European car giants are facing a massive shake-up, and a potentially devastating loss of income, from changes in the car market as electric vehicles cause a change in consumer behaviour, and Chinese car makers grab a significant share of the EV market.

The warnings come in a major new report from Allianz Trade, part of the European insurance giant, which says that China’s growing share of the EV market in its home market and the EU will see the European car industry shrink by €24 billion a year and associated supply chain industries shrink by an additional €21 billion.

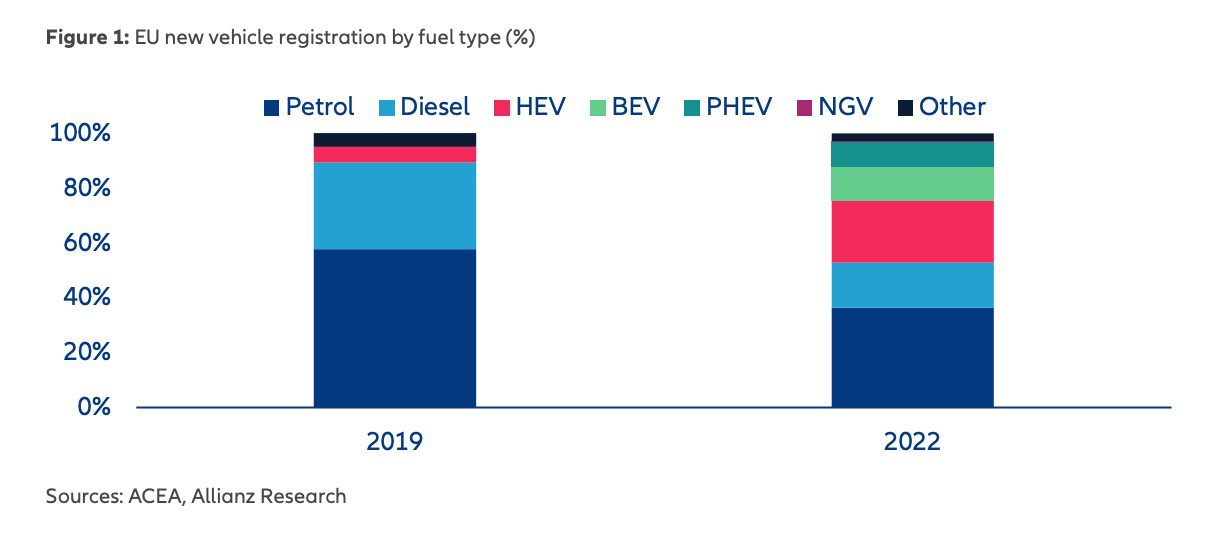

The report titled The Chinese challenge for the European automotive industry, cites a number of factors at play including a shift away from a car-centric society, the Chinese lead in EV, the fact that electric cars have fewer components, and Europe’s own ban on new fossil fuel cars from 2035.

“With the 2035 phase-out of internal combustion engines (ICE) looming, the automotive sector is on the cusp of a complete shake up, facing a transformation of its supplier base, changing customer needs, competition from new entrants and the reality of a less car-centric society,” the report says.

The stakes are high for Europe’s automotive industry because 80 per cent of cars sold in Europe are assembled locally and the industry’s exports have generated a trade surplus of between €70 billion and €110 billion every year over the past decade for the European economy.

The automotive sector is Europe’s largest single industrial sector, accounting for 10 per cent of its manufacturing industry. In Germany, it accounts for 15 per cent. The European auto sector also has a strong impact on upstream industries including metals, plastics and electronics.

China’s massive EV market driving the growth of Chinese brands

Allianz says China’s rapid consumer shift to EVs has enabled Chinese EV makers to capture the bulk of the new market at the expense of European legacy auto makers. This has enabled Chinese EV makers to scale significantly in recent years which now opens up export opportunities to the EU.

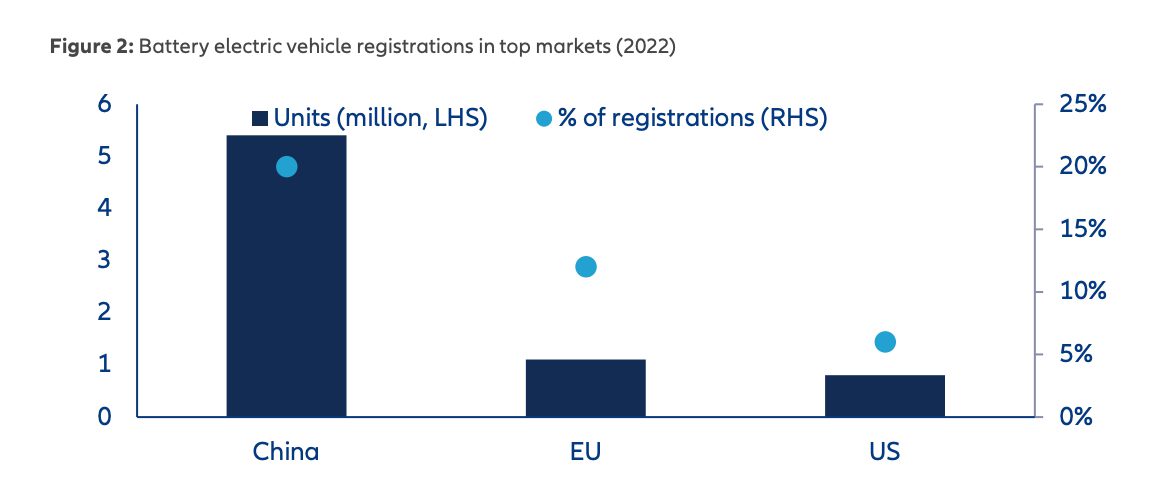

“Despite its rapid growth, Europe’s adoption of alternative energy vehicles comes only second in the world – and a distant second at that,” says Allianz

“In 2022, more than 5.4 million battery electric vehicles – two-thirds of the world total – were registered in China, +83% from 2021.”

China is the world’s largest car market with around 27 million cars sold in 2022. China also accounts for around 50% of European auto giant Volkswagen’s global sales.

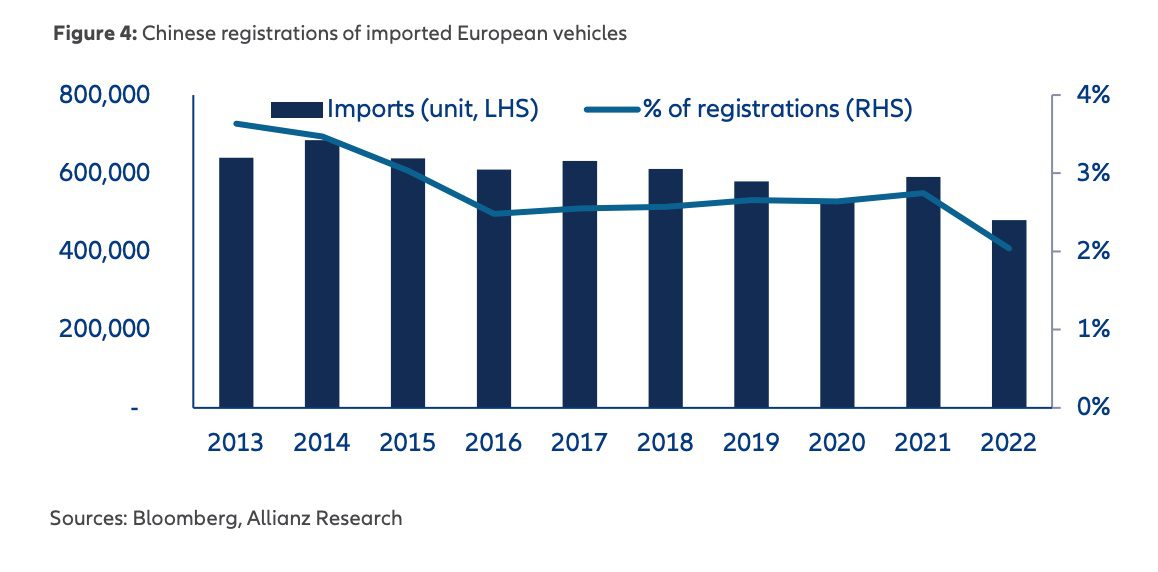

As Chinese EV makers’ domestic market share grows, companies like VW are getting squeezed out.

Alliance says that if Chinese manufacturers increase their domestic market shares to 75% by 2030, as it predicts, total sales in China by European carmakers would fall from an estimated 4.4 million units to 2.7 million in 2030. This would hurt German car makers, and the German economy, the most.

Allianz says that the Chinese government identified electric vehicles as the future competitive battleground in the late 2000s and invested heavily in the sector.

“Chinese authorities recognized the potential of EVs to address other critical issues such as air pollution and energy security.,” it says.

“But support to EVs was also clearly identified as a major opportunity for the domestic industry to leapfrog from being a tier-two country in legacy engine technologies to a leader in alternative energy technologies.”

Strong EV demand in Europe and US IRA has shifted China’s focus

Alliance says that Europe has become a key target for Chinese EV exports since the US is now a tougher market to crack after the introduction of the Inflation Reduction Act.

Allianz says that alternative energy vehicle sales reached 4.4 million in Europe in 2022, representing 47% of all new vehicle registrations – although that number includes mild hybrid cars.

What can European policymakers do?

Allianz recommends that European policymakers seek reciprocal trade terms with China and the US as well as promoting BEV adoption through improved charging infrastructure.

It also suggests allowing Chinese investment in local car assembly plants, increasing self-sufficiency in raw materials critical for battery manufacturing, and investing in next-generation battery technologies.

Reduction in total auto sales could compound the impact further

Another significant factor at play is the longevity of EVs and the possibility of autonomy. EVs currently get 4-5 times more milage over the life of the vehicle compared to ICE vehicles and many believe that the million-mile battery is just around the corner.

In his recent podcast interview with The Driven, technology researcher Tony Seba said that he predicts the convergence of electric vehicle longevity and autonomous driving could see the global automotive industry plunge by 75% by 2030 as vehicles last much longer and consumers opt for subscription Transport as a Service (TaaS) over purchasing a vehicle outright.

Seba says the transition to EVs won’t happen in a “one is to one” fashion. He says “it’s not a cleaner caterpillar” but rather a new butterfly with completely different properties.

“The day that we get level four, autonomous technology ready and approved by regulators, when that converges with on-demand, and electric transportation we will get what we call transportation as a service (TAAS),” says Seba.

“Some call it Robo taxi. Essentially, when that happens the cost per mile of transportation is going to drop by anywhere from 10 to 20 times.

“So even if gasoline automakers gave away their cars, that’s still gonna be a lot more expensive than the cost of transport as a service.”

If Seba’s predictions of million mile drivetrains and autonomous driving play out, a €45Bn drop in revenue might be a best case scenario for the European auto industry.

Daniel Bleakley is a clean technology researcher and advocate with a background in engineering and business. He has a strong interest in electric vehicles, renewable energy, manufacturing and public policy.