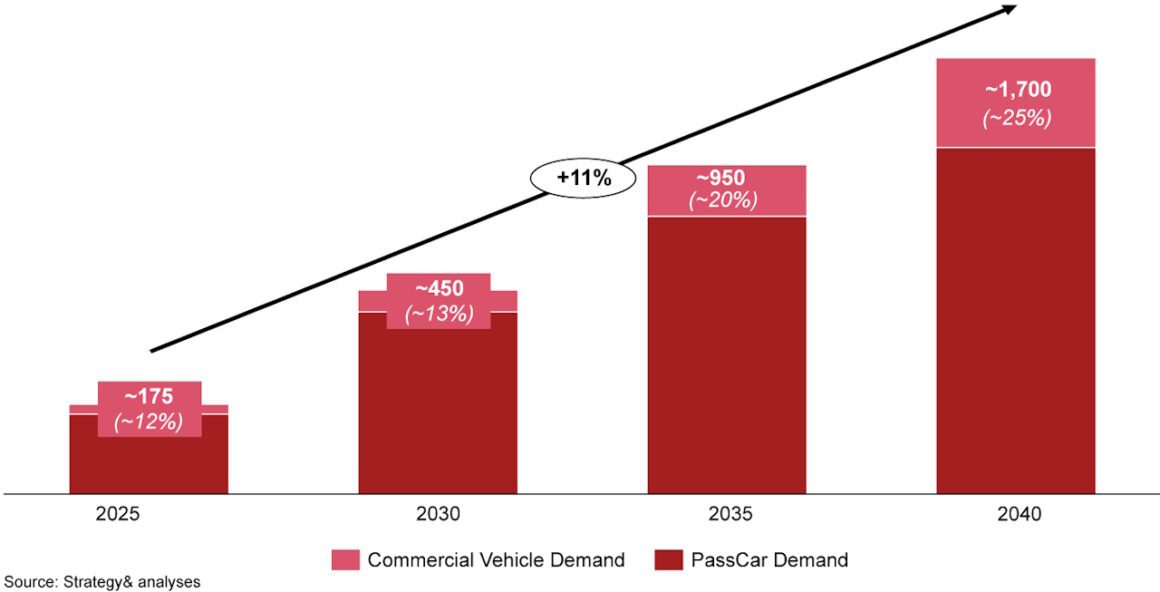

Strategy& unsurprisingly also found that truck battery demand will continue to be pushed higher. Global BET battery demand will surpass 400GWh by 2030 and 1,700GWh by 2040, with a particular emphasis on lithium iron phosphate (LFP) technology.

“After the transport sector struggled for a long time with the switch to electric trucks, we are now observing a profound change in the industry,” said Dr. Jörn Neuhausen, senior director and head of electromobility at Strategy& Germany.

“The third generation of electric trucks brings with it new platforms for different customer requirements and broad use in a wide variety of application scenarios.

“The basic prerequisite for this, however, is that private and public players from regulators to the automotive and energy sectors to logistics and the financial industry cooperate. The year 2030 marks a milestone in this development, from which the transformation of the industry will accelerate significantly due to regulatory factors.”

Joshua S. Hill is a Melbourne-based journalist who has been writing about climate change, clean technology, and electric vehicles for over 15 years. He has been reporting on electric vehicles and clean technologies for Renew Economy and The Driven since 2012. His preferred mode of transport is his feet.