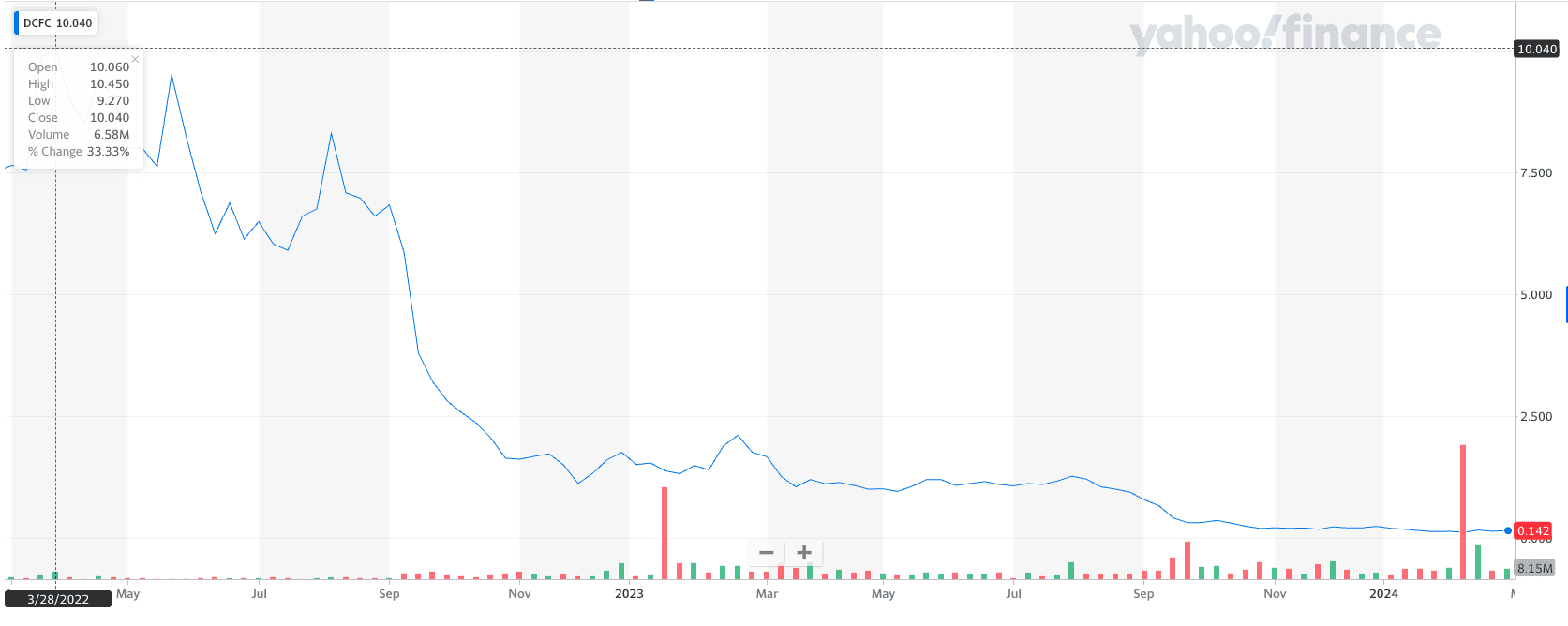

Australian EV charger maker Tritium has proposed a radical share plan to protect its listing on the Nasdaq stock exchange following a dramatic slump in its share price.

The company announced on Friday (Australia time) that it will propose a 200 to 1 share consolidation to boost its share price. It needs to act before April, and has called a shareholders meeting for March 22 in its home base of Brisbane.

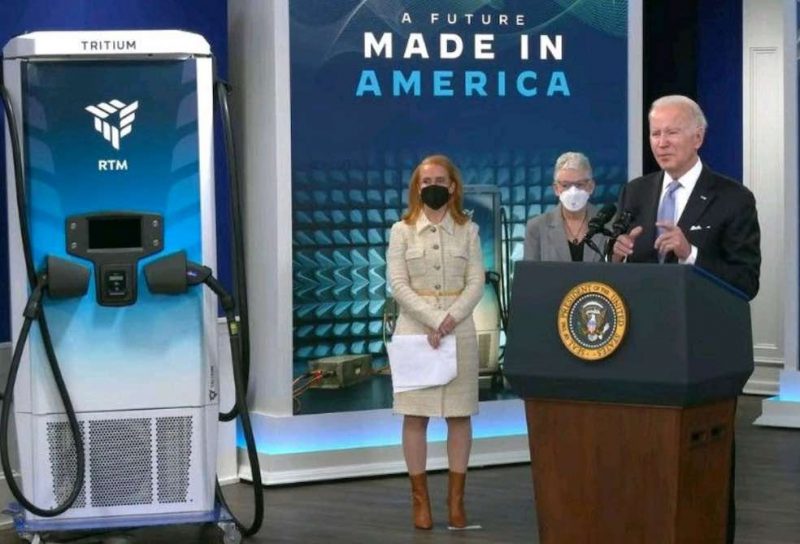

Tritium enjoyed a successful debut on the Nasdaq, delivering bumper returns to some of its original shareholders, but its share price slumped following concerns about its profitability and the reliability of its EV fast charging equipment, which has come under criticism.

The share price which has dropped from a high of $10.45 in March 2022 to a low of just $0.14 this week – a 75 fold slump in in just two years.

In October last year Tritium was warned it could lose its status on the Nasdaq stock exchange after losing nearly 90 per cent of its value. At the time Tritium said it had received a formal notice from Nasdaq that its stock had been trading under the minimum bid limit of $US1 for 30 consecutive business days.

To remain compliant with the listing rules, the stock must trade above $US1 for at least 10 consecutive business days. From October the company had at least another six months to achieve this which may explain the extraordinary meeting to consolidate the stock.

It has been reported that Tritium has also canvassed fund raising proposals, but there was no mention of these in the brief statement to shareholders.

Tritium has been plagued with reliability issues with its chargers in recent years however these issues mostly concern older models. In early February RACV announced it will replace all first generation Tritium chargers in Victoria with Kempower units by mid-2025 to deal with reliability problems on its network.

Daniel Bleakley is a clean technology researcher and advocate with a background in engineering and business. He has a strong interest in electric vehicles, renewable energy, manufacturing and public policy.