In yet another sign of the inexorable takeover of the passenger vehicle market by electric cars, the all-electric Tesla Model 3 has become the third best-selling car (ICE or electric) so far this year in California (33,005 sales), beaten only by the Toyota Camry (33,638) and the Honda Civic (39,081).

Alongside of this result, an interesting set of movements in internal combustion engine (ICE), hybrid (HEV), plug-in hybrid (PHEV) and battery electric (BEV) vehicles has occurred.

So why are California car and EV sales data important to the rest of us? Because what happens in the California market is generally a sign of what is to come for other Western passenger vehicle markets.

This results from California being a world-leader in:

- strict emissions legislation;

- significant incentives to promote the sale of low emission vehicles;

- strong support for public and private EVSE installations (through the US$2 billion Electrify America campaign kindly provided by VW as their mea culpa for Dieselgate) AND

- a broad public EV information and education campaign (again, via Electrify America).

As a result, the percentage (and actual volume) of electric vehicle sales (BEV, PHEV and HEV together) in California is well ahead of most places in the world, making it an indicator of what is to come as other global EV markets mature.

As part of that maturation process, it is interesting to see that the ‘valley of death’ alluded to by some pundits may be starting already.

By ‘valley of death’, I mean buyers abandoning the new ICE market in anticipation of buying an EV before the legacy manufacturers can build EVs in large (and profitable) enough numbers.

This could lead to a period of substantial losses for the existing auto industry, with the potential failure of one or more of them if they do not have the reserves to sustain them through to the other side.

And what signs do I suggest are there for this valley of death beginning? Well it’s the continuing (and accelerating) fall around the world in ICE vehicle sales alongside the continuing (and accelerating) increases in worldwide EV sales.

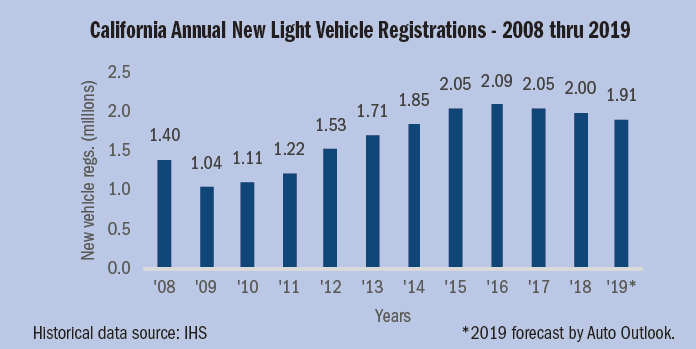

California is now on track for the third year in a row of falling total car sales in combination with continuing EV sales growth. (See figures 1 and 3 below).

On top of this, an increase in used car sales figures points to those people who did change cars choosing second-hand over new. (Figure 2). Californian light vehicle second-hand sales in general went up 5.2% in the first half of 2019, with 6 year old or newer up 10.2%.

Are people perhaps deciding that an EV is now within their next new car cycle, so only choosing cars that will last the time frame to when an EV suiting their needs (and price range) is expected to be available?

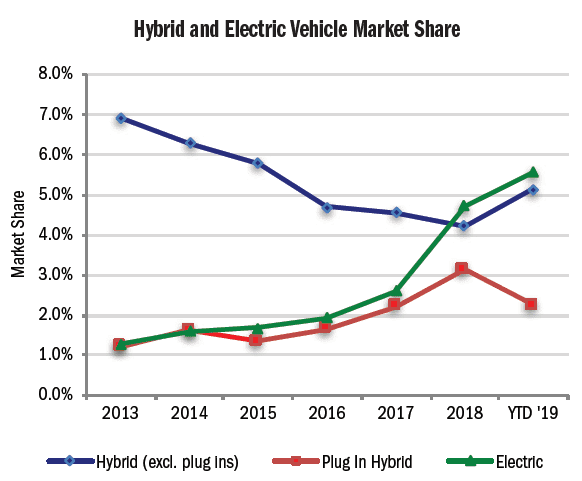

In the meantime, the EV purchase statistics make for interesting reading, as well as allowing room for further speculation. (See figure 3).

Overall EV sales now make up 13% of the total Californian market, with BEVs at 5.6%, HEVs at 5.2% and PHEVs at 2.2%. It is worth noting that Californian PHEV sales have taken a significant dip so far in 2019, whilst BEVs and HEVs have increased their shares.

Part of that dip in PHEVs could perhaps be attributed to there being fewer options for PHEVs with decent ‘electric-only’ ranges, given GM ended Chevrolet Volt production in March this year. A second explanation could be that full battery electric cars now offer ranges sufficient to let people skip the ‘stepping-stone’ technology of the PHEV in favour of the full BEV.

Meanwhile, the uptick in hybrid sales could be seen as an indication that EVs are moving from ‘early adopter’ interest to the more mainstream market. (Just as hybrids were the first-choice of the early EV adopters in the late 90’s and 2000’s).

Hybrids are now being marketed as the first ‘toe-dipping’ into EVs, through offering a first EV choice of a simple fuel-saving HEV drivetrain without the seeming complication of working out the leads. (The less said about the seeming perpetual motion machine marketing strategy for HEVs as ‘charges while you drive, no lead needed’, the better).

It will be interesting to see whether this HEV trend is an aberration or the start of a trend, as until now the market share of hybrids has been declining – perhaps as a result of the early adopters moving to full BEVs? (See figure 3).

Getting back to that statistic of the Tesla Model 3 being the third best-selling car of all fuel types in California so far this year (despite the significantly higher price of the Model 3 over the other two) – it begs the question of whether ICE sales will fall off a cliff when BEVs reach price parity with ICE vehicles (predicted to be around 2024) and are produced in enough numbers and styles to fight head-to-head with ICE offerings.

As a final note, that steepening ICE sales fall may also happen well before 2024: with VW about to launch the ID3 onto the market in large numbers early next year (and others to follow) – the ‘Tesla Stretch’ may very well turn into the ‘EV Stretch’ and EVs start slaying ICE sales before the price parity point is reached.

Bryce Gaton is an expert on electric vehicles and contributor for The Driven and Renew Economy. He has been working in the EV sector since 2008 and is currently working as EV electrical safety trainer/supervisor for the University of Melbourne. He also provides support for the EV Transition to business, government and the public through his EV Transition consultancy EVchoice.