New figures released by German car maker BMW in its annual electro-mobility market report new figures show that despite BMW’s early domination with its i3, it is now the Tesla Model 3 that is rapidly reshaping the European market.

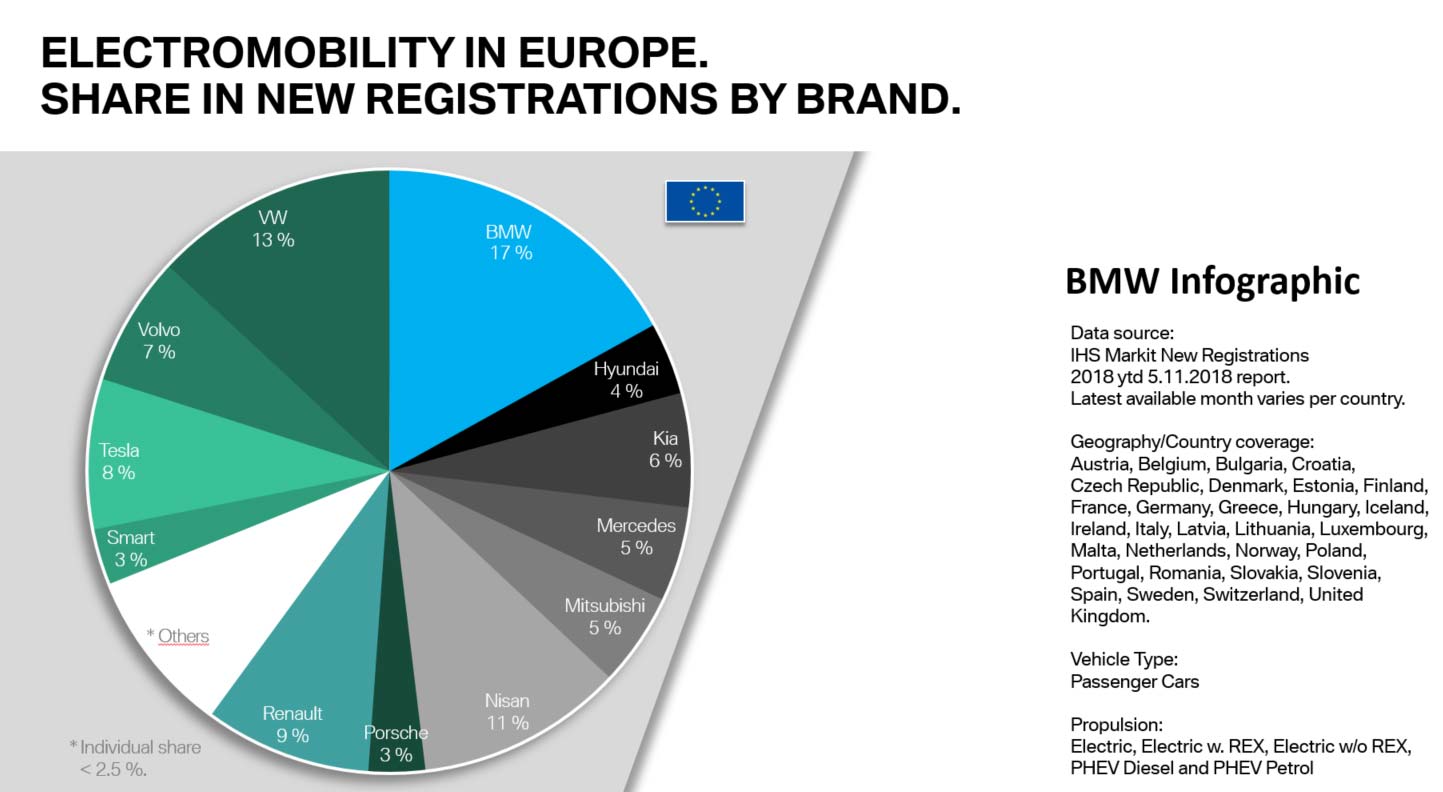

A year ago, BMW, which sells the all-electric i3 and the plug-in hybrid i8, was the most popular brand in European new electric car sales, ahead of Volkswagen with its e-Golf and other European brands such as Renault, Volvo, Mercedes-Benz, Smart and Porsche.

At the time The Driven asked the question, could BMW retain its domination of the electric car market in Europe. The answer appears to be no.

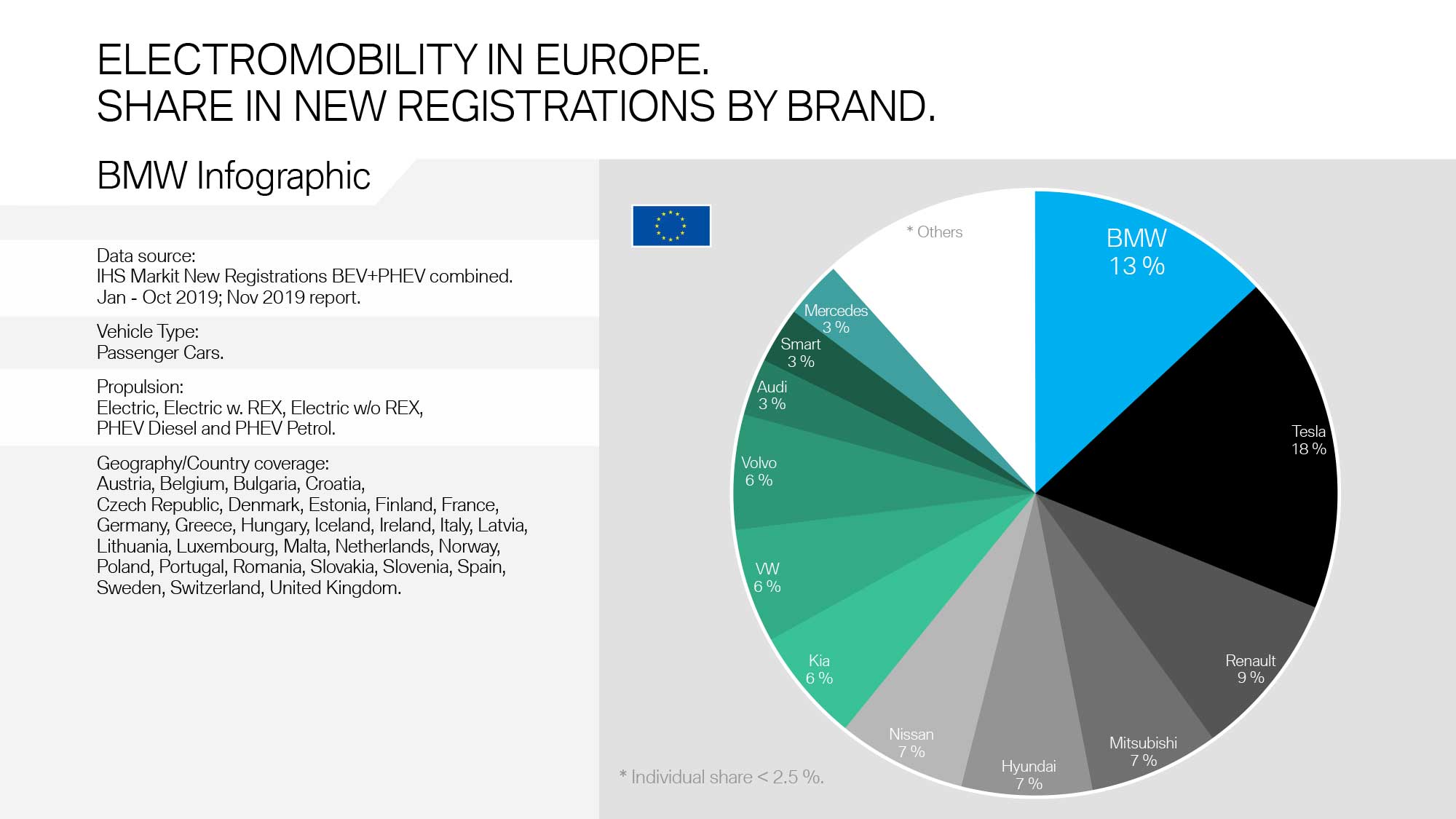

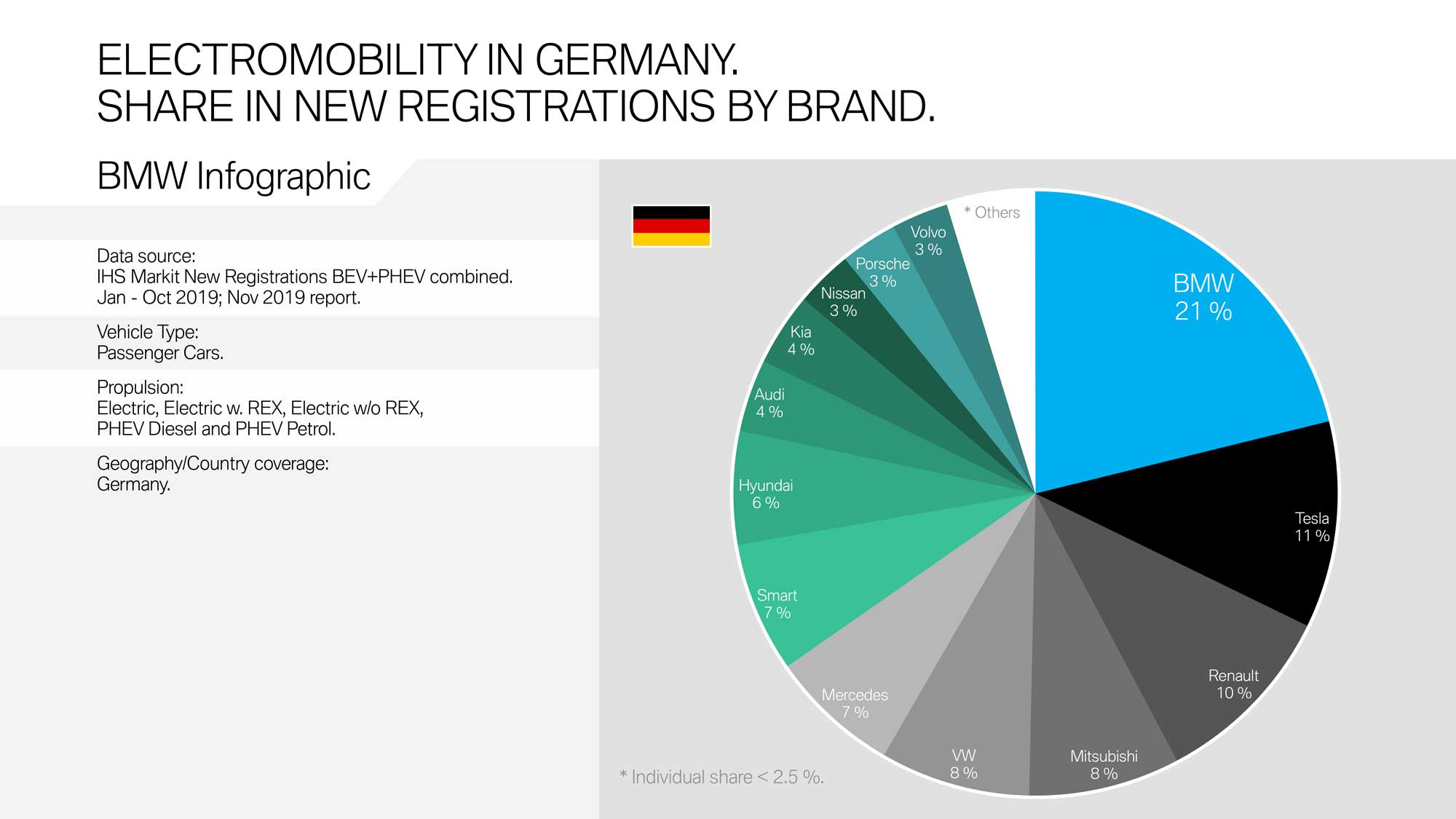

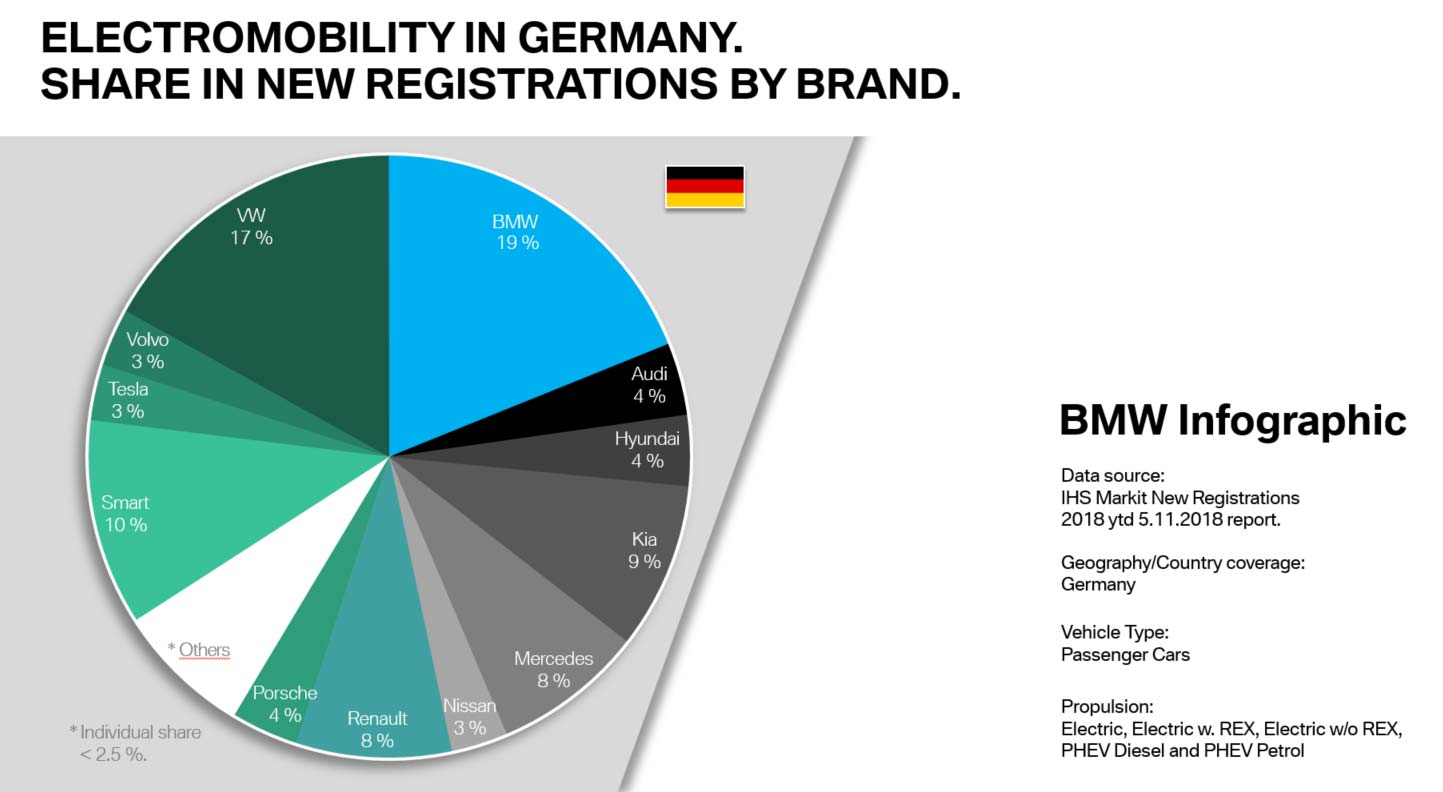

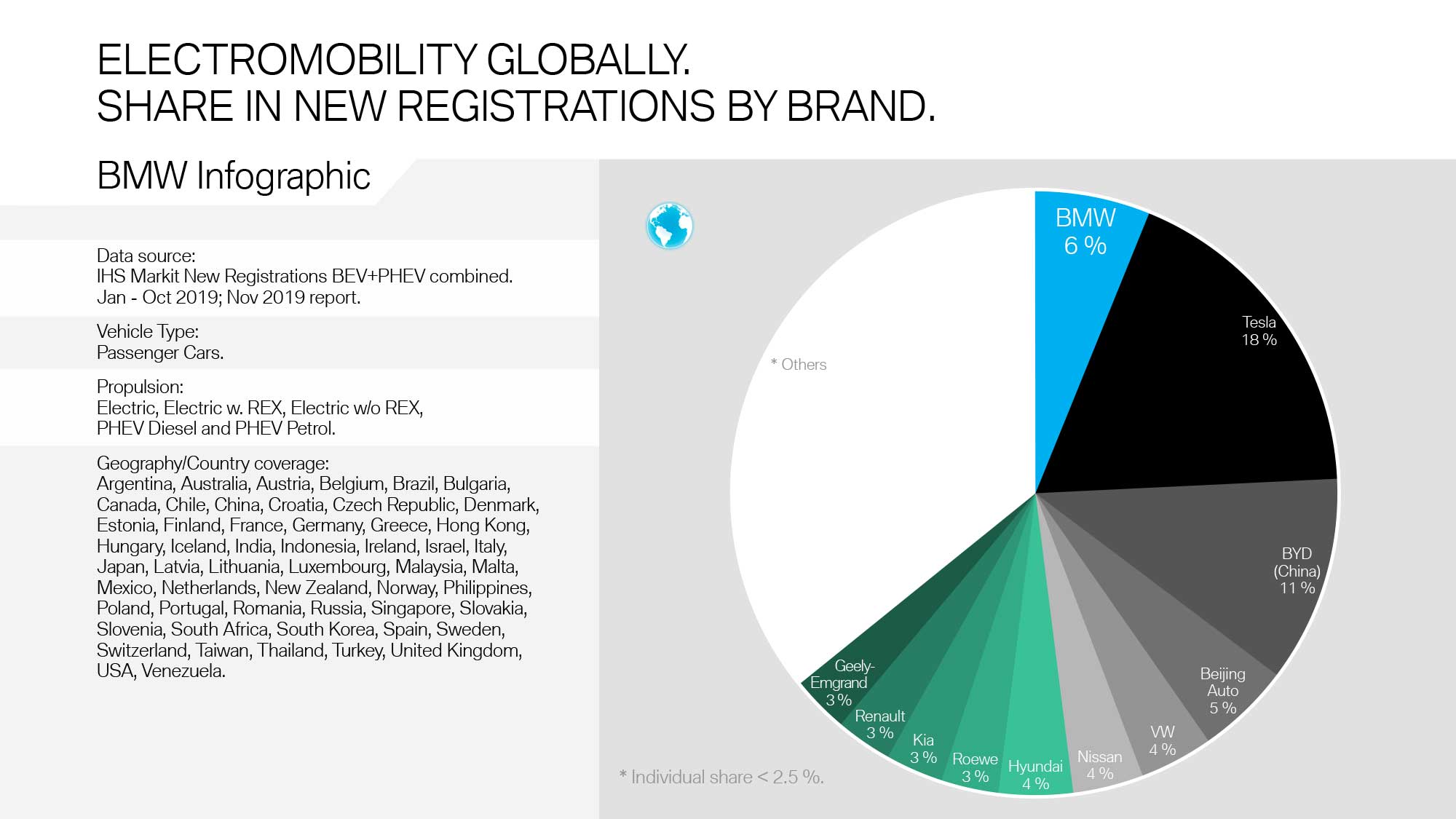

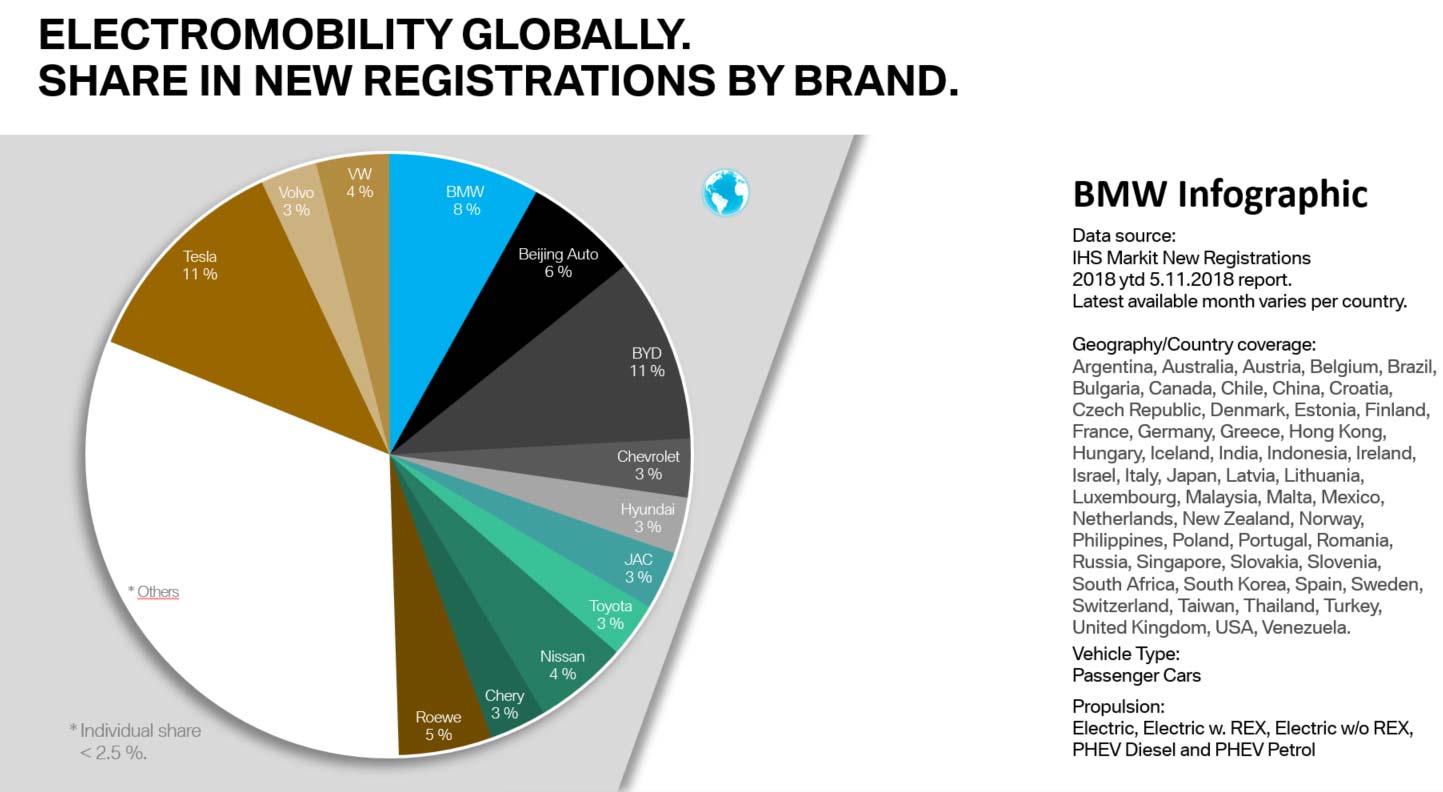

As can be seen in the graphs below (the first being 2019’s charts and the second, which can be viewed via the slider arrows, being from 2018), the landscape has vastly changed since the introduction of the Tesla Model 3 in early 2019.

In November 2018 BMW held 17% of new registrations of all electric vehicles including battery electric (BEV) and plug-in hybrid electric vehicles (PHEV), but first place position for new electric car registrations has now been claimed by Tesla at 18% of new registrations.

This is largely due to the introduction of the Model 3, a “profound shift” that was noted in August by electric car sales database EV-Volumes that is driving the penetration of electric vehicles further into the European market.

This doesn’t guarantee Tesla the leading position for future years, however. Tightening fuel emissions regulations will see car makers face big fines if average fleet emissions do not come in under 95 grams of CO2 per kilometre by 2021.

This is forcing all car makers to increase the number of electric vehicles in their fleet mix. Leading the chase is Volkswagen, bolstered by a need for redemption from the 2015 Dieselgate scandal, which has now launched its “electric offensive” with its first ID series electric hatchback, the ID.3.

Tesla’s claim of the dominant market share in Europe has come from approximately 38,000 sales as of August. Volkswagen by comparison has said that globally (and it is more than likely the majority of these are in Europe) it has taken 35,000 pre-orders for the ID.3 hatchback.

How this plays out depends on a few factors: the ability of the ID.3 in appealing to a different market than the Model 3, and is more likely to take more away from BMW’s i3 than Tesla’s popular electric sedan.

Another factor to consider is that sales of the Model 3 may already be tapering off now that deliveries to reservation holders, pent up after nearly three long years waiting for its arrival in Europe, have been exhausted.

Then there is of course BMW’s own electric strategy.

With a plan to introduce the i4 SUV in 2021, BMW may find itself well placed to deal with another onslaught from Tesla, depending on when it introduces the Model Y SUV to Europe (there are no dates as yet for overseas markets but the US launch date has already been brought forwards three months to early 2020).

First though, BMW will bring to market the all-electric Mini Cooper SE in 2020, for which it says it has taken over 45,000 pre-orders and which will no doubt offer a pleasing alternative to the ID.3.

Finally, there will be of course other electric introductions from other carmakers adding further to EV choice.

Globally, the picture of course looks somewhat different, with Chinese brands coming into play, but again Tesla’s market share growing significantly against BMW’s modest growth.

Bridie Schmidt is associate editor for The Driven, sister site of Renew Economy. She has been writing about electric vehicles since 2018, and has a keen interest in the role that zero-emissions transport has to play in sustainability. She has participated in podcasts such as Download This Show with Marc Fennell and Shirtloads of Science with Karl Kruszelnicki and is co-organiser of the Northern Rivers Electric Vehicle Forum. Bridie also owns a Tesla Model Y and has it available for hire on evee.com.au.