Global sales of electric vehicles are expected to increase so quickly that battery manufacturers are at risk of failing to meet production requirements as lithium mining capacity lags well behind demand.

These are the headline-grabbing findings from a new analysis published this week by Norwegian independent energy research group Rystad Energy.

It says that if investments in new lithium mines do not accelerate quickly, lithium mining capacity will not be able to keep up with demand through the decade.

According to Rystad Energy, today’s lithium mining capacity can comfortably satisfy current EV market demand, but as demand increases Rystad predicts a “serious lithium supply deficit” starting from 2027. Tesla’s Elon Musk has already flagged a delay in the Tesla truck because of the potential shortage of battery cells.

It estimates that current lithium mining capacity and the share created by EV demand will result in a supply deficit delaying the production of the equivalent of around 3.3 million EVs with a battery of 75kWh in 2027.

The impact will accelerate quickly thereafter, to around 9 million EVs in 2028 and some 20 million EVs in 2030.

Naturally, if efforts are not made now, the imbalance between demand and supply will only exaggerate over time and will cause delays for the production of millions of EVs.

Investments in new lithium mines must be made quickly, as Rystad Energy estimates that it can take between five and seven years to develop, finance, and build an average lithium mine project.

“A major disruption is brewing for electric vehicle manufacturers,” said James Ley, Senior Vice President at Rystad Energy’s Energy Metals team.

“Although there is plenty of lithium to mine in the ground, the existing and planned projects will not be enough to meet demand for the metal. If more mining projects are not added to the pipeline quickly, the energy transition of road transport may need to slow down.”

Passenger EV demand will not be the only stressor on lithium supplies, with electric buses, trucks, and hybrid cars also beginning to stretch supplies, as well as the shipping and aviation industries, and energy storage segments – in addition to the existing consumer technology demand.

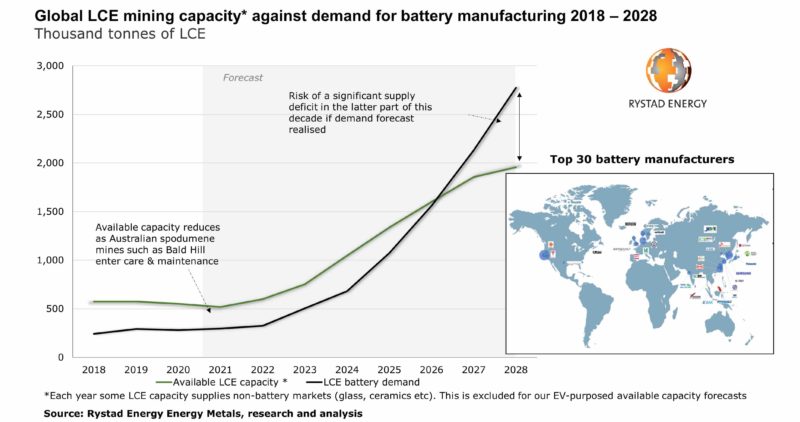

All told, and excluding the lithium mining capacity that supplies non-battery markets such as glass and ceramics, Rystad Energy measures the remaining lithium production capability that can be used for manufacturing batteries of all applications in 2021 stands at nearly 520,000 tonnes of lithium carbonate equivalent (LCE) per year.

Demand for LCE from battery manufacturers in 2021 is estimated at around 300,000 tonnes, and by 2025 LCE demand from battery manufacturers will skyrocket to just over 1 million tonnes, scratching at the tail of LCE mining capacity which will hit just over 1.3 million tonnes.

By 2026, this will tilt to a minor mining capacity deficit, and by 2028 the LCE mining capacity deficit will swell to nearly 820,000 tonnes, as LCE demand surges to 2.8 million tonnes. By 2030, the imbalance could swell to as much as 2 million tonnes.

“We anticipate that lithium prices could replicate their past turbulence if supplies cannot catch up with booming EV demand later this decade,” added Ley.

“Looking at the significant task ahead to build more mining capacity, prices could even triple as a result of the market imbalance.”

LCE prices averaged around $8,200 per tonne in 2020, but in the previous five years the price fluctuated wildly, from $6,500 per tonne in 2015 to a record high of $17,000 per tonne in 2018.

This 160% surge in pricing between 2015 and 2018 was due mainly to a rise in EV demand from China and a temporary shortage of lithium supply, which could naturally be replicated as the decade proceeds.

Rystad Energy conclude that there will not only need to be significant investment made in mining capacity, but structural changes will be necessary to make the lithium industry more sustainable, including the possibility of recycling lithium.

It says the EV industry will need to move as a whole towards second-life battery usage that results in near 100% recyclability.

However, even as battery recycling ramps up, Rystad does not expect it will plug the lithium supply gap after 2025, which will in turn result in lithium prices rising in line with demand until new mines are developed beyond the 40 or so that are currently proposed.

Joshua S. Hill is a Melbourne-based journalist who has been writing about climate change, clean technology, and electric vehicles for over 15 years. He has been reporting on electric vehicles and clean technologies for Renew Economy and The Driven since 2012. His preferred mode of transport is his feet.