Tesla is way out in front on electric car battery costs, giving it a 10-year head-start on other car makers, amid soaring demand for metals such as lithium and cobalt that is pushing material prices up, a new analysis says.

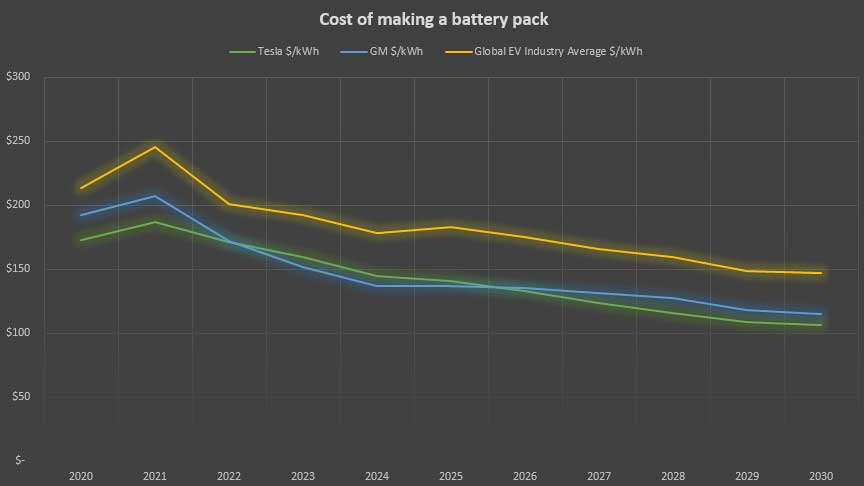

According to the new report from Sam Jaffe, of energy industry advisory firm Cairn ERA, Tesla battery packs currently cost 24% less than the industry average, and he expects Tesla to maintain that lead at the end of the decade.

While this is in part to the lower price Tesla pays for battery cells, it is also thanks to economies of scale, and the work the EV maker is doing on reducing costs of putting the cells into battery packs and integrating the pack into the vehicle.

“The scale allows them to keep the advantage,” Jaffe told CNBC on Wednesday (US time).

“They’re not just designing around the cell …. they’re designing around an integrated pack,” he said adding that carmakers such as GM and VW are also doing this, “Tesla is doing it in such a way it is giving them an advantage going out 10 years.”

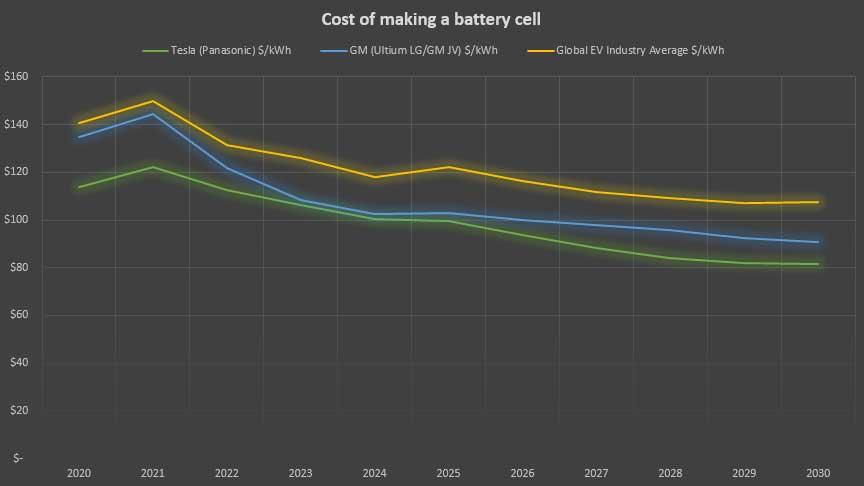

Tesla sources battery cells from its partner Panasonic as well as from Chinese battery makers including CATL. Cairn ERA’s report assumes US or European manufacturing costs and does not include cheaper LFP batteries from CATL in its calculations, though it says these costs have likely risen also.

In figures provided to The Driven, Cairn ERA says that Tesla pays $US142/kWh ($A183/kWh) on average for cells (but can make them for just $US114/kWh) compared to $US169/kWh ($A218/kWh) by GM and an industry average of $US186/kWh ($A240.kWh).

By 2030, Tesla could be making cells for a measly $US82/kWh ($A106/kWh), while the industry average would be $US108/kWh $A140/kWh), Cairn ERA says.

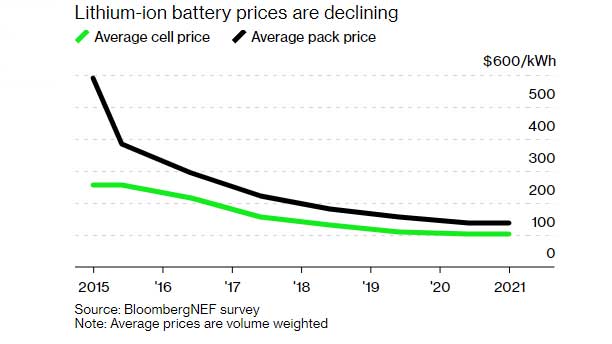

The figures are substantially higher than those put forward by BloombergNEF in late 2020, which agreed that Tesla pays less for its battery packs but put the figures at $SU115/kWh compared to an industry average of $US137/kWh.

That report also said that in China, some electric bus battery prices had already fallen below the magic $US100/kWh cited by analysts as needed for EVs to reach price parity with combustion vehicles.

But as Jaffe explained to The Driven, soaring prices for battery materials such as lithium and cobalt have seen Tesla’s prices shoot up by 20% and even more for other battery makers.

“Over the last three months, the world has entered into a battery famine. Demand is severely outracing supply. The same thing is happening with battery materials: Lithium is up 67% and cobalt 40% this year,” said Jaffe in hit note to The Driven.

“Because of the battery shortage and materials increase, battery prices have shot up. We model that Tesla’s prices have gone up 20% in the last three months and other car companies more than that.”

According to Cairn ERA, Tesla currently makes battery packs for $US187/kWh ($A241/kWh) – compared to GM’s $US207/kWh ($A267/kWh) while the industry average sits at $US246/kWh – and will reach $US106/kWh by the end of the decade.

BloombergNEF figures suggest breaking through the $100/kWh floor could happen as soon as 2023, although if the increase in battery materials maintains its high this could well push out to the end of the decade.

Jaffe believes the materials shortage will be resolved by the end of 2022, however.

“The shortages and pricing will remedy by the end of 2022 with all the new production capacity coming on line. But it’s a rough situation right now for anyone that needs to buy a battery,” says Jaffe.

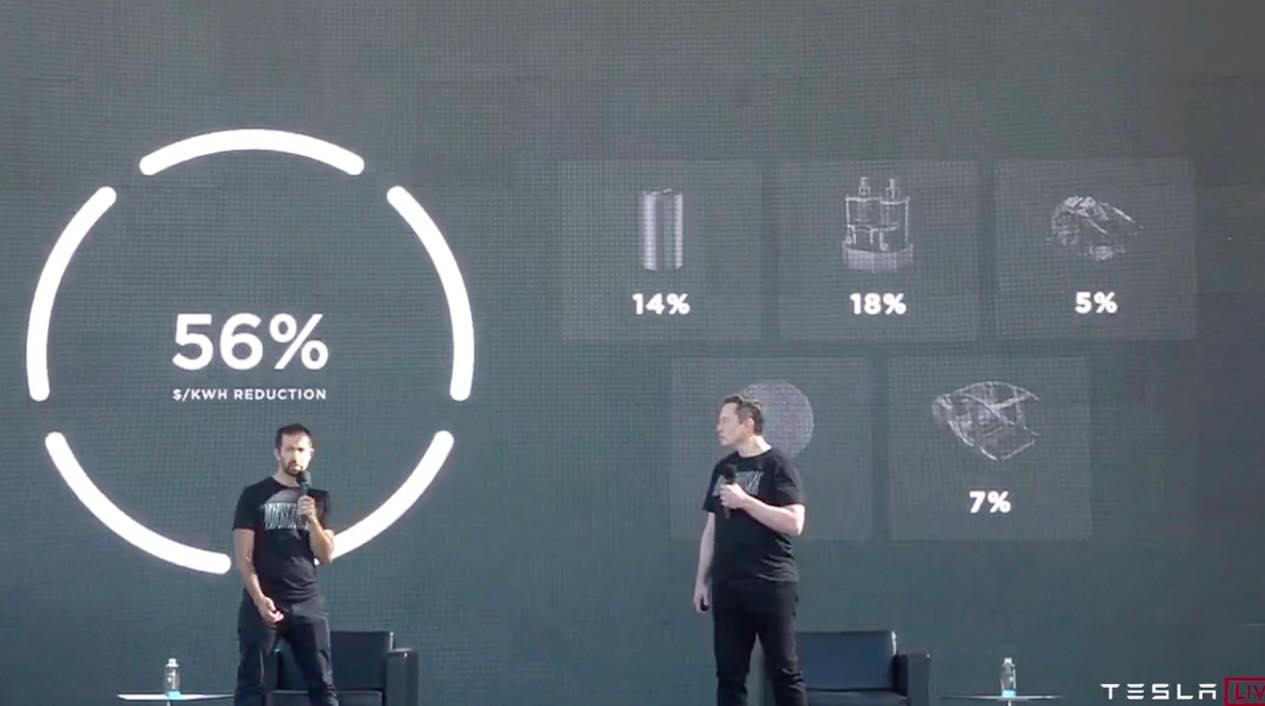

In September, Tesla outlined a plan to reduce the kilowatt-hour cost of making battery cells by 56%. It said it would do this by reducing the footprint of its factories, using silicon anodes with higher capacity and lower cost, new cobalt-free cathodes, dry cathode manufacturing, and integrating the pack into the structure of the vehicle body.

Meanwhile, Grace Tao Lin, VP of external affairs for Tesla in China, has weighed in on battery swapping, saying that while it may make sense for larger vehicles such as buses, Tesla has always been of the opinion that quick recharging is the best way.

Posting on Chinese social media channel Weibo, Tao Lin said that while Tesla did experiment with battery swapping in 2013, it believes improving charging efficiency is the best way to relieve “range anxiety”.

Tesla rival Nio, which is currently selling approximately 5,000-6,000 vehicles a month in China, uses battery swapping and currently has close to 200 swap stations planned. Tesla – the market leader in China in the premium EV segment – has approximately 6,000 Superchargers in China.

Bridie Schmidt is associate editor for The Driven, sister site of Renew Economy. She has been writing about electric vehicles since 2018, and has a keen interest in the role that zero-emissions transport has to play in sustainability. She has participated in podcasts such as Download This Show with Marc Fennell and Shirtloads of Science with Karl Kruszelnicki and is co-organiser of the Northern Rivers Electric Vehicle Forum. Bridie also owns a Tesla Model Y and has it available for hire on evee.com.au.