The total installed capacity of Australia’s electric vehicle public DC fast charging network grew a staggering 33 per cent just in the fourth quarter of 2023, and more than half of this came from the dominant player in the market, Tesla.

Next System’s Australian Electric Vehicle Public Fast Charger Report (co-authored by myself and another contributor to The Driven, Riz Akhtar) analysed comprehensive DC charger data from Carloop that included the number of sites, chargers and installed capacity, as well as charger speeds and pricing trends.

We found that 50,500 kW of total installed charger capacity (the sum of all new DC charger capacity ratings) was added to the Australian fast charger network in the fourth quarter of last year, nearly four times more than the 13,600 kW added in the fourth quarter of 2022.

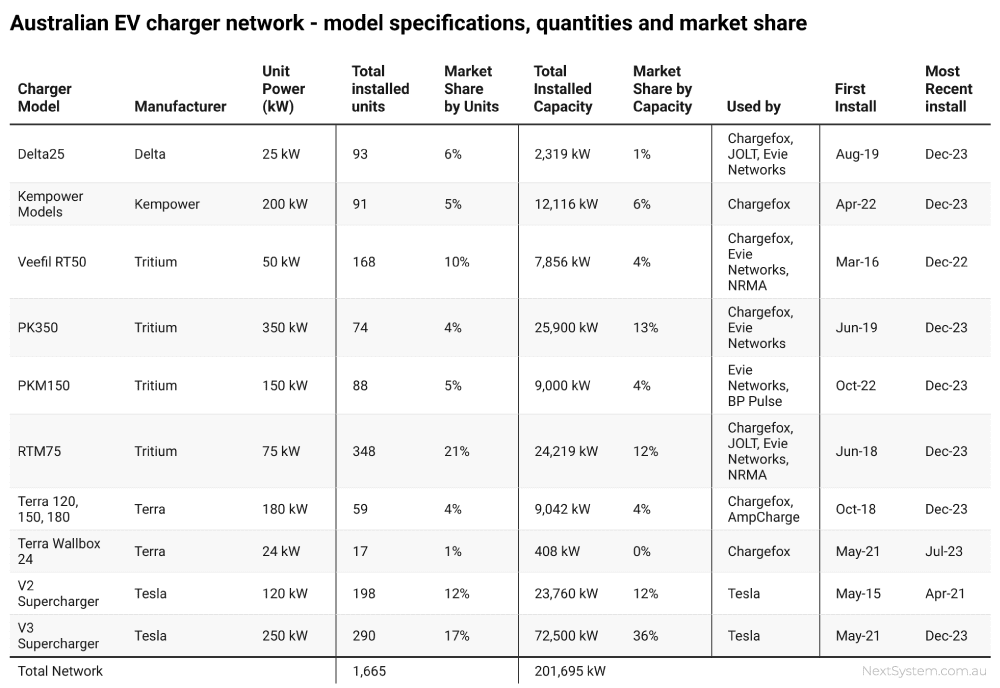

New installations by charger models

The new installations were dominated by 126 of Tesla’s V3 Superchargers, which added 30,500 kW to the network or 60% of all new capacity. It was followed by 65 Tritium RTM75 models. Kempower also had an impressive quarter with 45 new installations of its models.

The graph above provides insights into how charger technology is changing in Australia. We can see older models such as the Tesla V2 Supercharger (red dotted line) and Tritium Veefil RT50 (blue dotted line) being phased out for the new V3 Supercharger (red solid line) and Tritium RTM75 (blue solid line).

We can also see the emergence of Kempower models on the network over the past 12 months. Our research also showed that average charger power ratings have increased by 52% from 87 kW in 2016 to 133 kW in 2023.

Ten charger models made by five different manufacturers make up 93% of all charger capacity on the Australian network. While Tesla V2 and V3 Superchargers make up 48% of total network installed power capacity, Tritium leads on total installed units with 348 of its RTM75 model representing 21% of all chargers on the network.

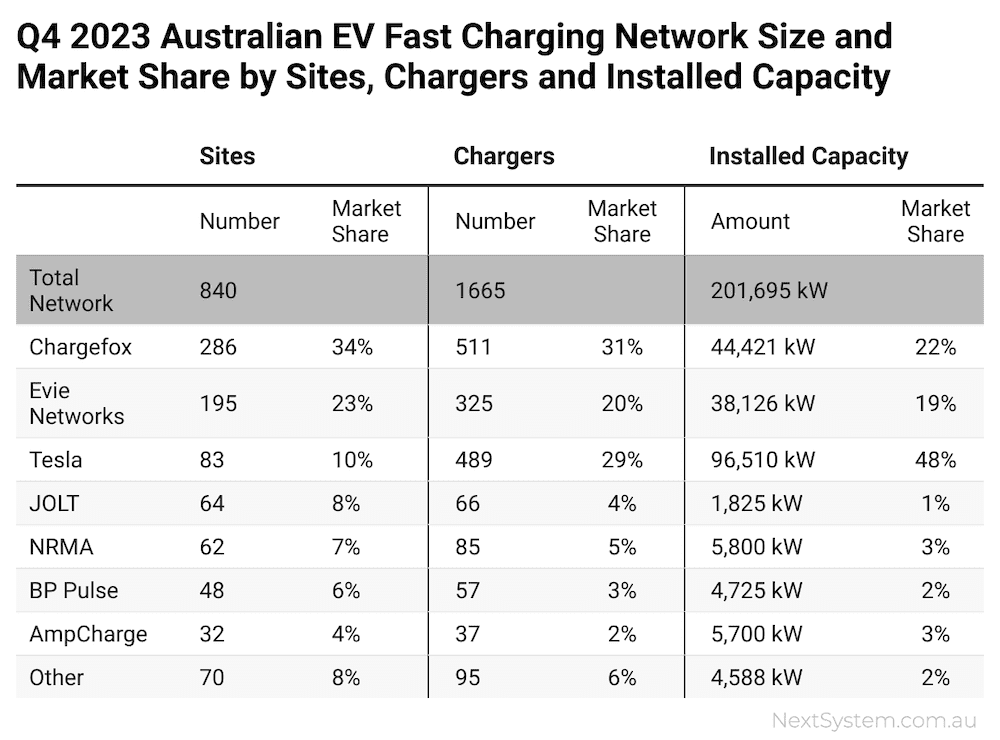

Market share by network operators

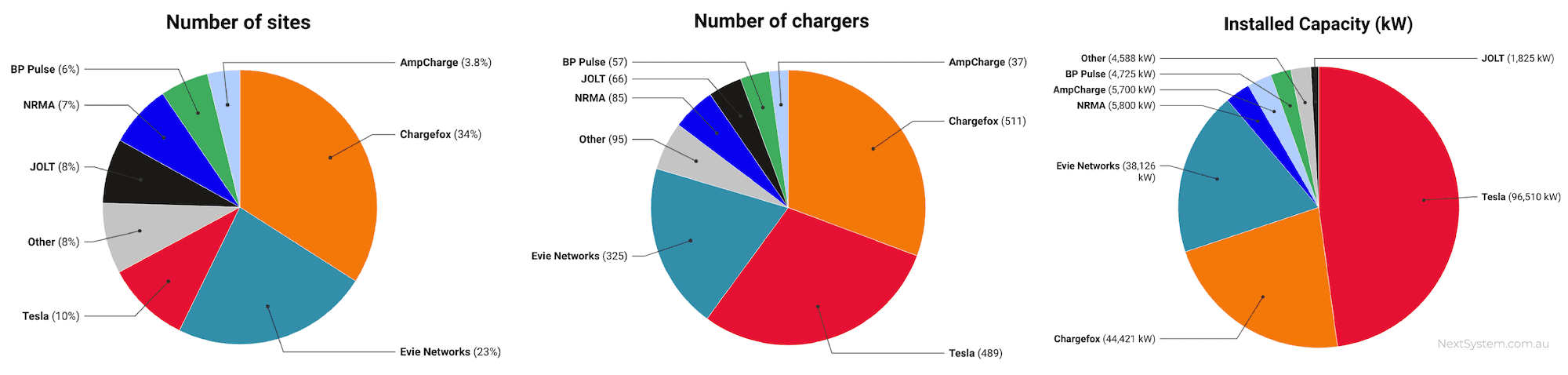

Our report also looked at network market share by number of sites, chargers and installed capacity for all major network operators. Note that in our national analysis we grouped various state based networks which are owned by RACV, RAA, RAC as well as the WA EV Network (Synergy and Horizon) and Electric Highway Tasmania under the Chargefox network.

It’s important to point out that unlike Evie Networks, Chargefox doesn’t own any charging hardware, it only supplies the billing platform. In that respect, Evie Networks is actually the largest network based on sites.

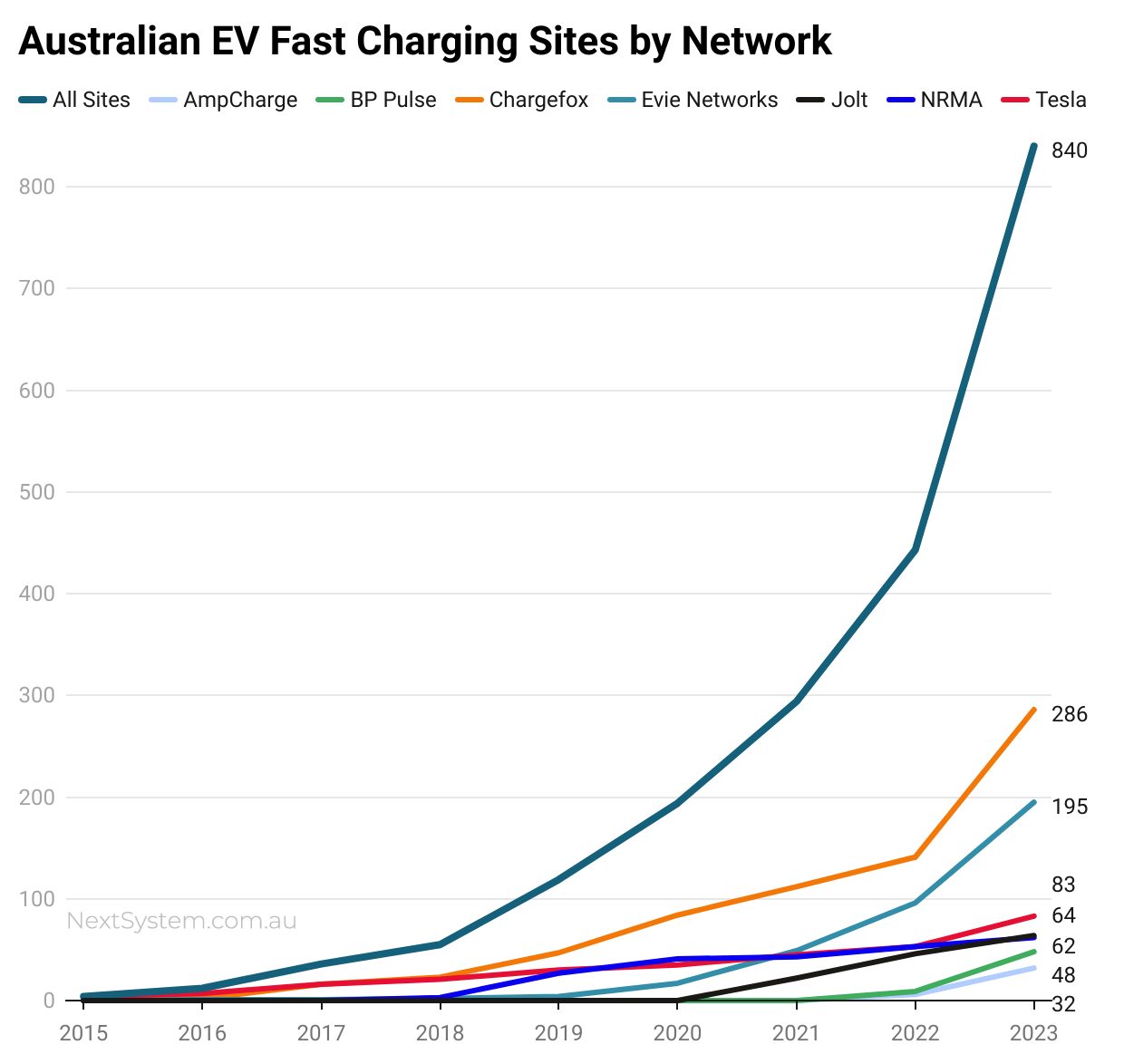

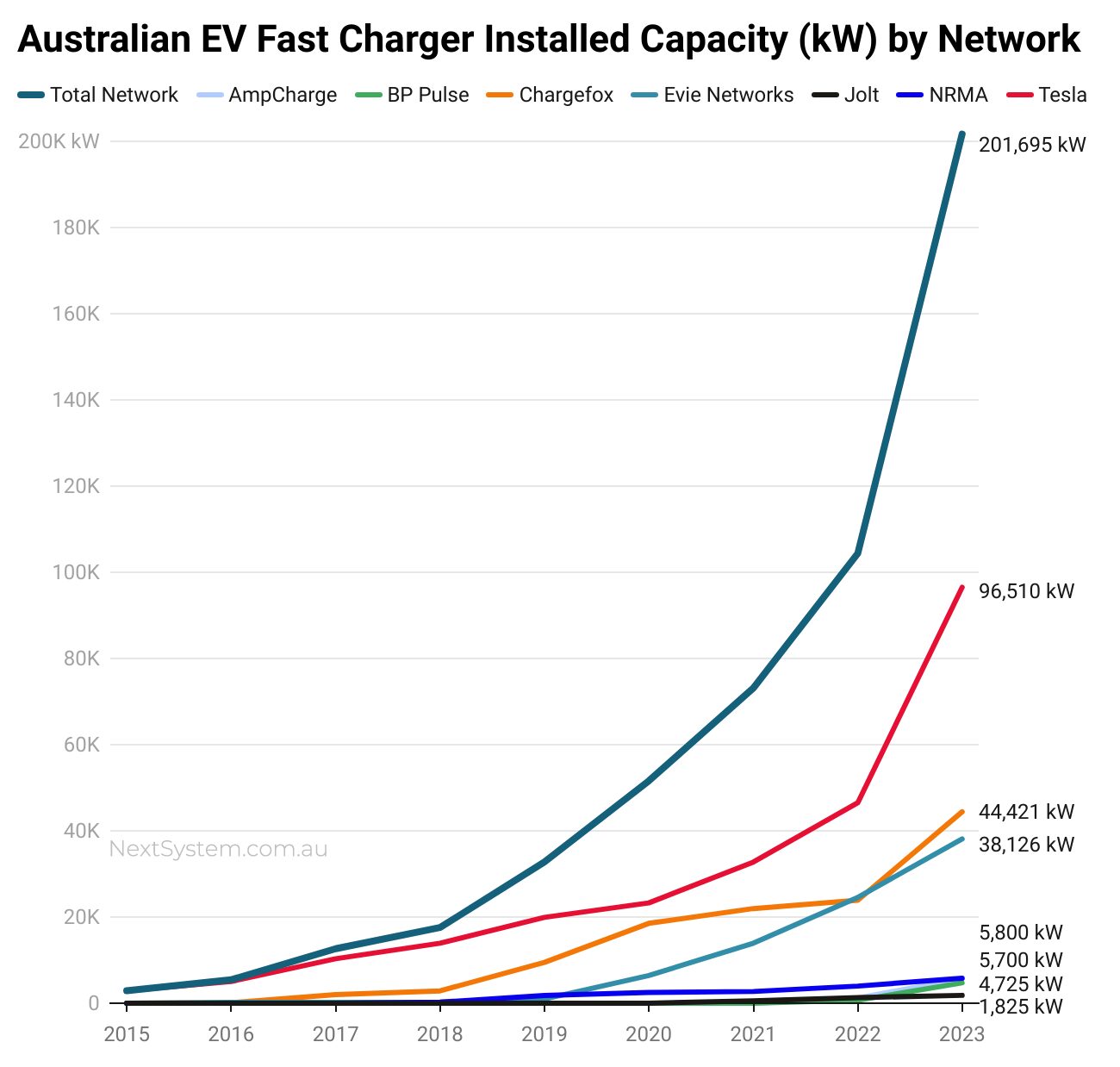

Our data includes installation dates for all charging stations in Australia which enables us to gain insights of how the network has grown over time.

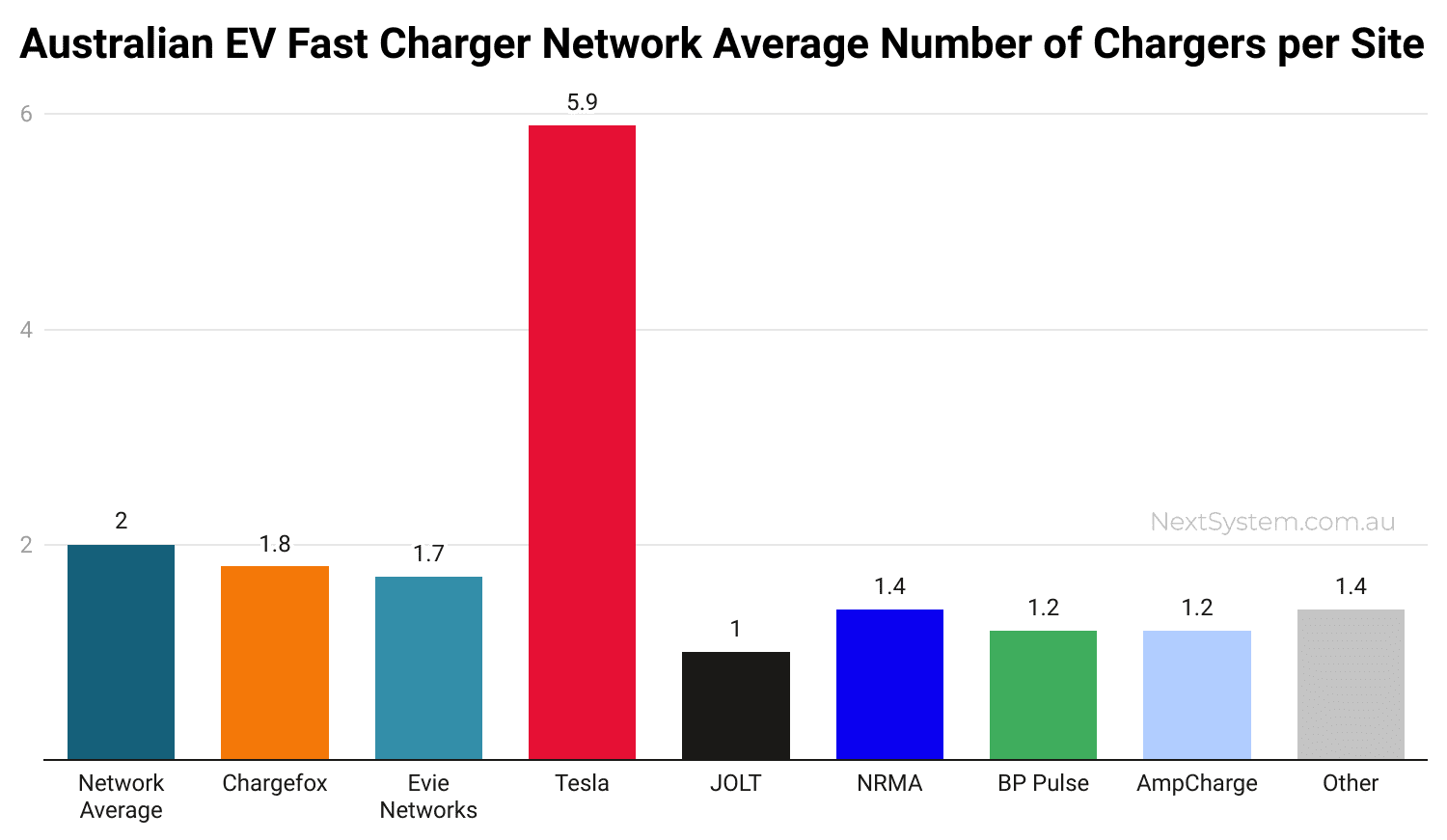

While Tesla only made up 10% of the network based on sites, it scores a much higher market share based on total charging units and installed capacity. This is because Tesla charging sites have on average 5.9 chargers per site, more than three times more chargers per site than all other networks.

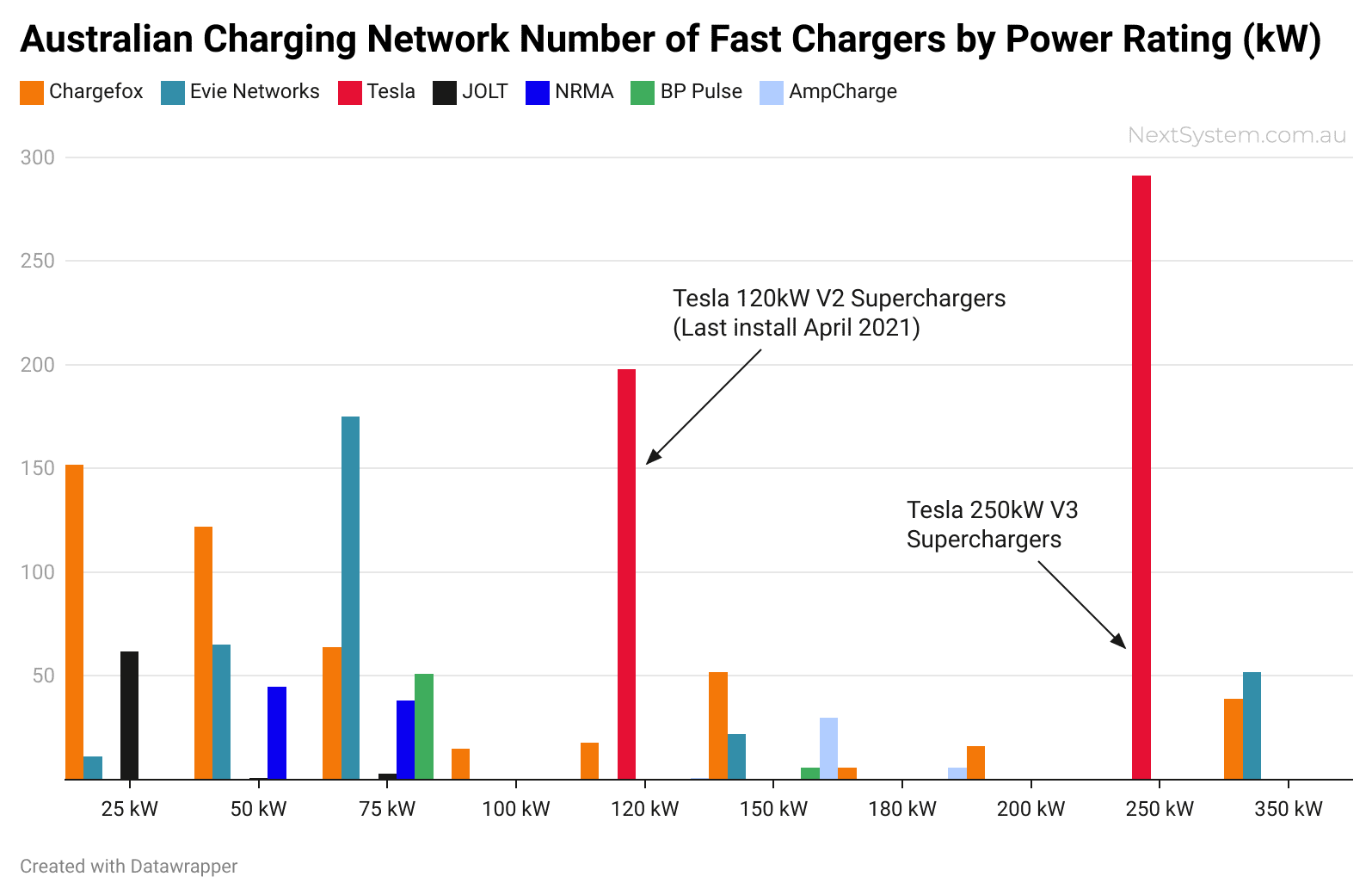

Not only do Tesla charging sites have more chargers than other networks, the chargers themselves have much higher power ratings. The chart below provides a representation of the Australian charging network showing the quantity of chargers for each power specification for each network operator.

Here we see most networks with a diverse range of charger speeds while Tesla made a step change from 120 kW V2 Superchargers to 250 kW V3 in 2021 resulting in significant growth in installed capacity over the past 2 years. This is reflected when graphing total network installed capacity over time.

Sites, chargers and power ratings

Analysing the Australian EV fast charging network based on number of sites, chargers and installed capacity produces very different results when calculating overall network market share but each metric is important to the overall quality of the network.

Increasing the number of sites increases overall network coverage which is vital to filling in black spots and ensuring regional communities have access to public fast charging. Increasing the number of chargers per site and the overall power capacity means more electrons flowing into EV batteries which is critical to the charging network keeping pace with EV uptake.

Comparing all three metrics we can see that while Tesla has focussed on fewer sites with more chargers and more capacity, other networks have so far focussed on more sites with fewer chargers.

Lack of public DC fast chargers is often quoted as being a major obstacle to electric vehicle uptake in Australia.

However the results from our Q4 2023 fast charger report show the Australian fast charging network is now growing faster than the Australian EV fleet. Let’s see if that growth is maintained in the first quarter of 2024.

Daniel Bleakley is a clean technology researcher and advocate with a background in engineering and business. He has a strong interest in electric vehicles, renewable energy, manufacturing and public policy.