Shares in New York-based hydrogen truck manufacturer Hyzon Motors have suffered a massive plunge since last Friday after the company revealed a mass of irregularities that led analysts to downgrade the company’s stock.

Hyzon Motors, which has developed a handful of hydrogen fuel-cell commercial vehicles, announced last week that it would not be able to file its second quarter financial results by an August 15 deadline due to a range of issues across the company.

According to Hyzon’s statement, the company “become aware of revenue recognition timing issues in China” as well as “operational inefficiencies at Hyzon Motors Europe B.V., the company’s European joint venture with Holthausen.”

Just over a year after the company began trading on the Nasdaq stock exchange with an initial market value of $US2.7 billion, the company has now had to appoint a committee of board members and independent counsel and advisors to assess the irregularities in its China operations.

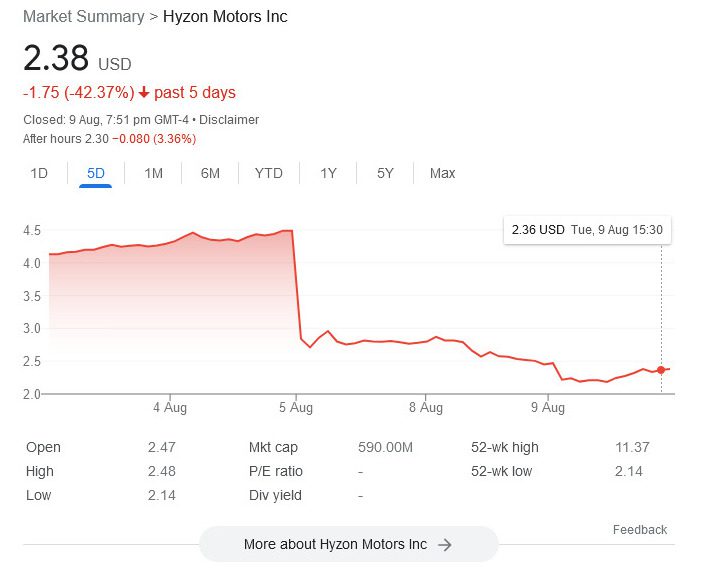

In the wake of the news, Hyzon’s shares plummeted 45% and caused analysts to downgrade the company’s stock rating.

The news prompted J.P. Morgan analyst William Peterson to double downgrade the company’s stock from overweight to underweight and withdraw his stock price target, down from $6. Wedbush Securities’ Dan Ives similarly downgraded Hyzon from outperform to neutral and slashed his stock price target to $3 from $7.

“There are more questions than answers at the moment with the myriad of issues identified in the filing that we fear could slow down the growth story of Hyzon (that was actually progressing well the last six months) with this black cloud now over the story,” said Ives.

“In a risk-off market and worries about many EV names, the last thing investors wanted to see was this news and thus we move to the sidelines on the name until we have a better grasp of the issues at hand.”

Michael Shlisky at D.A. Davidson similarly cut his rating from buy to neutral and explained that the eventual outcome of the irregularities could be nothing more than a minor restatement and an improved European operation, or it could lead to much more drastic changes.

“We simply do not know where things will go at this point, and these types of investigations and restructuring actions can be expensive and distracting,” Shilsky wrote. “We are moving to the sidelines until we have more clarity on these matters.”

Among the fears is that Hyzon Motors would be delisted from Nasdaq.

In an SEC filing last week, Hyzon explained that the “delay in filing will have no immediate effect on the listing or trading of the Company’s common stock, although there can be no assurances that further delays … will not have an impact on the listing or trading of the Company’s common stock.”

Considering that Hyzon has already been delivering its hydrogen-powered commercial trucks and buses and racked up a hefty number of purchase agreements, the company’s current financial turmoil may nevertheless significantly undermine any future growth or success.

Joshua S. Hill is a Melbourne-based journalist who has been writing about climate change, clean technology, and electric vehicles for over 15 years. He has been reporting on electric vehicles and clean technologies for Renew Economy and The Driven since 2012. His preferred mode of transport is his feet.