The NSW government says it’s unfair electric vehicle owners don’t have to pay a specific tax towards roads, as officials steel themselves to study the implications of today’s 393-page High Court ruling that struck down Victoria’s electric vehicle (EV) tax.

However, a Productivity Commission review in 2017 shows that EV owners are already contributing significant amounts to the overall road budget.

The NSW government was reacting to the High Court ruling that invalidated Victoria’s EV road user tax, on the grounds the constitution only gives the commonwealth the right to charge excise taxes on goods.

It claims the ruling creates an unfair situation that sees “only drivers of non-electric vehicles as the only road users making a contribution to road maintenance”.

NSW treasurer Daniel Mookhey says the implications of the ruling need to be carefully considered. “The transition to net zero is only possible if the rules are applied fairly and are seen to be fair,” he said in a statement.

NSW will start talks with the states and territories on the ruling, but a spokesperson for the Treasurer would not preempt the direction they would take. The NSW government recently confirmed it will impose an EV road tax from July, 2027, after announcing it would scrap EV rebates and stamp duty exemptions from the end of this year.

EV owners still actually paying for roads

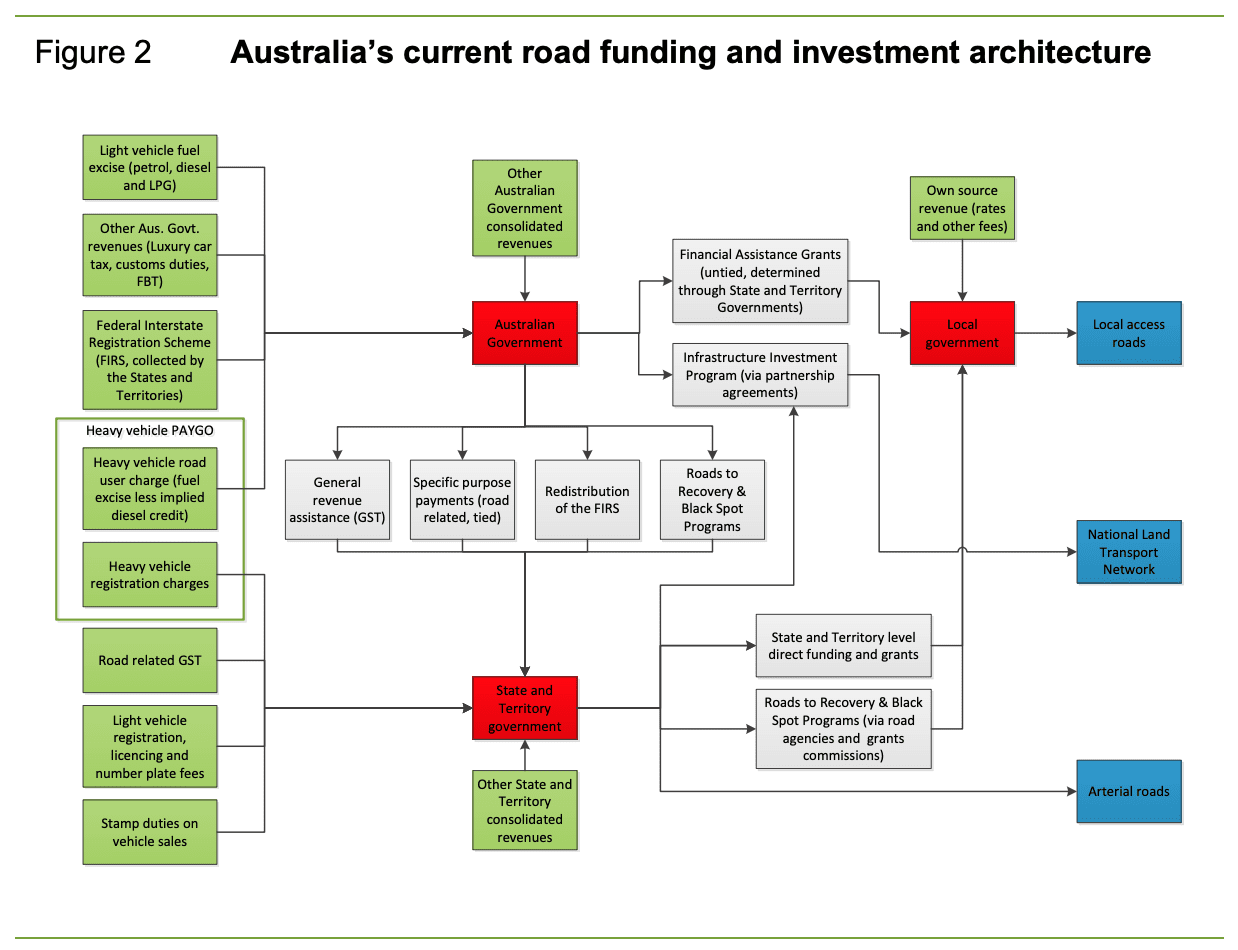

The perception that EV owners are getting a free ride is not entirely correct, because funding for roads is not as simple as taking a cut of fuel taxes.

The Productivity Commission, for instance, says money for roads comes from a wide range of different channels – including taxes EV owners pay on their cars.

It found road maintenance funding includes council rates, luxury car taxes, stamp duties and registration fees, many of which EV owners already pay.

According to the Australian Local Government Association, the burden of funding local roads is increasingly falling on local councils’ rates income.

In 2015-16, the total road budget was $26.4 billion and fuel excise taxes covered about 44 per cent of that, but it’s a fee that is being eroded by fuel efficient vehicles and changes in driver behaviour, such as car sharing.

Furthermore, states do not receive a share of the fuel excise tax per se, but funding from the federal government to support road spending.

The federal government is responsible for the fuel excise tax on petrol and diesel which amounted to $12.1 billion in the 2021 financial year. Last year the Australian Automobile Association (AAA) said 70 per cent of this was spent on roads that year, up from 40 per cent the year before.

And yet it’s a tiny drop in a broader bucket of income that goes towards road maintenance.

Local councils are also significant investors in roads, with spending touching $6.2 billion in 2014-15 compared to $12.5 billion by the states and territories and $4.8 billion by the federal government, the Productivity Commission found.

And even if road funding was as simple as replacing a fuel tax, it’s still unclear why state governments, rather than the federal government, should be the ones to take the lead on a new EV road tax.

Rachel Williamson is a science and business journalist, who focuses on climate change-related health and environmental issues.