Elon Musk says demand for Tesla electric cars is “far more” than the EV maker is making, and the agreement to sell as many as 150,000 electric Model 3s to car rental giant Hertz (350 of which will come to Australia) has “zero effect” on its economics. In fact, no contract has been signed between the two companies.

In a tweet on Monday (US time), Musk responded to news that Tesla had surged 9% to close at an all-time high of more than $US1,200 ($A1594) saying, “You’re welcome!” It was the second time in a week that Tesla had added the value of VW, or twice the value of Ford, in a single day.

“If any of this is based on Hertz, I’d like to emphasize that no contract has been signed yet,” Musk tweeted.

“Tesla has far more demand than production, therefore we will only sell cars to Hertz for the same margin as to consumers. Hertz deal has zero effect on our economics.”

Tesla shares closed at $US1,208.59 ($A1605.43) in the US on Monday, tipping over the $US1,220 mark in after-hours trading as its market cap reached $US1.2 trillion.

The recent rally by Tesla follows a record profitable third quarter and even a stock split in August 2020 in a year that saw its market cap soar above that of big oil’s ExxonMobil, Shell and BP combined.

You’re welcome!

If any of this is based on Hertz, I’d like to emphasize that no contract has been signed yet.

Tesla has far more demand than production, therefore we will only sell cars to Hertz for the same margin as to consumers.

Hertz deal has zero effect on our economics.

— Elon Musk (@elonmusk) November 2, 2021

After delivering record 241,300 electric cars in the third quarter, Tesla is on the cusp of opening two more factories in Berlin and Texas and says it is aiming to keep the momentum of its growth story going with a 50% increase in deliveries every year to reach 20 million annually.

It is on track to achieve this in 2021 with more than 625,000 deliveries to the end of September, and Tesla could find itself achieving this more easily than expected – if, as Musk’s message above implies, production (and notorious supply chain issues of 2021) can keep up.

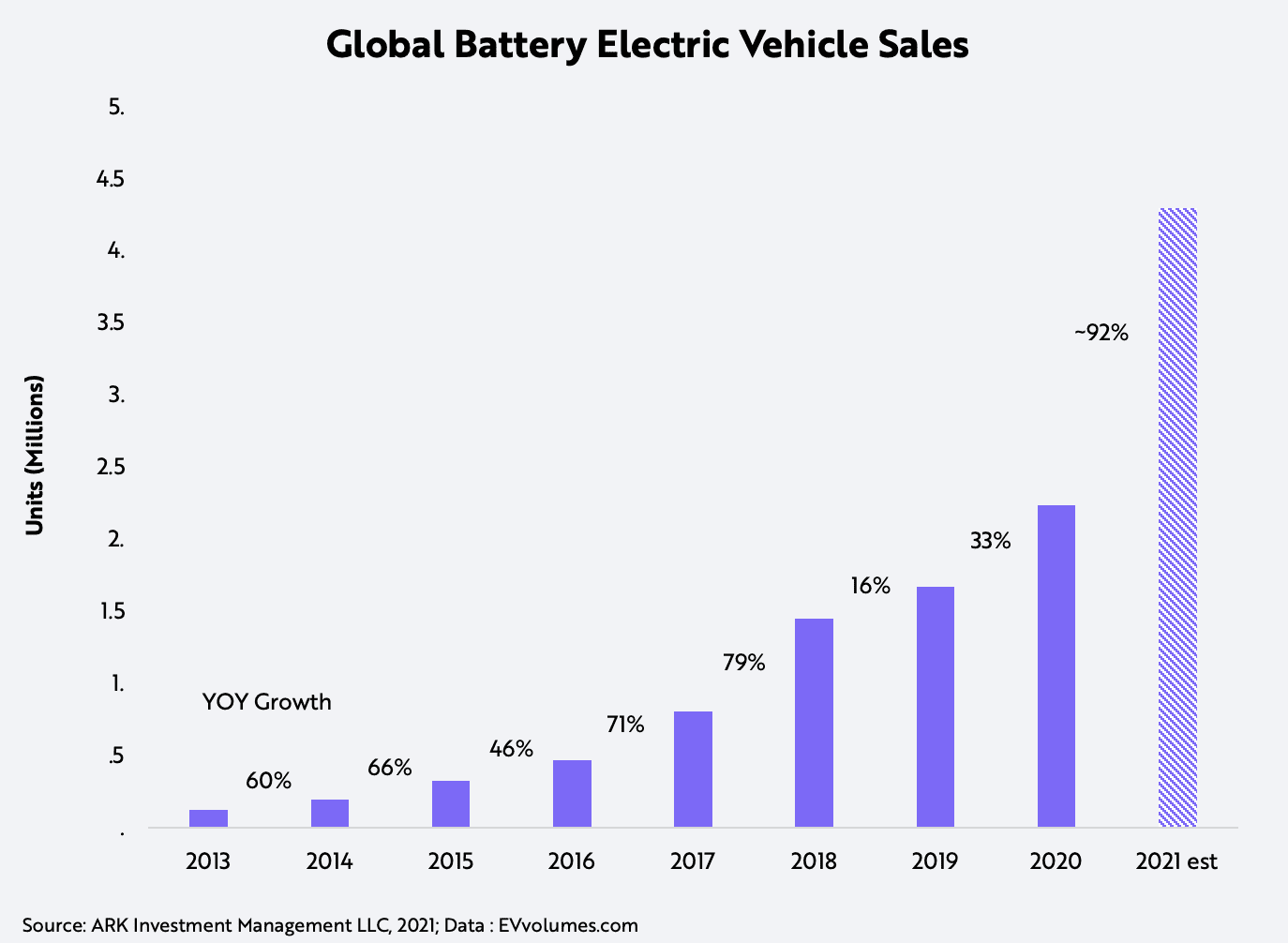

Research from investment firm Ark Invest suggests that EV sales are so high that clean transport technology is busting the traditional adoption curve.

“Contrary to a typical s-curve, since 2013 the growth in global EV unit sales has accelerated from 60% to an estimated 90%+, as shown below,” wrote Ark Invest’s Sam Korus in a note by email.

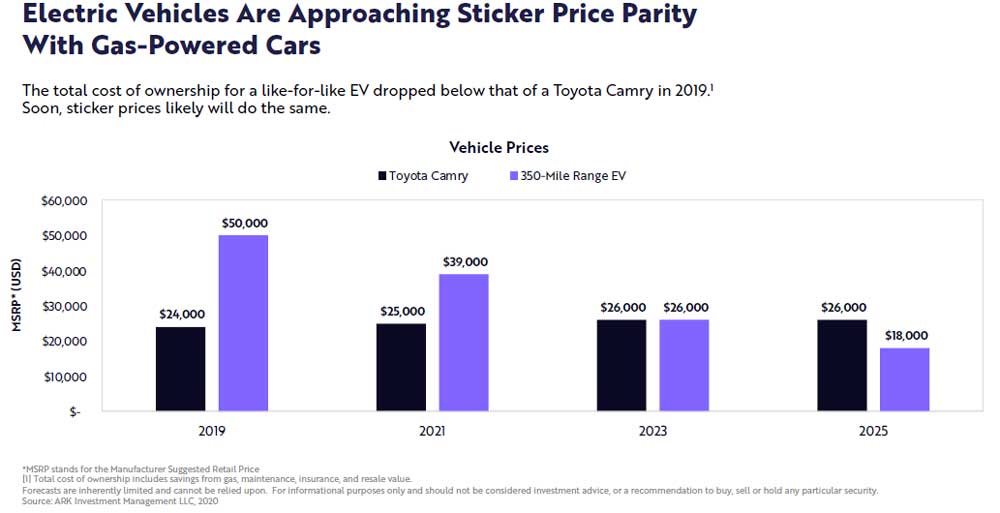

The analyst noted a few adoption factors at play here, centring around dropping battery manufacturing costs, enabling cheaper price points for electric cars which in turn attracts a wider buying audience.

Once EV sticker prices dip below the $US25,000 mark, the adoption curve could become more of an adoption ski jump. Ark Invest predicts this will happen as soon as 2023, which incidentally is when Tesla has flagged the introduction of a budget electric hatchback.

By then, as noted by The Driven in August, Tesla will have gone head to head with the ubiquitous Toyota Camry – and if Ark Invest’s sticker price comparison below is any indication, the “Californian cockroach” will have well and truly overtaken it.

First, cell constraints must be addressed; a factor that is holding back the introduction of the Tesla Semi, and the reborn Tesla Roadster.

In the meantime, the adoption of the Tesla Model 3 as Hertz’s zero-emissions chariot will get more bums in seats, only further accelerating the transition to electric vehicles.

Bridie Schmidt is associate editor for The Driven, sister site of Renew Economy. She has been writing about electric vehicles since 2018, and has a keen interest in the role that zero-emissions transport has to play in sustainability. She has participated in podcasts such as Download This Show with Marc Fennell and Shirtloads of Science with Karl Kruszelnicki and is co-organiser of the Northern Rivers Electric Vehicle Forum. Bridie also owns a Tesla Model Y and has it available for hire on evee.com.au.