Tesla has placed more orders for electric car batteries with South Korean battery major LG Chem, which will produce them at a US factory in order to meet a growing demand for EV batteries.

Tesla has gone from strength to strength in 2020 despite a downturn due to the Covid-19 pandemic that has legacy car makers feeling the pinch.

On Friday Tesla announced it had delivered 90,000 vehicles in the second quarter of 2020, even though it had reluctantly closed its Fremont factory to comply with stay-at-home measures put in place by California to stem the pandemic.

Since January, Tesla shares have continued to outdo analyst expectations, most recently surging past $US1,200 to cement the EV maker’s new title of most valuable car maker in the world by market cap.

Now, sources have told global news wire Reuters that Tesla is placing orders for more batteries as well as for other components from suppliers.

“Tesla is asking not only LG Chem but other suppliers to increase supplies, as its cars are selling well,” one source told Reuters, reporting that another source said LG Chem will also convert some Korean factories to make more batteries, also for Tesla.

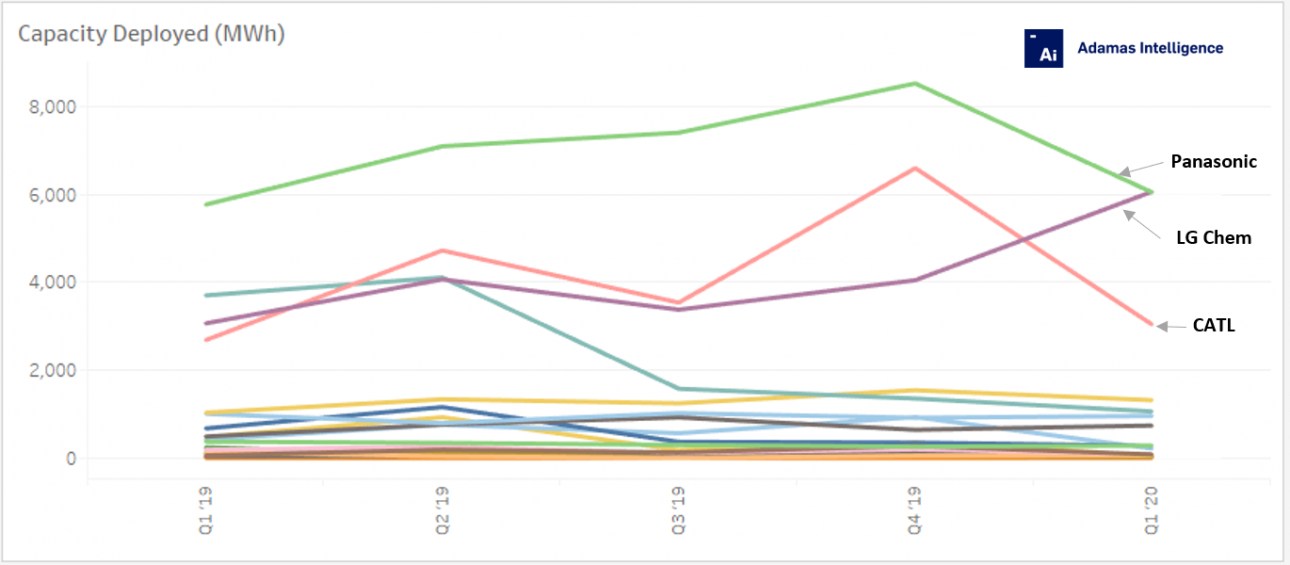

Along with Panasonic (which makes batteries in a joint venture with Tesla in Nevada) and CATL, LG Chem is one of three battery partnerships that Tesla has forged in its missions to disrupt the fossil-fuelled car industry.

It would seem that the South Korean battery maker is also going from strength to strength, with stock values rising from 314,000KRW ($A376.82) in January to 508,000KRW ($A609.64) at market close on Monday.

LG Chem already makes batteries in China for Tesla where it supplies the Shanghai Gigafactory, making it now the second largest EV maker according to Korean electronics news agency The Elec.

Whether the new orders will see it surpass fellow Tesla partner CATL, which currently holds claim to be the largest battery maker in China, will be of interest. Reuters reports that LG Chem declined to comment on the reports and that Tesla was not available outside business hours for comment.

However, with the new orders, LG Chem may well be on track to outperform both Panasonic and CATL globally. Data gathered by Adamas Intelligence shows that in the first quarter of 2020 it had edged out Panasonic, producing 6.07GWh battery capacity to Panasonic’s 6.05GWh.

By end April, Adamas Intelligence reports that LG Chem still held the lead with 1.44GWH installed that month, despite CATL taking the lead in terms of production with 1.33GWh manufactured.

Panasonic has since resigned an agreement with Tesla that will see prices locked in for the next three years and guarantee orders for 10 years.

The Elec reports that LG Chem is also ramping up production of batteries using nickel-cobalt-manganese-aluminum (NCMA) anodes, to supply US car giant General Motors.

LG Chem also has a battery factory in Poland that by 2022 will produce 70GWh capacity by 2022 according to the UK’s Faraday Institute, and also has relationships with Volkswagen, PSA and Renault.

Bridie Schmidt is associate editor for The Driven, sister site of Renew Economy. She has been writing about electric vehicles since 2018, and has a keen interest in the role that zero-emissions transport has to play in sustainability. She has participated in podcasts such as Download This Show with Marc Fennell and Shirtloads of Science with Karl Kruszelnicki and is co-organiser of the Northern Rivers Electric Vehicle Forum. Bridie also owns a Tesla Model Y and has it available for hire on evee.com.au.