European electric vehicle sales have surged almost 25% in the past year, dominated by the booming German auto market, as its peak auto industry body discusses a further tightening of CO2 reduction measures.

Western Europe is subject to strict vehicle emissions regulations and it’s beginning to pay off, according to auto market analyst Matthias Schmidt.

Currently the 2021 limit for a carmaker’s average fleet emissions is 95gm/CO2 per kilometre. Manufacturers can pool together to collaboratively reach those limits, such as in the case of Ford and Volvo. Other car makers in danger of having to pay fines for not reaching CO2 limits can buy credits off EV makers to make up for their own high emissions, such as in the case of Honda and Tesla.

In a new report updated on Monday (Europe time), Schmidt says that the latest movements signify “winds of change” in the European auto market.

“February marked a perhaps historical turning point in the European passenger car market,” says Schmidt.

“The European automotive mouthpiece, ACEA – representing European passenger car manufacturers – appeared to fall into line with new European Commission Green Deal proposals to be discussed this summer.”

According to Schmidt, the European Union’s discussions are looking to further tighten reduction targets to 50% by 2030 as opposed to the current 37.5 per cent reduction target.

“This would result in a new target, set to see fleet CO2 targets half over current 2021 levels to around 60g/km (WLTP) by 2030,” says Schmidt.

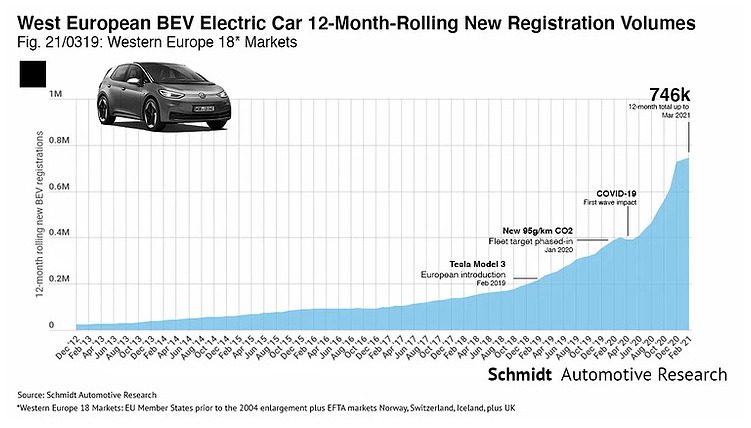

The current targets are already seeing a positive impact for Europe’s transport-related emissions reductions and the growth of the EV market.

According to the new figures collected by Schmidt, the rolling 12-month sales for EVs to March 2021 hit 746,000 units, a 23.7% increase year-on-year.

But without Germany, Schmidt notes that the battery electric vehicle market would have taken a downward turn in the opening two months of 2021 if it weren’t for German EV sales.

Propped up by generous joint government/carmaker subsidies up to €9,000 ($A13,877), German fleets in particular are enjoying a boon to transition to electric cars. On the plug-in hybrid front in particular, this has resulted in Germany accounting for one-third of sales in West Europe.

Carmakers are facing the tightening regulations by doing the only things possible: transitioning to electric in an effort to reduce their fleet emissions.

Volvo will sell only electric cars worldwide from 2030, US auto giant Ford announced in February that it would only sell electric in Europe by 2030, BMW’s Mini brand (which accounts for approximately 12.5% of BMW’s sales worldwide) is to go all-electric from 2030 and will release its last fossil-fuel vehicle in 2025.

Volkswagen – indisputably Germany’s best-selling carmaker on both the fossil-fuel and EV market (including both battery electric and plug-in hybrids) – in 2018 said its last generation of petrol and diesel vehicles will launch in 2026.

Bridie Schmidt is associate editor for The Driven, sister site of Renew Economy. She has been writing about electric vehicles since 2018, and has a keen interest in the role that zero-emissions transport has to play in sustainability. She has participated in podcasts such as Download This Show with Marc Fennell and Shirtloads of Science with Karl Kruszelnicki and is co-organiser of the Northern Rivers Electric Vehicle Forum. Bridie also owns a Tesla Model Y and has it available for hire on evee.com.au.