Sales of plug-in electric vehicles in Sweden surpassed that of Norway in the first quarter of 2021, with much of the credit going to a generous bonus-malus scheme.

Nordic countries lead the world in electric vehicle uptake. In 2020, three-quarters of all vehicles sold in Norway were plug-in electric (including both battery-electric vehicles (BEVs) and plug-in hybrids, or PHEVs).

Norway remains the clear leader in terms of market share in 2021, but in the first quarter, more plug-in vehicles were sold in neighbouring Sweden, with 32,388 plug-ins delivered compared to 29,789 in Norway.

European auto sales analyst Matthias Schmidt credits this at least in part to the country’s generous bonus-malus scheme, which delivers a maximum SEK 60,000 bonus (about $A9,000) for low emissions vehicles while placing extra fees on the purchase of petrol and diesel vehicles made after 2018, and which emit more than 95 grams/CO2 per kilometre.

While Sweden’s figures look very encouraging, there is devil in the details. Currently, plug-in hybrids – which are now being made with longer all-electric ranges – but have been dubbed a “wolf in sheep’s clothing” by clean transport group Transport & Environment – make up the majority of plug-in sales in Sweden.

But the playing field for plug-in vehicles in Sweden is changing. As Schmidt notes, Sweden’s bonus scheme for battery electric vehicles increased to SEK 70,000 (around $A10,700 converted) in April.

Additionally, the ceiling for PHEVs eligible for the bonus scheme has been lowered from 70g/km previously down to 60g/km WLTP.

The change in incentives is already having an effect.

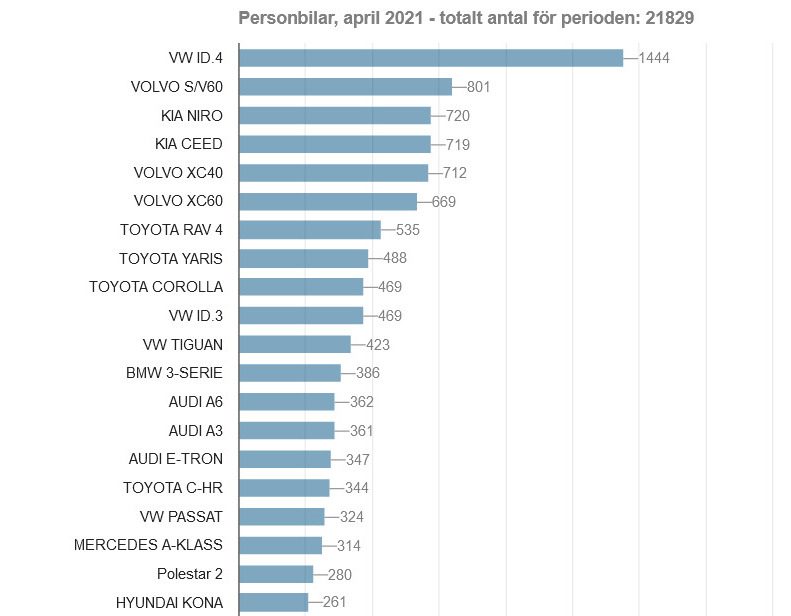

While – perhaps unsurprisingly – Volvo plug-in hybrids such as the XC60 PHEV and V60 PHEV – have previously dominated the market, it was instead the Volkswagen ID.4 electric SUV that won out in April.

And not just in front of all other plug-in electrics but above all other vehicles of any drivetrain.

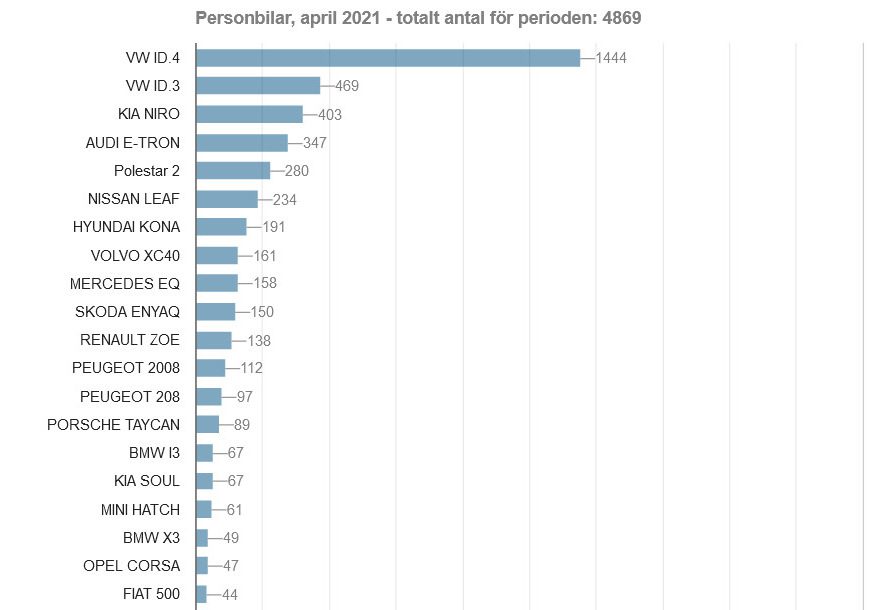

Looking at battery electric sales is also an interesting exercise. While Tesla was the number one battery-electric brand in Europe for the first quarter of 2021, it is nowhere to be seen at the top of the leaderboard in Sweden.

In fact, Tesla only sold 11 cars in Sweden in April, compared to 1,444 ID.4s, 469 ID.3s, 403 Kia e-Niros, 347 Audi e-trons and 280 Polestars.

But as Schmidt notes, this could all change as 2021 rolls on. The EV maker has reversed its 12-month cumulative rolling market share and is expected to claim 20% of the market share by the end of 2021.

While this is not as high as its 31% record in 2019, the opening of the Berlin factory and thousands of Model Ys stands to make its impact felt.

Bridie Schmidt is associate editor for The Driven, sister site of Renew Economy. She has been writing about electric vehicles since 2018, and has a keen interest in the role that zero-emissions transport has to play in sustainability. She has participated in podcasts such as Download This Show with Marc Fennell and Shirtloads of Science with Karl Kruszelnicki and is co-organiser of the Northern Rivers Electric Vehicle Forum. Bridie also owns a Tesla Model Y and has it available for hire on evee.com.au.