The introduction of large battery electric vehicles is transforming not only the auto market, it is also changing the way in which energy utility providers need to respond to the increased demand created by charging needs, a new study has found.

The study, titled “EV Growing Pains“, was conducted by EV/grid management solution firm Fleetcarma, and compared EV charging behaviour and in particular, the impact of longer range electric vehicles on grid, in 2014 and 2019.

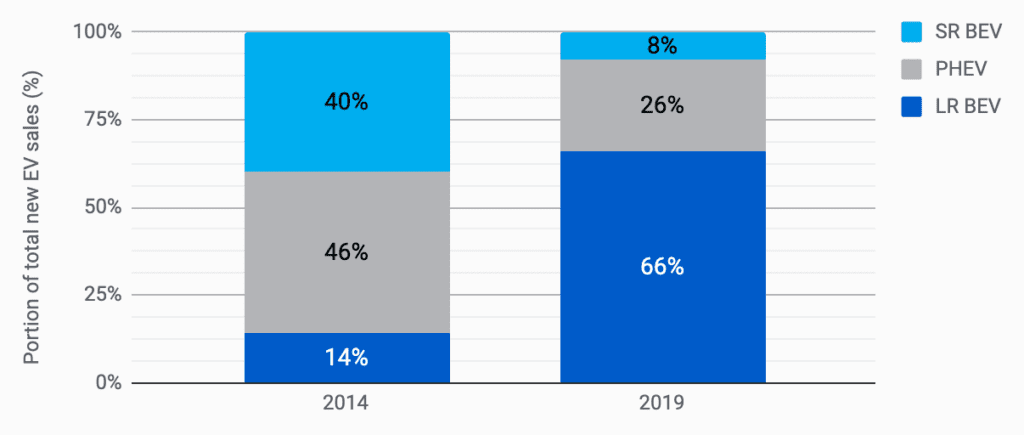

The penetration of long range EVs in the US electric vehicle market increased from 14% in 2014 to 66% in 2019, says Fleetcarma, largely as a result of the new generation long range EVs made by Tesla, which has upturned the auto market by forcing people to shift perceptions that EVs are low-powered and cannot drive far enough.

In particular, it is Tesla’s “mass-market” Model 3, the base model of which offers around 400km driving range, that has led the charge of long range EVs, claiming 60% of all new battery electric vehicle sales in the US since it went into production in 2017.

The Model 3 has had a similar impact in electric vehicles in Australia since its introduction in August 2019, tripling the national electric vehicle fleet from 2018 and claiming 70% of the EV market in 2019 in just four months.

The Fleetcarma study’s focus is on how this is impacting the grid. It shows that while long range battery electric vehicles are not necessarily charged for longer periods of time, because they have a greater draw on the grid, they present new challenges for utility providers.

According to the study, owners of both long range battery electric vehicles (LRBEVs) and short range battery electric vehicles (SRBEVs) charge their vehicles for about the same amount of time on average – 3-3.5 hours.

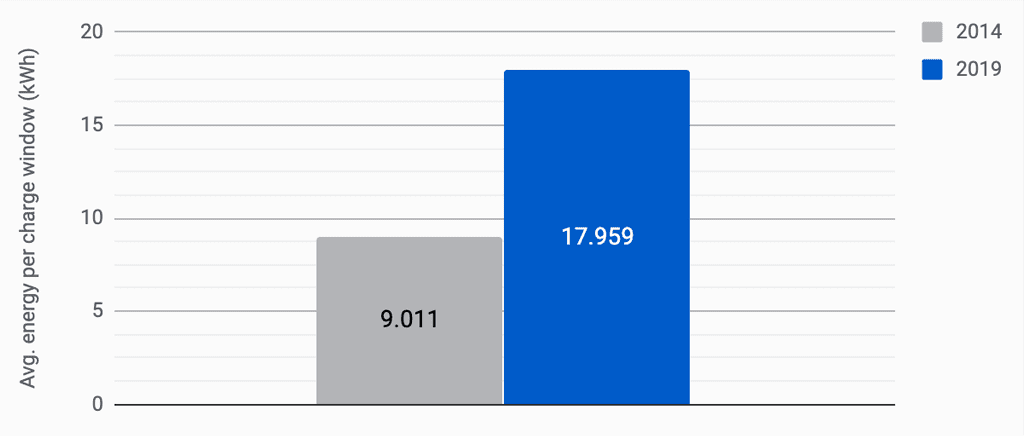

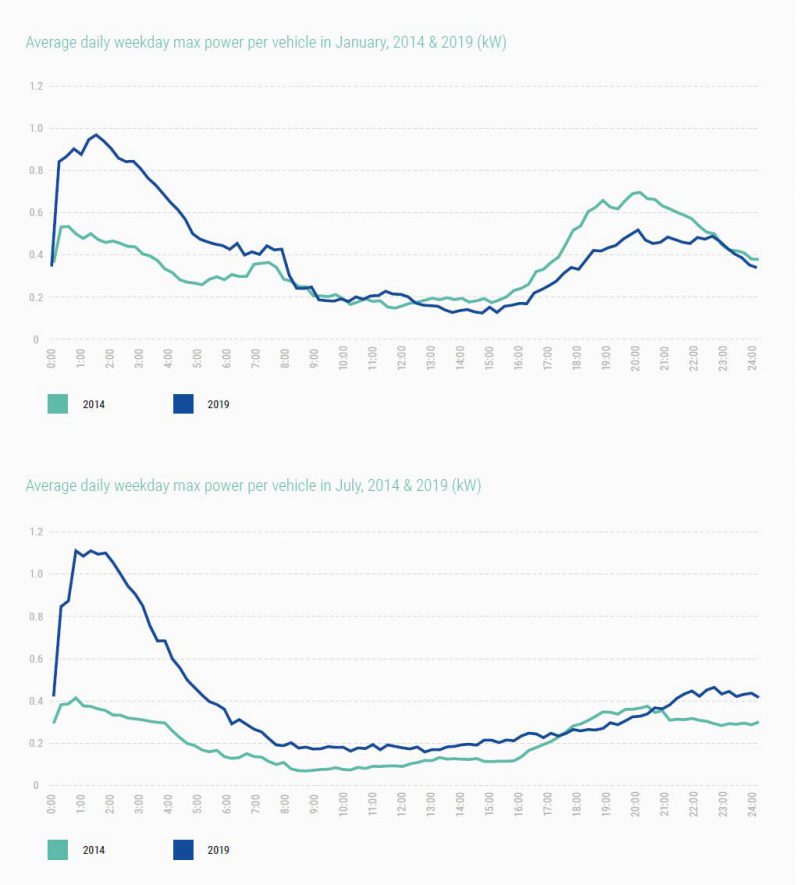

But with the increased penetration of LRBEVs, the average amount of power drawn during that 3-3.5 hour charge periods has doubled from 9kWh in 2014 to 18kWh in 2019.

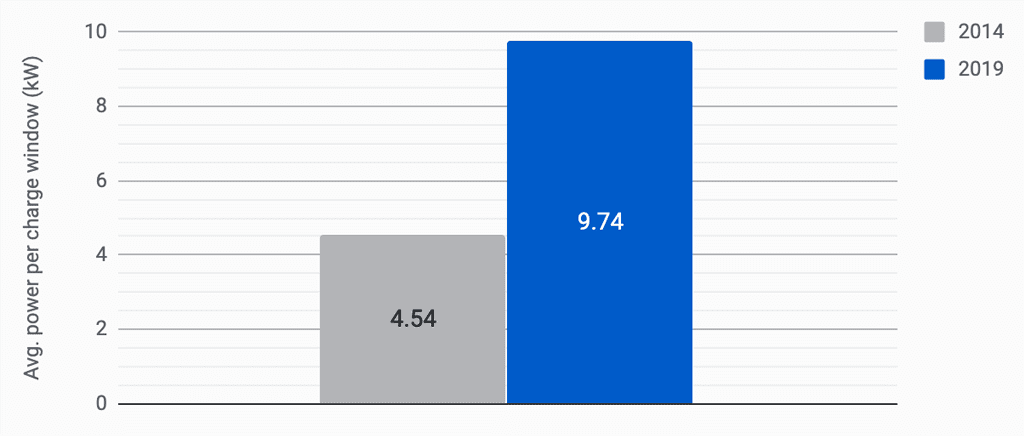

Unsurprisingly, this also results in higher amounts of power being drawn during that charge window. According to Fleetcarma, this has doubled from an average 4.54kW in 2014 to 9.74kW in 2019.

Fleetcarma says that while the longer range of large battery electric vehicles is beneficial for drivers, it creates multiple issues for utility companies.

“From a load-management perspective, the most challenging aspect of long-range BEVs is trying to predict when charging will occur, as long-range BEVs do not need to be charged every day,” wrote the authors of the Fleetcarma study in the report.

As more drivers switch to electric vehicles, so too will the penetration of Level 2 home chargers that up the amount of power able to be drawn from around 2kW using a standard powerpoint to up to 22kW using an AC wall charger depending on a particular installation.

For most home owners on single-phase power this would be 7kW at most, and at destinations such as shopping centres using three-phase this can be up to 22kW power.

Fleetcarma says that Level 2 chargers such as these are more commonly used outside the home (as opposed to DC fast chargers) as well.

However, it is still at-home charging that is having the greatest impact on the grid, according to Fleetcarma’s analysis, as drivers tend to charge at night to take advantage of off-peak tariffs.

Compounding the situation is the phenomenon known as “clustering”, whereby EV penetration is greater in certain locales as driver vehicle buying intentions are influenced by what they see on local roads.

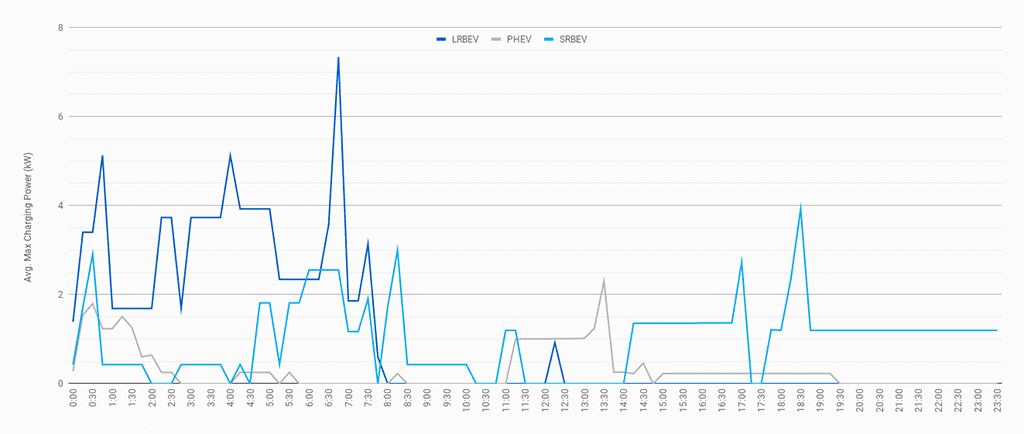

“The biggest risk posed by EVs is at the distribution level of the grid. EV clustering is a trend that shows that EVs may not be distributed evenly across the utility service territory, with the high likelihood of EV owner concentration on a specific street or neighborhood,” writes Fleetcarma, which simulated the effect of clustering in the study.

“To simulate this, five vehicles from each vehicle type were selected at random and their load was combined for a randomly selected day. This would represent the vehicles being charged on the same residential transformer. The results clearly show that long-range BEVs have significantly higher power draws as this group had an average max power peak of 7.34 kW.”

These trends are only likely to continue, says Fleetcarma, noting the planned introduction of even larger battery vehicles such as Rivian’s R1T electric utility truck and R1S ute which will offer up to 180kWh battery capacity.

“Ultimately, the factor that has driven all of these changes was the increase of battery capacities in the newer vehicles. They made the vehicles more appealing, increasing the overall adoption, and they have a larger impact for utilities. However, this evolution is just the beginning,” write the authors of the report.

“As the market continues to evolve it will be critical that utilities gather up-to-date data so they can properly manage this increasing load.”

Two methods of responding to electric vehicle charging load include utility-controlled direct load control (DLC) and customer-controlled (behavioural) methods such as time-of-use pricing, says Fleertcarma.

However, as direct load control methods can be expensive and only address a small portion of charging, and standard time-of-use programs tend to shift charging times to directly after peak times have ended, Fleetcarma considers an EV-specific time-of-use program would result in a more effective outcome.

Although EV numbers in Australia are still comparatively very low against overseas markets such as the US, these impacts described in the report are not likely to be felt for some time. However, studies such as these offer an opportunity for local utility providers to prepare for the inevitable transition to electric vehicles.

RenewEconomy and its sister sites One Step Off The Grid and The Driven will continue to publish throughout the Covid-19 crisis, posting good news about technology and project development, and holding government, regulators and business to account. But as the conference market evaporates, and some advertisers pull in their budgets, readers can help by making a voluntary donation here to help ensure we can continue to offer the service free of charge and to as wide an audience as possible. Thankyou for your support.

Bridie Schmidt is associate editor for The Driven, sister site of Renew Economy. She has been writing about electric vehicles since 2018, and has a keen interest in the role that zero-emissions transport has to play in sustainability. She has participated in podcasts such as Download This Show with Marc Fennell and Shirtloads of Science with Karl Kruszelnicki and is co-organiser of the Northern Rivers Electric Vehicle Forum. Bridie also owns a Tesla Model Y and has it available for hire on evee.com.au.