More than 2.6 million electric vehicles were sold across two of the world’s major markets in 2020, with Europe selling almost as many plug-in electric cars as China, new data has shown.

Analysts are predicting EV sales will continue to increase both in China and Europe in 2021, sending a strong signal that the transition to clean transport is moving into a phase of rapid adoption.

Across the Western European market, plug-in electric car sales rose to 12.3% of car sales in 2020, according to auto analyst Matthias Schmidt, while the broader market fell 25% during the pandemic to 1985 levels of just 10.8 million.

In China, meanwhile, EV sales reached 5.4% of the broader market in 2020. Energy economist Gregor McDonald notes this indicates both markets have reached the critical 5% level that is pinned by growth research as a take-off point for new technology.

EV sales are tipped to rise to 15% of the entire auto market in 2021 by clean transport lobby Transport & Environment (T&E), and China’s auto industry body CAAM expects the country’s EV sales to rise by 40% in 2021 to 1.8 million. In both markets, EV leader Tesla is either planning or already conducting local production.

Both markets have taken an aggressive stance on carbon emissions and pollution caused by internal combustion vehicles, introducing policies and financial incentives designed to accelerate the adoption of electric vehicles.

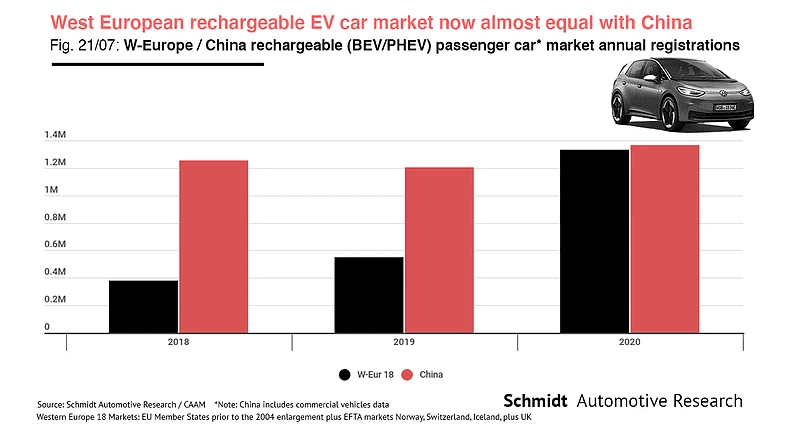

China’s push to electrification saw electric vehicle sales exceed 1.2 million in 2018, and a cutting back of incentives in June 2019 saw the market decrease slightly that year.

But according to 2020 data from CAAM, EV sales rose again to 1.367 million units while sales of petrol and diesel cars fell from 24.563 to 23.944 million units after it extended subsidies again (it has since announced these will again be cut by 20% in 2021).

In the meantime, Europe’s push has seen sales rise significantly, led by Norway where electric cars now account for 54% of the entire auto market. Schmidt has included EU member states before the 2004 enlargement, plus Norway, Iceland and Switzerland.

According to Schmidt Automotive Research, just 35,000 fewer electric cars (1.33 million including battery electric and plug-in hybrid vehicles) were sold in Western Europe in 2020 than in China, which now has a weakening grasp on the title of global EV market leader.

Europe can credit its EV sales increase to the tightening vehicle emissions restrictions that now require carmakers to have a fleet average of 95 grams CO2 per kilometre or face costly fines.

Key European markets such as France and Germany have also expanded subsidies to buy electric vehicles in packages aimed at stimulating Covid-affected economies.

The results of these stances are undeniable – it does not matter which region leads the market, as their combined push shows the clean transport transition is well underway.

Bridie Schmidt is associate editor for The Driven, sister site of Renew Economy. She has been writing about electric vehicles since 2018, and has a keen interest in the role that zero-emissions transport has to play in sustainability. She has participated in podcasts such as Download This Show with Marc Fennell and Shirtloads of Science with Karl Kruszelnicki and is co-organiser of the Northern Rivers Electric Vehicle Forum. Bridie also owns a Tesla Model Y and has it available for hire on evee.com.au.